Description

The Bioplastics Market Report is now also available in parts (e.g. individual country profiles or all manufacturer profiles). Please feel free to contact us and we will immediately send you an offer for your specific selection.

How much biobased content do bioplastics really contain? More and more, this is becoming a mathematical question: Biomass-based polymers are increasingly being added to conventional petroleum or natural gas plastics. Legislators and certification bodies decide at which organic content and with which properties these “bioattributed” or “mass-balanced” materials may be sold as bioplastics. In any case, demand for alternative plastics is high, and “bio” versions are now available for virtually all grades and applications. This is the eighth time that Ceresana has investigated the dynamically growing global market for “green” polymers: Analysts expect revenues generated with bioplastics to increase to around USD 11.4 billion by 2032.

Compostable Plastics for the Circular Economy

So far, there is no generally accepted definition and no uniform labeling for bioplastics. The European Union Commission published conditions for bioplastics in November 2022. They should have “a positive impact on the environment, rather than exacerbating plastic pollution, climate change and biodiversity loss”. According to this, the biomass for bioplastics should “come from sustainable sources,” preferably organic waste and by-products. Products that “could be carelessly discarded” should not be allowed to be labeled as “biodegradable”. Petrochemical oxo-degradable plastics, which break down into small pieces when exposed to air and light, have already been banned in Europe since 2021.

Ceresana’s current bioplastics market study primarily examines thermoplastics made from renewable raw materials that are biodegradable, i.e. can be decomposed by microorganisms in nature or at least composted in industrial plants. PHA from sugar and TPS from starch, for example, are biobased and biodegradable. However, there are also plastics made from biogenic raw materials that are not compostable, for example PEF made from fructose or bio-polyethylene based on sugar cane. The market study also covers petrochemical biodegradable plastics – such as PCL, PBAT or PBS. Not included here, however, are biobased elastomers, thermosets, natural fiber-reinforced plastics (NFRP), and composites such as wood-plastic composites (WPC).

Sustainable Packaging Made from Polylactic Acid and Starch

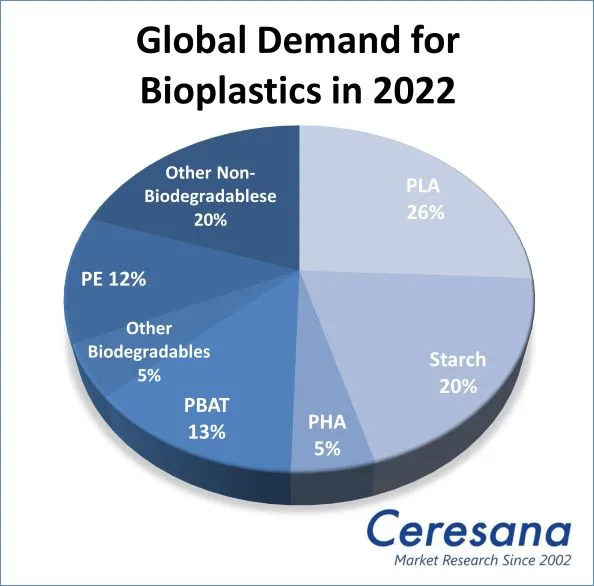

According to the EU Commission, bioplastics should preferably be used in durable products. However, today they are commercially successful mainly in applications where compostability is important: The most important sales market for biopolymers is the packaging industry, which currently processes almost 60% of all bioplastics. Ceresana expects the highest growth over the next few years in the bags, sacks and pouches division. Biodegradable plastics, particularly polylactic acids (PLA) and starch polymers, currently account for 68% of the total bioplastics market. For this product group, Ceresana’s current market study forecasts further growth of 11.7% per year up until 2032. Biobased but non-biodegradable plastics, such as bio-polyethylene, PET or PA, are expected to increase at lower rates of 7.8% per year.

The Study in Short:

Chapter 1 of the study provides a comprehensive presentation and analysis of the global market for bioplastics – including forecasts up to 2032: For each region, the development of demand (tonnes), revenues (USD and EUR) and production (tonnes) is indicated.

In addition, the application areas of bioplastics are examined individually:

- Rigid packaging

- Flexible packaging (bags, sacks and pouches)

- Other flexible packaging

- Consumer goods

- Automotive and electronics

- Other applications

For the regions Europe, North America, Asia-Pacific and “Rest of the World”, the production of bioplastics is divided into product groups:

- Polylactic acid (PLA)

- Starch

- Other biodegradable plastics

- Non-biodegradable plastics.

The demand for bioplastics per region is broken down into different types of plastics:

- Polylactic acid (PLA)

- Starch

- Polyhydroxyalkanoates (PHA)

- Polybutylene adipate terephthalate (PBAT)

- Other non-biodegradable plastics

Chapter 2 examines the 11 most important sales countries individually: Germany, France, the United Kingdom, Italy, the Netherlands, Spain, USA, China, Japan, South Korea and Taiwan. In each case, the following are presented: demand and revenues, demand split by application area and type of product (PLA, starch-based, other biodegradable plastics, non-biodegradable biobased plastics).

Chapter 3 provides useful company profiles of the most important bioplastics manufacturers, clearly categorized by contact details, revenue, profit, product range, production sites and brief profile. Detailed profiles are provided by 120 manufacturers, e.g. BASF SE, Braskem S.A., Far Eastern New Century Corporation (FENC), NatureWorks LLC, Novamont S.p.A., Rodenburg Biopolymers B.V., Teijin Limited, Total Corbion PLA BV, and Vegeplast S.A.S.

Scope of the Report:

Attributes | Details |

Base Year | 2022 |

Trend Period | 2020 – 2032 |

Forecast Period | 2023 – 2032 |

Pages | 350 |

Application Areas | Rigid packaging, Flexible Packaging (Bags, Sacks, Pouches), Other flexible packaging, Consumer Goods, Automotive and Electronics, and Other Applications |

Product Groups | Polylactic acid (PLA), Starch, Other Biodegradable Plastics, and Other Non-Biodegradable Plastics |

Company Profiles | BASF, Braskem, FENC, NatureWorks, Novamont, Rodenburg, Teijin, Total Corbion, and Vegeplast (Selection) |

Edition | 8th edition |

Publication | May 2023 |

FAQs

How will bioplastics sales develop by 2032?

Analysts expect revenues generated with bioplastics to rise to approx. USD 11.4 billion by 2031.

What application area is expected to experience the highest growth?

The highest growth rates over the next few years are expected in the bags, sacks and pouches segment.

Which plastic types are not considered in this market study?

Biobased elastomers, thermosets, natural fiber-reinforced plastics (NFRP), and composites such as wood-plastic composites (WPC) are not considered in this market study.

1 Market Data: World and Regions

1.1 World

1.1.1 Basics

1.1.2 Demand

1.1.3 Revenues

1.1.4 Production

1.1.5 Demand Split by Application Area

1.1.6 Demand Split by Product

1.2 Europe

1.2.1 Demand

1.2.2 Revenues

1.2.3 Production

1.2.4 Applications and Products

1.3 North America

1.3.1 Demand

1.3.2 Revenues

1.3.3 Production

1.3.4 Applications and Products

1.4 Asia-Pacific

1.4.1 Demand

1.4.2 Revenues

1.4.3 Production

1.4.4 Applications and Products

1.5 Rest of the World

1.5.1 Demand

1.5.2 Revenues

1.5.3 Production

1.5.4 Applications and Products

2 Market Data: Countries

2.1 Europe

2.1.1 France

2.1.2 Germany

2.1.3 Italy

2.1.4 Spain

2.1.5 The Netherlands

2.1.6 United Kingdom

2.1.7 Rest of Europe

2.2 North America

2.2.1 Canada / Mexico

2.2.2 USA

2.3 Asia-Pacific

2.3.1 China

2.3.2 Japan

2.3.3 South Korea

2.3.4 Taiwan

2.3.5 Other Asia-Pacific

3 Company Profiles

3.1 Western Europe

Austria (3)

Belgium (2)

Finland (2)

France (3)

Germany (8)

Italy (7)

Norway (1)

Portugal (1)

Spain (3)

Sweden (1)

Switzerland (2)

The Netherlands (5)

United Kingdom (2)

3.2 Eastern Europe

Greece (1)

Czechia (1)

Turkey (2)

3.3 North America

Canada (1)

Mexico (1)

USA (14)

3.4 South America

Brazil (1)

3.5 Asia-Pacific

Australia (2)

China (30)

India (1)

Japan (12)

Singapore (1)

South Korea (7)

Taiwan (4)

Thailand (1)

3.6 Middle East

Saudi Arabia (1)

Graph 1: Global demand from 2020 to 2032

Graph 2: Global demand from 2020 to 2032 – split by region

Graph 3: Global revenues from 2020 to 2032 in million USD and million EUR

Graph 4: Global revenues from 2020 to 2032 in million USD – split by region

Graph 5: Global revenues from 2020 to 2032 in million EUR – split by region

Graph 6: Global production from 2020 to 2032

Graph 7: Global production from 2020 to 2032 – split by region

Graph 8: Global demand from 2020 to 2032 – split by application

Graph 9: Global demand in the application area of rigid packaging from 2020 to 2032 – split by region

Graph 10: Global demand in the application area of flexible packaging – bags from 2020 to 2032 – split by region

Graph 11: Global demand in the application area of flexible packaging – others from 2020 to 2032 – split by region

Graph 12: Global demand in the application area of consumer goods from 2020 to 2032 – split by region

Graph 13: Global demand for bioplastics in the application area of automotive & electronics from 2020 to 2032 – split by region

Graph 14: Global demand in other application areas from 2020 to 2032 – split by region

Graph 15: Global demand from 2020 to 2032 – split by product

Graph 16: Global demand for PLA from 2020 to 2032 – split by region

Graph 17: Global demand for starch-based plastics from 2020 to 2032 – split by region

Graph 18: Global demand for PHA from 2020 to 2032 – split by region

Graph 19: Global demand for PBAT from 2020 to 2032 – split by region

Graph 20: Global demand for other biodegradable plastics from 2020 to 2032 – split by region

Graph 21: Global demand for bio-PE from 2020 to 2032 – split by region

Graph 22: Global demand for other non-biodegradable plastics from 2020 to 2032 – split by region

Graph 23: Demand in Europe from 2020 to 2032

Graph 24: Revenues generated in Europe from 2020 to 2032 in million USD and million EUR

Graph 25: Production in Europe from 2020 to 2032

Graph 26: Demand in Europe from 2020 to 2032 – split by application

Graph 27: Demand in North America from 2020 to 2032

Graph 28: Revenues generated in North America from 2020 to 2032 in billion USD and billion EUR

Graph 29: Production in North America from 2020 to 2032

Graph 30: Demand in North America from 2020 to 2032 – split by application

Graph 31: Demand in Asia-Pacific from 2020 to 2032

Graph 32: Revenues generated in Asia-Pacific from 2020 to 2032 in billion USD and billion EUR

Graph 33: Production in Asia-Pacific from 2020 to 2032

Graph 34: Demand in Asia-Pacific from 2020 to 2032 – split by application

Graph 35: Demand in the rest of the world from 2020 to 2032

Graph 36: Revenues generated in the rest of the world from 2020 to 2032 in million USD and million EUR

Graph 37: Production in the rest of the world from 2020 to 2032

Graph 38: Demand in the rest of the world from 2020 to 2032 – split by application

Graph 39: Demand in France from 2020 to 2032

Graph 40: Demand in Germany from 2020 to 2032

Graph 41: Demand in Italy from 2020 to 2032

Graph 42: Demand in Spain from 2020 to 2032

Graph 43: Demand in the Netherlands from 2020 to 2032

Graph 44: Demand in the United Kingdom from 2020 to 2032

Graph 45: Demand in the remaining countries of Europe from 2020 to 2032

Graph 46: Demand in Canada & Mexico from 2020 to 2032

Graph 47: Demand in the USA from 2020 to 2032

Graph 48: Demand in China from 2020 to 2032

Graph 49: Demand in Japan from 2020 to 2032

Graph 50: Demand in South Korea from 2020 to 2032

Graph 51: Demand in Taiwan from 2020 to 2032

Graph 52: Demand in the remaining countries of Asia-Pacific from 2020 to 2032

Table 1: Global demand from 2020 to 2032 – split by region

Table 2: Global revenues from 2020 to 2032 in million USD – split by region

Table 3: Global revenues from 2020 to 2032 in million EUR – split by region

Table 4: Global production from 2020 to 2032 – split by region

Table 5: Global demand from 2020 to 2032 – split by application

Table 6: Global demand in the application area of rigid packaging from 2020 to 2032 – split by region

Table 7: Global demand in the application area of flexible packaging – bags from 2020 to 2032 – split by region

Table 8: Global demand in the application area of flexible packaging – others from 2020 to 2032 – split by region

Table 9: Global demand in the application area of consumer goods from 2020 to 2032 – split by region

Table 10: Global demand for bioplastics in the application area of automotive & electronics from 2020 to 2032 – split by region

Table 11: Global demand in other application areas from 2020 to 2032 – split by region

Table 12: Global demand from 2020 to 2032 – split by product

Table 13: Global demand for PLA from 2020 to 2032 – split by region

Table 14: Global demand for starch-based plastics from 2020 to 2032 – split by region

Table 15: Global demand for PHA from 2020 to 2032 – split by region

Table 16: Global demand for PBAT from 2020 to 2032 – split by region

Table 17: Global demand for other biodegradable plastics from 2020 to 2032 – split by region

Table 18: Global demand for bio-PE from 2020 to 2032 – split by region

Table 19: Global demand for other non-biodegradable plastics from 2020 to 2032 – split by region

Table 20: Demand in Europe from 2020 to 2032 – split by major country

Table 21: Revenues generated in Europe from 2020 to 2032 in million USD and million EUR

Table 22: Production in Europe from 2020 to 2032 – split by major country

Table 23: Production in Europe from 2020 to 2032 – split by product

Table 24: Demand in Europe from 2020 to 2032 – split by application

Table 25: Demand in Europe from 2020 to 2032 – split by product

Table 26: Demand in North America from 2020 to 2032 – split by major country

Table 27: Revenues generated in North America from 2020 to 2032 in million USD and million EUR

Table 28: Production in North America from 2020 to 2032 – split by major country

Table 29: Production in North America from 2020 to 2032 – split by product

Table 30: Demand in North America from 2020 to 2032 – split by application

Table 31: Demand in North America from 2020 to 2032 – split by product

Table 32: Demand in Asia-Pacific from 2020 to 2032 – split by major country

Table 33: Revenues generated in Asia-Pacific from 2020 to 2032 in million USD and million EUR

Table 34: Production in Asia-Pacific from 2020 to 2032 – split by major country

Table 35: Production in Asia-Pacific from 2020 to 2032 – split by product

Table 36: Demand in Asia-Pacific from 2020 to 2032 – split by application

Table 37: Demand in Asia-Pacific from 2020 to 2032 – split by product

Table 38: Revenues generated in the rest of the world from 2020 to 2032 in million USD and million EUR

Table 39: Production in the rest of the world from 2020 to 2032 – split by product

Table 40: Demand in the rest of the world from 2020 to 2032 – split by application

Table 42: Revenues generated in France from 2029 to 2032, in million USD and million EUR

Table 43: Demand in France from 2020 to 2032 – split by application

Table 44: Demand in France from 2020 to 2032 – split by product

Table 45: Revenues generated in Germany from 2020 to 2032 in million USD and million EUR

Table 46: Demand in Germany from 2020 to 2032 – split by application

Table 47: Demand in Germany from 2020 to 2032 – split by product

Table 48: Revenues generated in Italy from 2020 to 2032 in million USD and million EUR

Table 49: Demand in Italy from 2020 to 2032 – split by application

Table 50: Demand in Italy from 2020 to 2032 – split by product

Table 51: Revenues in Spain from 2020 to 2032 in million USD and million EUR

Table 52: Demand in Spain from 2020 to 2032 – split by application

Table 53: Demand in Spain from 2020 to 2032 – split by product

Table 54: Revenues generated in the Netherlands from 2020 to 2032 in million USD and million EUR

Table 55: Demand in the Netherlands from 2020 to 2032 – split by application

Table 56: Demand in the Netherlands from 2020 to 2032 — split by product

Table 57: Revenues generated in the United Kingdom from 2020 to 2032 in million USD and million EUR

Table 58: Demand in the United Kingdom from 2020 to 2032 – split by application

Table 59: Demand in the United Kingdom from 2020 to 2032 – split by product

Table 60: Revenues generated in the remaining countries of Europe from 2020 to 2032 in million USD and million EUR

Table 61: Demand in the remaining countries of Europe from 2020 to 2032 – split by application

Table 62: Demand in the remaining countries of Europe from 2020 to 2032 – split by product

Table 63: Revenues in Canada & Mexico from 2020 to 2032 in million USD and million EUR

Table 64: Demand in Canada & Mexico from 2020 to 2032 – split by application

Table 65: Demand in Canada & Mexico from 2020 to 2032 – split by product

Table 66: Revenues generated in the USA from 2020 to 2032 in million USD and million EUR

Table 67: Demand in the USA from 2020 to 2032 – split by application

Table 68: Demand in the USA from 2020 to 2032 – split by product

Table 69: Revenues generated in China from 2020 to 2032 in million USD and million EUR

Table 70: Demand in China from 2020 to 2032 – split by application

Table 71: Demand in China from 2020 to 2032 – split by product

Table 72: Revenues in Japan from 2020 to 2032 in million USD and million EUR

Table 73: Demand in Japan from 2020 to 2032 – split by application

Table 74: Demand in Japan from 2020 to 2032 – split by product

Table 75: Revenues generated in South Korea from 2020 to 2032 in million USD and million EUR

Table 76: Demand in South Korea from 2020 to 2032 – split by application

Table 77: Demand in South Korea from 2020 to 2032 – split by product

Table 78: Revenues generated in Taiwan from 2020 to 2032 in million USD and million EUR

Table 79: Demand in Taiwan from 2020 to 2032 – split by application

Table 80: Demand in Taiwan from 2020 to 2032 – split by product

Table 81: Revenues in the remaining countries of Asia-Pacific from 2020 to 2032 in million USD and million EUR

Table 82: Demand in the remaining countries of Asia-Pacific from 2020 to 2032 – split by application

Table 83: Demand in the remaining countries of Asia-Pacific from 2020 to 2032 – split by product