Description

The Plastics Market Report – Europe is now also available in parts (e.g. individual country profiles or all manufacturer profiles). Please feel free to contact us and we will immediately send you an offer for your specific selection.

Plastics play a major role in the “Green Deal” that aims to make Europe climate-neutral by 2050. EU initiatives for circular economy and bioeconomy promote recycling and bioplastics, whereas plastic waste and microplastics are to be restricted. Further, Europe wants to become less dependent on oil and gas imports. Despite crises and conflicts, nearly 57 million tonnes of plastics were sold in Europe last year, around 3 million tonnes more than in 2015. This is the second time Ceresana has analyzed the entire European market for all commercially important plastics: from mass-produced standard polymers, such as polyethylene, polypropylene, PET or PVC, to high-performance plastics needed for lightweight construction and special technical applications.

A Growing Market for Plastics

Market researchers at Ceresana expect average sales growth of 2.0% per year for the European plastics industry. This major economic sector is thus expected to reach a volume of around EUR 107 billion in 2031. This impressive figure does not include synthetic fibers for textiles; nor does it take into account synthetic resins and silicones for paints and coatings, adhesives and sealants. In Europe, Germany is the largest producer of plastics, with a market share of almost 22%, followed by Russia, Belgium and France. Regionally, production and consumption of plastics are developing very differently. Ceresana’s new plastics market report examines the different types of plastics and their areas of application in detail.

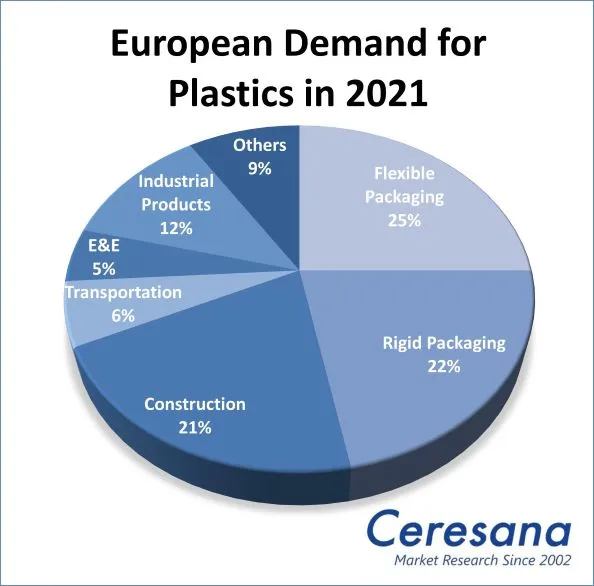

Polymers for Packaging and Construction

Packaging and construction products currently account for around 68% of total demand for plastics in Europe. The two plastic types polyethylene and polypropylene dominate the “flexible packaging” application area, i.e. films, bags and sacks. PET, on the other hand, is the main type of plastic used for “rigid packaging” in Europe, for example for bottles and lids, cans, cups and boxes. Instead of bottles, plastic bags are increasingly being used for some beverages. Compostable bioplastics are becoming increasingly competitive, especially for food packaging. In the construction industry, plastics are needed for both structural and civil engineering, for example for films, cables, pipes, profiles, dowels, coatings and membranes. Despite concerns from environmentalists, PVC is still the most widely used type of plastic in this sector. Insulation materials such as EPS help save energy.

Overview of the Study:

Chapter 1 provides a detailed presentation and analysis of the European market for plastics – including forecasts up to 2031.

The following application areas are examined in this study:

- Flexible packaging

- Rigid packaging

- Construction

- Transportation

- Electrical & electronics

- Industry

- Other applications

These plastic types are considered individually:

- Polyethylene (LDPE, LLDPE and HDPE)

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polyethylene Terephthalat (PET)

- Polystyrene (PS und EPS)

- Other Plastics (polyurethane (PUR), polyamide (PA), acrylonitrile butadiene styrene (ABS), polycarbonate (PC), polymethyl methacrylate (PMMA), polyoxymethylene (POM), polybutylene terephthalate (PBT), styrene acrylonitrile (SAN), fluoropolymers and bioplastics)

Chapter 2 considers 23 countries individually: Demand, revenues, production, and import & export of plastics. Total production and trade volumes are broken down by type of plastic. The development of total demand is reported for each type of plastic and application.

Chapter 3 provides useful company profiles of the most important European manufacturers of plastics, clearly structured by contact details, revenues, profit, product range, production sites and brief profile. Detailed profiles are provided by 112 manufacturers, e.g. BASF SE, Borealis AG, Covestro AG, Braskem S.A., DuPont (E.I.) De Nemours, ExxonMobil Corp., Lanxess AG, LyondellBasell Industries N.V., The Dow Chemical Company, Total S.A., SABIC und Ineos Group, Ltd.

Scope of the Report:

Attributes | Details |

| Base Year | 2021 |

| Trend Period | 2019 – 2031 |

| Forecast Period | 2022 – 2031 |

| Pages | 520 |

| Application Areas | Flexible Packaging, Rigid Packaging, Construction, Transportation, Electrical & Electronics, Industry, Other Applications |

| Plastic Types | Polyethylene (LDPE, LLDPE and HDPE), Polyvinyl Chlorid (PVC), Polypropylene (PP), Polyethylene Terephthalat (PET), Polystyrene (PS und EPS), Other Plastics |

| Company Profiles | BASF SE, Borealis AG, Covestro AG, Braskem S.A., DuPont (E.I.) De Nemours, ExxonMobil Corp., Lanxess AG, LyondellBasell Industries N.V., The Dow Chemical Company, Total S.A., SABIC und Ineos Group, Ltd. (Selection) |

| Edition | 2nd edition |

| Publication | August 2022 |

FAQs

How will the plastics market develop in Europe up to the year 2031?

We expect average sales growth of 2.0% per year for the European plastics industry. This sector is thus expected to reach a volume of around EUR 107 billion in 2031.

Which countries have the largest market share of the production of plastics?

Germany is the largest producer of plastics, with a market share of almost 22%, followed by Russia, Belgium and France.

Which application areas account for the highest use of plastics?

With a share of 68% of total demand for plastics in Europe, packaging and construction products represent the largest application areas.

1 Market Data

1.1 Europe

1.1.1 Demand

1.1.2 Revenues

1.1.3 Production

1.1.4 Applications

1.1.4.1 Flexible Packaging

1.1.4.2 Rigid Packaging

1.1.4.3 Construction Industry

1.1.4.4 Transportation

1.1.4.5 Electrical and Electronics

1.1.4.6 Industrial Products

1.1.4.7 Other Applications

1.1.5 Products

1.1.5.1 Polyethylene – LDPE

1.1.5.2 Polyethylene – LLDPE

1.1.5.3 Polyethylene – HDPE

1.1.5.4 Polypropylene (PP)

1.1.5.5 Polyvinyl Chloride (PVC)

1.1.5.6 Polyethylene Terephthalate (PET)

1.1.5.7 Polystyrene (PS & EPS)

1.1.5.8 Other Plastics

2 Market Data: Countries

2.1 Europe

2.1.1 Austria

2.1.1.1 Demand and Revenues

2.1.1.2 Production and Trade

2.1.2 Belgium

2.1.2.1 Demand and Revenues

2.1.2.2 Production and Trade

2.1.3 Bulgaria

2.1.3.1 Demand and Revenues

2.1.3.2 Production and Trade

2.1.4 Czechia

2.1.4.1 Demand and Revenues

2.1.4.2 Production and Trade

2.1.5 Denmark

2.1.6 Finland

2.1.6.1 Demand and Revenues

2.1.6.2 Production and Trade

2.1.7 France

2.1.7.1 Demand and Revenues

2.1.7.2 Production and Trade

2.1.8 Germany

2.1.8.1 Demand and Revenues

2.1.8.2 Production and Trade

2.1.9 Greece

2.1.9.1 Demand and Revenues

2.1.9.2 Production and Trade

2.1.10 Hungary

2.1.10.1 Demand and Revenues

2.1.10.2 Production and Trade

2.1.11 Italy

2.1.11.1 Demand and Revenues

2.1.11.2 Production and Trade

2.1.12 Norway

2.1.12.1 Demand and Revenues

2.1.12.2 Production and Trade

2.1.13 Poland

2.1.13.1 Demand and Revenues

2.1.13.2 Production and Trade

2.1.14 Portugal

2.1.14.1 Demand and Revenues

2.1.14.2 Production and Trade

2.1.15 Romania

2.1.15.1 Demand and Revenues

2.1.15.2 Production and Trade

2.1.16 Russia

2.1.16.1 Demand and Revenues

2.1.16.2 Production and Trade

2.1.17 Slovakia

2.1.17.1 Demand and Revenues

2.1.17.2 Production and Trade

2.1.18 Spain

2.1.18.1 Demand and Revenues

2.1.18.2 Production and Trade

2.1.19 Sweden

2.1.19.1 Demand and Revenues

2.1.19.2 Production and Trade

2.1.20 Switzerland

2.1.21 The Netherlands

2.1.21.1 Demand and Revenues

2.1.21.2 Production and Trade

2.1.22 Turkey

2.1.22.1 Demand and Revenues

2.1.22.2 Production and Trade

2.1.23 United Kingdom

2.1.23.1 Demand and Revenues

2.1.23.2 Production and Trade

2.1.24 Rest of Europe

2.1.24.1 Demand and Revenues

2.1.24.2 Production and Trade

3 Company Profiles*

Austria (2 Producers)

Belarus (2)

Belgium (7)

Cyprus (1)

France (6)

Germany (20)

Greece (2)

Hungary (2)

Italy (8)

Luxembourg (1)

Norway (2)

Poland (3)

Portugal (1)

Romania (1)

Russia (14)

Serbia (1)

Slovakia (1)

Spain (8)

Switzerland (4)

The Netherlands (13)

Turkey (7)

Ukraine (2)

United Kingdom (4)

*Note: The profiles are assigned to the country in which the company or holding is headquartered. Profiles also include JVs and subsidiaries.

Graph 1: European demand for plastics from 2019 to 2031

Graph 2: Revenues generated with plastics in Europe from 2019 to 2031 in billion USD and billion EUR

Graph 3: Production of plastics across Europe from 2019 to 2031

Graph 4: Demand for plastics in Austria from 2019 to 2031

Graph 5: Production of plastics in Austria from 2019 to 2031

Graph 6: Demand for plastics in Belgium from 2019 to 2031

Graph 7: Production of plastics in Belgium from 2019 to 2031

Graph 8: Demand for plastics in Bulgaria from 2019 to 2031

Graph 9: Production of plastics in Bulgaria from 2019 to 2031

Graph 10: Demand for plastics in Czechia from 2019 to 2031

Graph 11: Production of plastics in Czechia from 2019 to 2031

Graph 12: Demand for plastics in Denmark from 2019 to 2031

Graph 13: Demand for plastics in Finland from 2019 to 2031

Graph 14: Production of plastics in Finland from 2019 to 2031

Graph 15: Demand for plastics in France from 2019 to 2031

Graph 16: Production of plastics in France from 2019 to 2031

Graph 17: Demand for plastics in Germany from 2019 to 2031

Graph 18: Production of plastics in Germany from 2019 to 2031

Graph 19: Demand for plastics in Greece from 2019 to 2031

Graph 20: Production of plastics in Greece from 2019 to 2031

Graph 21: Demand for plastics in Hungary from 2019 to 2031

Graph 22: Production of plastics in Hungary from 2019 to 2031

Graph 23: Demand for plastics in Italy from 2019 to 2031

Graph 24: Production of plastics in Italy from 2019 to 2031

Graph 25: Demand for plastics in Norway from 2019 to 2031

Graph 26: Production of plastics in Norway from 2019 to 2031

Graph 27: Demand for plastics in Poland from 2019 to 2031

Graph 28: Production of plastics in Poland from 2019 to 2031

Graph 29: Demand for plastics in Portugal from 2019 to 2031

Graph 30: Production of plastics in Portugal from 2019 to 2031

Graph 31: Demand for plastics in Romania from 2019 to 2031

Graph 32: Production of plastics in Romania from 2019 to 2031

Graph 33: Demand for plastics in Russia from 2019 to 2031

Graph 34: Production of plastics in Russia from 2019 to 2031

Graph 35: Demand for plastics in Slovakia from 2019 to 2031

Graph 36: Production of plastics in Slovakia from 2019 to 2031

Graph 37: Demand for plastics in Spain from 2019 to 2031

Graph 38: Production of plastics in Spain from 2019 to 2031

Graph 39: Demand for plastics in Sweden from 2019 to 2031

Graph 40: Production of plastics in Sweden from 2019 to 2031

Graph 41: Demand for plastics in Switzerland from 2019 to 2031

Graph 42: Demand for plastics in the Netherlands from 2019 to 2031

Graph 43: Production of plastics in the Netherlands from 2019 to 2031

Graph 44: Demand for plastics in Turkey from 2019 to 2031

Graph 45: Production of plastics in Turkey from 2019 to 2031

Graph 46: Demand for plastics in the United Kingdom from 2019 to 2031

Graph 47: Production of plastics in the United Kingdom from 2019 to 2031

Graph 48: Demand for plastics in the rest of Europe from 2019 to 2031

Graph 49: Production of plastics in the rest of Europe from 2019 to 2031

Table 1: European demand for plastics from 2019 to 2031 – split by countries

Table 2: Revenues generated with plastics in Europe from 2019 to 2031 in billion USD and billion EUR

Table 3: Revenues generated with plastics in Europe in billion EUR from 2019 to 2031 – split by countries

Table 4: European production of plastics from 2019 to 2031 – split by countries

Table 5: European demand for plastics from 2019 to 2031 – split by applications

Table 6: European demand for plastics in the segment flexible packaging from 2019 to 2031 – split by countries

Table 7: European demand for plastics in the segment flexible packaging from 2019 to 2031 – split by products

Table 8: European demand for plastics in the segment rigid packaging from 2019 to 2031 – split by countries

Table 9: European demand for plastics in the segment rigid packaging from 2019 to 2031 – split by products

Table 10: European demand for plastics in the segment construction from 2019 to 2031 – split by countries

Table 11: European demand for plastics in the segment construction from 2019 to 2031 – split by products

Table 12: European demand for plastics in the segment transportation from 2019 to 2031 – split by countries

Table 13: European demand for plastics in the segment transportation from 2019 to 2031 – split by products

Table 14: European demand for plastics in the segment electrical and electronics from 2019 to 2031 – split by countries

Table 15: European demand for plastics in the segment electrical and electronics from 2019 to 2031 – split by products

Table 16: European demand for plastics in the segment industry from 2019 to 2031 – split by countries

Table 17: European demand for plastics in the segment industry from 2019 to 2031 – split by products

Table 18: European demand for plastics in the segment other applications from 2019 to 2031 – split by countries

Table 19: European demand for plastics in the segment other applications from 2019 to 2031 – split by products

Table 20: European demand for plastics from 2019 to 2031 – split by products

Table 21: European demand for LDPE from 2019 to 2031 – split by countries

Table 22: European demand for LLDPE from 2019 to 2031 – split by countries

Table 23: European demand for HDPE from 2019 to 2031 – split by countries

Table 24: European demand for PP from 2019 to 2031 – split by countries

Table 25: European demand for PVC from 2019 to 2031 – split by countries

Table 26: European demand for PET from 2019 to 2031 – split by countries

Table 27: European demand for PS & EPS from 2019 to 2031 – split by countries

Table 28: European demand for other plastics from 2019 to 2031 – split by countries

Table 29: Revenues generated with plastics in Austria from 2019 to 2031 in million USD and million EUR

Table 30: Demand for plastics in Austria from 2019 to 2031 – split by applications

Table 31: Demand for plastics in Austria from 2019 to 2031 – split by products

Table 32: Production, import, and export of and demand for plastics in Austria from 2019 to 2031

Table 33: Import of plastics in Austria from 2019 to 2031 – split by products

Table 34: Export of plastics in Austria from 2019 to 2031 – split by products

Table 35: Production of plastics in Austria from 2019 to 2031 – split by products

Table 36: Revenues generated with plastics in Belgium from 2019 to 2031 in million USD and million EUR

Table 37: Demand for plastics in Belgium from 2019 to 2031 – split by applications

Table 38: Demand for plastics in Belgium from 2019 to 2031 – split by products

Table 39: Demand for plastics in the segment flexible packaging in Belgium from 2019 to 2031 – split by products

Table 40: Demand for plastics in the segment rigid packaging in Belgium from 2019 to 2031 – split by products

Table 41: Demand for plastics in the construction segment in Belgium from 2019 to 2031 – split by products

Table 42: Demand for plastics in the transportation segment in Belgium from 2019 to 2031 – split by products

Table 43: Demand for plastics in the E&E segment in Belgium from 2019 to 2031 – split by products

Table 44: Demand for plastics in the industry segment in Belgium from 2019 to 2031 – split by products

Table 45: Demand for plastics in the segment others in Belgium from 2019 to 2031 – split by products

Table 46: Production, import, and export of and demand for plastics in Belgium from 2019 to 2031

Table 47: Import of plastics in Belgium from 2019 to 2031 – split by products

Table 48: Export of plastics in Belgium from 2019 to 2031 – split by products

Table 49: Production of plastics in Belgium from 2019 to 2031 – split by products

Table 50: Revenues generated with plastics in Bulgaria from 2019 to 2031 in million USD and million EUR

Table 51: Demand for plastics in Bulgaria from 2019 to 2031 – split by applications

Table 52: Demand for plastics in Bulgaria from 2019 to 2031 – split by products

Table 53: Import of plastics in Bulgaria from 2019 to 2031 – split by products

Table 54: Production, import, and export of and demand for plastics in Bulgaria from 2019 to 2031

Table 55: Export of plastics in Bulgaria from 2019 to 2031 – split by products

Table 56: Revenues generated with plastics in Czechia from 2019 to 2031 in million USD and million EUR

Table 57: Demand for plastics in Czechia from 2019 to 2031 – split by applications

Table 58: Demand for plastics in Czechia from 2019 to 2031 – split by products

Table 59: Import of plastics in Czechia from 2019 to 2031 – split by products

Table 60: Production, import, and export of and demand for plastics in Czechia from 2019 to 2031

Table 61: Export of plastics in Czechia from 2019 to 2031 – split by products

Table 62: Production of plastics in Czechia from 2018 to 2030 – split by products

Table 63: Revenues generated with plastics in Denmark from 2019 to 2031 in million USD and million EUR

Table 64: Demand for plastics in Denmark from 2019 to 2031 – split by applications

Table 65: Demand for plastics in Denmark from 2019 to 2031 – split by products

Table 66: Revenues generated with plastics in Finland from 2019 to 2031 in million USD and million EUR

Table 67: Demand for plastics in Finland from 2019 to 2031 – split by applications

Table 68: Demand for plastics in Finland from 2019 to 2031 – split by products

Table 69: Import of plastics in Finland from 2019 to 2031 – split by products

Table 70: Production, import, and export of and demand for plastics in Finland from 2019 to 2031

Table 71: Export of plastics in Finland from 2019 to 2031 – split by products

Table 72: Production of plastics in Finland from 2019 to 2031 – split by products

Table 73: Revenues generated with plastics in France from 2019 to 2031 in million USD and million EUR

Table 74: Demand for plastics in France from 2019 to 2031 – split by applications

Table 75: Demand for plastics in France from 2019 to 2031 – split by products

Table 76: Demand for plastics in the segment flexible packaging in France from 2019 to 2031 – split by products

Table 77: Demand for plastics in the segment rigid packaging in France from 2019 to 2031 – split by products

Table 78: Demand for plastics in the construction segment in France from 2019 to 2031 – split by products

Table 79: Demand for plastics in the transportation segment in France from 2019 to 2031 – split by products

Table 80: Demand for plastics in the segment E&E in France from 2019 to 2031 – split by products

Table 81: Demand for plastics in the industry segment in France from 2019 to 2031 – split by products

Table 82: Demand for plastics in the segment others in France from 2019 to 2031 – split by products

Table 83: Production, import, and export of and demand for plastics in France from 2019 to 2031

Table 84: Import of plastics in France from 2019 to 2031 – split by products

Table 85: Export of plastics in France from 2019 to 2031 – split by products

Table 86: Production of plastics in France from 2019 to 2031 – split by products

Table 87: Revenues generated with plastics in Germany from 2019 to 2031 in million USD and million EUR

Table 88: Demand for plastics in Germany from 2019 to 2031 – split by applications

Table 89: Demand for plastics in Germany from 2019 to 2031 – split by products

Table 90: Demand for plastics in the segment flexible packaging in Germany from 2019 to 2031 – split by products

Table 91: Demand for plastics in the segment rigid packaging in Germany from 2019 to 2031 – split by products

Table 92: Demand for plastics in the construction segment in Germany from 2019 to 2031 – split by products

Table 93: Demand for plastics in the transportation segment in Germany from 2019 to 2031 – split by products

Table 94: Demand for plastics in the segment E&E in Germany from 2019 to 2031 – split by products

Table 95: Demand for plastics in the industry segment in Germany from 2019 to 2031 – split by products

Table 96: Demand for plastics in the segment others in Germany from 2019 to 2031 – split by products

Table 97: Production, import, and export of and demand for plastics in Germany from 2019 to 2031

Table 98: Import of plastics in Germany from 2019 to 2031 – split by products

Table 99: Export of plastics in Germany from 2019 to 2031 – split by products

Table 100: Production of plastics in Germany from 2018 to 2030 – split by products

Table 101: Revenues generated with plastics in Greece from 2019 to 2031 in million USD and million EUR

Table 102: Demand for plastics in Greece from 2019 to 2031 – split by applications

Table 103: Demand for plastics in Greece from 2019 to 2031 – split by products

Table 104: Import of plastics in Greece from 2019 to 2031 – split by products

Table 105: Export of plastics in Greece from 2019 to 2031 – split by products

Table 106: Production of plastics in Greece from 2019 to 2031 – split by products

Table 107: Production, import, and export of and demand for plastics in Greece from 2019 to 2031

Table 108: Revenues generated with plastics in Hungary from 2019 to 2031 in million USD and million EUR

Table 109: Demand for plastics in Hungary from 2019 to 2031 – split by applications

Table 110: Demand for plastics in Hungary from 2019 to 2031 – split by products

Table 111: Import of plastics in Hungary from 2019 to 2031 – split by products

Table 112: Production, import, and export of and demand for plastics in Hungary from 2019 to 2031

Table 113: Export of plastics in Hungary from 2019 to 2031 – split by products

Table 114: Production of plastics in Hungary from 2019 to 2031 – split by products

Table 115: Revenues generated with plastics in Italy from 2019 to 2031 in million USD and million EUR

Table 116: Demand for plastics in Italy from 2019 to 2031 – split by applications

Table 117: Demand for plastics in Italy from 2019 to 2031 – split by products

Table 118: Demand for plastics in the segment flexible packaging in Italy from 2019 to 2031 – split by products

Table 119: Demand for plastics in the segment rigid packaging in Italy from 2019 to 2031 – split by products

Table 120: Demand for plastics in the construction segment in Italy from 2019 to 2031 – split by products

Table 121: Demand for plastics in the transportation segment in Italy from 2019 to 2031 – split by products

Table 122: Demand for plastics in the E&E segment in Italy from 2019 to 2031 – split by products

Table 123: Demand for plastics in the industry segment in Italy from 2019 to 2031 – split by products

Table 124: Demand for plastics in the segment others in Italy from 2019 to 2031 – split by products

Table 125: Production, import, and export of and demand for plastics in Italy from 2019 to 2031

Table 126: Import of plastics in Italy from 2019 to 2031 – split by products

Table 127: Export of plastics in Italy from 2019 to 2031 – split by products

Table 128: Production of plastics in Italy from 2019 to 2031 – split by products

Table 129: Revenues generated with plastics in Norway from 2019 to 2031 in million USD and million EUR

Table 130: Demand for plastics in Norway from 2019 to 2031 – split by applications

Table 131: Demand for plastics in Norway from 2019 to 2031 – split by products

Table 132: Import of plastics in Norway from 2019 to 2031 – split by products

Table 133: Production, import, and export of and demand for plastics in Norway from 2019 to 2031

Table 134: Export of plastics in Norway from 2019 to 2031 – split by products

Table 135: Production of plastics in Norway from 2019 to 2031 – split by products

Table 136: Revenues generated with plastics in Poland from 2019 to 2031 in million USD and million EUR

Table 137: Demand for plastics in Poland from 2019 to 2031 – split by applications

Table 138: Demand for plastics in Poland from 2019 to 2031 – split by products

Table 139: Demand for plastics in the segment flexible packaging in Poland from 2019 to 2031 – split by products

Table 140: Demand for plastics in the segment rigid packaging in Poland from 2019 to 2031 – split by products

Table 141: Demand for plastics in the construction segment in Poland from 2019 to 2031 – split by products

Table 142: Demand for plastics in the transportation segment in Poland from 2019 to 2031 – split by products

Table 143: Demand for plastics in the E&E segment in Poland from 2019 to 2031 – split by products

Table 144: Demand for plastics in the industry segment in Poland from 2019 to 2031 – split by products

Table 145: Demand for plastics in the segment others in Poland from 2019 to 2031 – split by products

Table 146: Production, import, and export of and demand for plastics in Poland from 2019 to 2031

Table 147: Import of plastics in Poland from 2019 to 2031 – split by products

Table 148: Export of plastics in Poland from 2019 to 2031 – split by products

Table 149: Production of plastics in Poland from 2019 to 2031 – split by products

Table 150: Revenues generated with plastics in Portugal from 2019 to 2031 in million USD and million EUR

Table 151: Demand for plastics in Portugal from 2019 to 2031 – split by applications

Table 152: Demand for plastics in Portugal from 2019 to 2031 – split by products

Table 153: Production, import, and export of and demand for plastics in Portugal from 2019 to 2031

Table 154: Import of plastics in Portugal from 2019 to 2031 – split by products

Table 155: Export of plastics in Portugal from 2019 to 2031 – split by products

Table 156: Production of plastics in Portugal from 2019 to 2031 – split by products

Table 157: Revenues generated with plastics in Romania from 2019 to 2031 in million USD and million EUR

Table 158: Demand for plastics in Romania from 2019 to 2031 – split by applications

Table 159: Demand for plastics in Romania from 2019 to 2031 – split by products

Table 160: Import of plastics in Romania from 2019 to 2031 – split by products

Table 161: Production, import, and export of and demand for plastics in Romania from 2019 to 2031

Table 162: Export of plastics in Romania from 2019 to 2031 – split by products

Table 163: Production of plastics in Romania from 2019 to 2031 – split by products

Table 164: Revenues generated with plastics in Russia from 2019 to 2031 in million USD and million EUR

Table 165: Demand for plastics in Russia from 2019 to 2031 – split by applications

Table 166: Demand for plastics in Russia from 2019 to 2031 – split by products

Table 167: Demand for plastics in the segment flexible packaging in Russia from 2019 to 2031 – split by products

Table 168: Demand for plastics in the segment rigid packaging in Russia from 2019 to 2031 – split by products

Table 169: Demand for plastics in the construction segment in Russia from 2019 to 2031 – split by products

Table 170: Demand for plastics in the transportation segment in Russia from 2019 to 2031 – split by products

Table 171: Demand for plastics in the E&E segment in Russia from 2019 to 2031 – split by products

Table 172: Demand for plastics in the industry segment in Russia from 2019 to 2031 – split by products

Table 173: Demand for plastics in the segment others in Russia from 2019 to 2031 – split by products

Table 174: Production, import, and export of and demand for plastics in Russia from 2019 to 2031

Table 175: Import of plastics in Russia from 2019 to 2031 – split by products

Table 176: Export of plastics in Russia from 2019 to 2031 – split by products

Table 177: Production of plastics in Russia from 2019 to 2031 – split by products

Table 178: Revenues generated with plastics in Slovakia from 2019 to 2031 in million USD and million EUR

Table 179: Demand for plastics in Slovakia from 2019 to 2031 – split by applications

Table 180: Demand for plastics in Slovakia from 2019 to 2031 – split by products

Table 181: Import of plastics in Slovakia from 2019 to 2031 – split by products

Table 182: Production, import, and export of and demand for plastics in Slovakia from 2019 to 2031

Table 183: Export of plastics in Slovakia from 2019 to 2031 – split by products

Table 184: Production of plastics in Slovakia from 2019 to 2031 – split by products

Table 185: Revenues generated with plastics in Spain from 2019 to 2031 in million USD and million EUR

Table 186: Demand for plastics in Spain from 2019 to 2031 – split by applications

Table 187: Demand for plastics in Spain from 2019 to 2031 – split by products

Table 188: Demand for plastics in the segment flexible packaging in Spain from 2019 to 2031 – split by products

Table 189: Demand for plastics in the segment rigid packaging in Spain from 2019 to 2031 – split by products

Table 190: Demand for plastics in the construction segment in Spain from 2019 to 2031 – split by products

Table 191: Demand for plastics in the transportation segment in Spain from 2019 to 2031 – split by products

Table 192: Demand for plastics in the E&E segment in Spain from 2019 to 2031 – split by products

Table 193: Demand for plastics in the industry segment in Spain from 2019 to 2031 – split by products

Table 194: Demand for plastics in the segment others in Spain from 2019 to 2031 – split by products

Table 195: Production, import, and export of and demand for plastics in Spain from 2019 to 2031

Table 196: Import of plastics in Spain from 2019 to 2031 – split by products

Table 197: Export of plastics in Spain from 2019 to 2031 – split by products

Table 198: Production of plastics in Spain from 2019 to 2031 – split by products

Table 199: Revenues generated with plastics in Sweden from 2019 to 2031 in million USD and million EUR

Table 200: Demand for plastics in Sweden from 2019 to 2031 – split by applications

Table 201: Demand for plastics in Sweden from 2019 to 2031 – split by products

Table 202: Import of plastics in Sweden from 2019 to 2031 – split by products

Table 203: Production, import, and export of and demand for plastics in Sweden from 2019 to 2031

Table 204: Export of plastics in Sweden from 2019 to 2031 – split by products

Table 205: Production of plastics in Sweden from 2018 to 2030 – split by products

Table 206: Revenues generated with plastics in Switzerland from 2019 to 2031 in million USD and million EUR

Table 207: Demand for plastics in Switzerland from 2019 to 2031 – split by applications

Table 208: Demand for plastics in Switzerland from 2019 to 2031 – split by products

Table 209: Demand for plastics in the Netherlands from 2019 to 2031 – split by applications

Table 210: Demand for plastics in the Netherlands from 2019 to 2031 – split by products

Table 211: Revenues generated with plastics in the Netherlands from 2019 to 2031 in million USD and million EUR

Table 212: Demand for plastics in the segment flexible packaging in the Netherlands from 2019 to 2031 – split by products

Table 213: Demand for plastics in the segment rigid packaging in the Netherlands from 2019 to 2031 – split by products

Table 214: Demand for plastics in the construction segment in the Netherlands from 2019 to 2031 – split by products

Table 215: Demand for plastics in the transportation segment in the Netherlands from 2019 to 2031 – split by products

Table 216: Demand for plastics in the E&E segment in the Netherlands from 2019 to 2031 – split by products

Table 217: Demand for plastics in the industry segment in the Netherlands from 2019 to 2031 – split by products

Table 218: Demand for plastics in the segment others in the Netherlands from 2019 to 2031 – split by products

Table 219: Production, import, and export of and demand for plastics in the Netherlands from 2019 to 2031

Table 220: Import of plastics in the Netherlands from 2019 to 2031 – split by products

Table 221: Export of plastics in the Netherlands from 2019 to 2031 – split by products

Table 222: Production of plastics in the Netherlands from 2019 to 2031 – split by products

Table 223: Revenues generated with plastics in Turkey from 2019 to 2031 in million USD and million EUR

Table 224: Demand for plastics in Turkey from 2019 to 2031 – split by applications

Table 225: Demand for plastics in Turkey from 2019 to 2031 – split by products

Table 226: Demand for plastics in the segment flexible packaging in Turkey from 2019 to 2031 – split by products

Table 227: Demand for plastics in the segment rigid packaging in Turkey from 2019 to 2031 – split by products

Table 228: Demand for plastics in the construction segment in Turkey from 2019 to 2031 – split by products

Table 229: Demand for plastics in the transportation segment in Turkey from 2019 to 2031 – split by products

Table 230: Demand for plastics in the E&E segment in Turkey from 2019 to 2031 – split by products

Table 231: Demand for plastics in the industry segment in Turkey from 2019 to 2031 – split by products

Table 232: Demand for plastics in the segment others in Turkey from 2019 to 2031 – split by products

Table 233: Production, import, and export of and demand for plastics in Turkey from 2019 to 2031

Table 234: Import of plastics in Turkey from 2019 to 2031 – split by products

Table 235: Export of plastics in Turkey from 2019 to 2031 – split by products

Table 236: Production of plastics in Turkey from 2019 to 2031 – split by products

Table 237: Revenues generated with plastics in the United Kingdom from 2019 to 2031 in million USD and million EUR

Table 238: Demand for plastics in the United Kingdom from 2019 to 2031 – split by applications

Table 239: Demand for plastics in the United Kingdom from 2019 to 2031 – split by products

Table 240: Demand for plastics in the segment flexible packaging in the United Kingdom from 2019 to 2031 – split by products

Table 241: Demand for plastics in the segment rigid packaging in the United Kingdom from 2019 to 2031 – split by products

Table 242: Demand for plastics in the construction segment in the United Kingdom from 2019 to 2031 – split by products

Table 243: Demand for plastics in the transportation segment in the United Kingdom from 2019 to 2031 – split by products

Table 244: Demand for plastics in the E&E segment in the United Kingdom from 2019 to 2031 – split by products

Table 245: Demand for plastics in the industry segment in the United Kingdom from 2019 to 2031 – split by products

Table 246: Demand for plastics in the segment others in the United Kingdom from 2019 to 2031 – split by products

Table 247: Production, import, and export of and demand for plastics in the United Kingdom from 2019 to 2031

Table 248: Import of plastics in the United Kingdom from 2019 to 2031 – split by products

Table 249: Export of plastics in the United Kingdom from 2019 to 2031 – split by products

Table 250: Production of plastics in the United Kingdom from 2019 to 2031 – split by products

Table 251: Demand for plastics in the rest of Europe from 2019 to 2031 – split by applications

Table 252: Demand for plastics in the rest of Europe from 2019 to 2031 – split by products

Table 253: Revenues generated with plastics in the remaining countries of Europe from 2019 to 2031 in million USD and million EUR

Table 254: Production, import, and export of and demand for plastics in the remaining European countries from 2019 to 2031

Table 255: Production of plastics in the rest of Europe from 2019 to 2031 – split by products