Description

The Bags & Sacks Market Report – World is now also available in parts (e.g. individual country profiles or all manufacturer profiles). Please feel free to contact us and we will immediately send you an offer for your specific selection.

Should single use carrier bags be banned? Discussions on this topic increase in the media of many countries. More and more countries try to banish lightweight plastic bags in particular from retail or at least to reduce their consumption. However, not only carrier bags belong to the sector bags and sacks: The current Ceresana bags and sacks market report, which is already the second edition, also provides extensive information on garbage bags and sacks, heavy duty and industry sacks as well as pouch packaging for foodstuffs. Many different influential factors affect this complex market. Besides several plastic types (mainly LDPE, LLDPE, HDPE, PP, and woven plastic strips), the study also covers bags and sacks made of paper.

Industrial Bags Strongly Dependent on Economy

Demand for heavy duty and industry sacks depends to a large extent on the economic development of the respective countries. Trade links are very important for transport packaging: Demand can profit from free trade agreements and free movement of goods; protectionist measures and trade barriers, however, can impede market dynamics. Furthermore, the construction economy in particular has a decisive impact since construction materials are often transported and traded in woven plastic or polyethylene bags. The fundamental trends regarding the development of the economy as well as the construction industry are therefore analyzed in detail in the individual country profiles (2.1.1 to 2.5.5).

Bags Profit from Packaging Industry Trends

Bags and sacks provide benefits that are desirable for consumers and the lightweight packaging industry: good printability, material saving, appealing looks, and increasingly often resealability. Their usability for food continues to increase. Global demand for pouch packaging made of plastics in the segment food is likely to grow by 4.2% per year until 2025.

Stand-Up Pouches Growing Most Dynamically

Plastics and paper are the most popular materials for packaging bags. A particularly dynamically growing segment within the global packaging industry are stand-up pouches made of plastics that can, for example, be used for dried fruits, ready-made meals for the microwave or for beverages and sauces. In the non-food segment, stand-up pouches are also increasingly used, for example for detergents and cleaners or cosmetics and personal care products. They are also increasingly often used to package wet food for animals. Worldwide, about 230 billion stand-up pouches were sold in 2017. The European market reached a volume of over 45 billion units – thus, sales more than sextupled in the past 15 years. In the USA, Canada, and Mexico, demand rose to more than 30 billion units. The region Asia-Pacific reached a share of almost 55% of the global market. Demand is expected to continue to increase by 7% respectively in the upcoming years. Especially resealable stand-up pouches will increase rapidly: Ceresana expects growth rates of over 10% per year.

The Study in Brief:

Chapter 1 provides a description and analysis of the global market for bags and sacks made of plastics or paper – including forecasts up to 2025. For every region of the world, figures (in tonnes) such as demand split by material and by application as well as amounts of production split by material are given.

In Chapter 2, the demand for bags and sacks split by application and material, production split by material (“LDPE”, “LLDPE”, “HDPE”, “other plastics (film)”, “woven plastics”, “paper”) as well as import and export split by material are analyzed for 16 countries.

Chapter 3 analyzes the application areas of bags and sacks in detail: Data (in tonnes) on the development of demand in the application areas carrier bags, garbage bags and sacks, heavy duty and industry sacks, food packaging, as well as other applications. The indications are further split by material (plastic and paper).

Chapter 4 takes a look at the demand (in tonnes) for bags and sacks split by the types of material polyethylene, other plastics (film), woven plastics, as well as paper.

Chapter 5 provides useful profiles of the largest bags and sacks manufacturers, clearly arranged according to contact details, turnover, profit, product range, production sites, profile summary, product types, and application areas. In-depth profiles of 107 manufacturers are given, including Amcor Ltd., DowDuPont, Formosa Plastics Corporation, Mondi Group, Oji Holdings, Sealed Air Corporation, Smurfit Kappa Group Plc, Stora Enso Oyj, and Toppan Printing Co., Ltd

Scope of the Report:

Attributes | Details |

| Base Year | 2017 |

| Trend Period | 2009 – 2025 |

| Forecast Period | 2018 – 2025 |

| Pages | 550 |

| Materials | LDPE, LLDPE, HDPE, Other Plastics, Woven Plastics, Paper |

| Applications | Carrier Bags, Garbage Bags and Sacks, Heavy Duty and Industry Sacks, Food Packaging, Other Applications |

| Company Profiles | BillerudKorsnäs AB, Constantia Flexibles Group GmbH, DS SMITH plc, Huhtamäki Oyi, Melitta Unternehmensgruppe Bentz KG, Mondi Group, Smurfit Kappa Group Plc, Stora Enso Oyj, VICAT SA, and Wihuri Group (Selection) |

| Edition | 2nd edition |

| Publication | October 2018 |

FAQs

How will global demand for plastic pouch packaging in the food sector develop until 2025?

The Global demand for pouch packaging made of plastics in the segment food is likely to grow by 4.2% per year until 2025.

Demand for which type of bags will develop most dynamically?

The most dynamic growth segment within the packaging industry is stand-up pouches made of plastic. Especially the demand for resealable stand-up pouches will increase rapidly: Ceresana expects growth rates of over 10% per year.

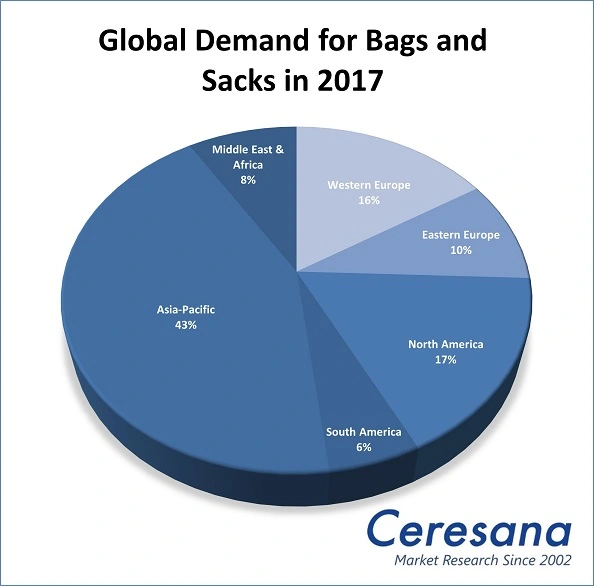

How was global consumption of bags and sacks distributed in 2017?

With 43%, the Asia-Pacific region was the largest consumer of bags and sacks. North America follows at a great distance with 17% and Western Europe with 16%. In last place is South America (5%).

1 Market Data: World and Regions

1.1 World

1.1.1 Demand

1.1.2 Production

1.2 Western Europe

1.2.1 Demand

1.2.2 Production

1.3 Eastern Europe

1.3.1 Demand

1.3.2 Production

1.4 North America

1.4.1 Demand

1.4.2 Production

1.5 South America

1.5.1 Demand

1.5.2 Production

1.6 Asia-Pacific

1.6.1 Demand

1.6.2 Production

1.7 Middle East & Africa

1.7.1 Demand

1.7.2 Production

2 Market Data: Countries

2.1 Western Europe

2.1.1 France

2.1.1.1 Demand

2.1.1.2 Production and Trade

2.1.2 Germany

2.1.2.1 Demand

2.1.2.2 Production and Trade

2.1.3 Italy

2.1.3.1 Demand

2.1.3.2 Production and Trade

2.1.5 Spain

2.1.5.1 Demand

2.1.5.2 Production and Trade

2.1.6 United Kingdom

2.1.6.1 Demand

2.1.6.2 Production and Trade

2.1.7 Other Western Europe

2.1.7.1 Demand

2.1.7.2 Production and Trade

2.2 Eastern Europe

2.2.1 Poland

2.2.1.1 Demand

2.2.1.2 Production and Trade

2.2.2 Russia

2.2.2.1 Demand

2.2.2.2 Production and Trade

2.2.3 Turkey

2.2.3.1 Demand

2.2.3.2 Production and Trade

2.2.4 Other Eastern Europe

2.2.4.1 Demand

2.2.4.2 Production and Trade

2.3 North America

2.3.1 Canada

2.3.1.1 Demand

2.3.1.2 Production and Trade

2.3.2 Mexico

2.3.2.1 Demand

2.3.2.2 Production and Trade

2.3.3 USA

2.3.3.1 Demand

2.3.3.2 Production and Trade

2.4 South America

2.4.1 Brazil

2.4.1.1 Demand

2.4.1.2 Production and Trade

2.4.2 Other South America

2.4.2.1 Demand

2.4.2.2 Production and Trade

2.5 Asia-Pacific

2.5.1 China

2.5.1.1 Demand

2.5.1.2 Production and Trade

2.5.2 India

2.5.2.1 Demand

2.5.2.2 Production and Trade

2.5.3 Japan

2.5.3.1 Demand

2.5.3.2 Production and Trade

2.5.4 South Korea

2.5.4.1 Demand

2.5.4.2 Production and Trade

2.5.5 Other Asia-Pacific

2.5.5.1 Demand

2.5.5.2 Production and Trade

3 Market Data: Applications

3.1 World

3.1.1 Carrier Bags – Plastics

3.1.2 Garbage Bags and Sacks – Plastics

3.1.3 Heavy Duty and Industry – Plastics

3.1.4 Food Packaging – Plastics

3.1.5 Other Applications – Plastics

3.1.6 Carrier Bags – Paper

3.1.7 Heavy Duty and Industry – Paper

3.1.8 Food Packaging – Paper

3.1.9 Other Applications – Paper

3.2 Western Europe

3.2.1 Carrier Bags – Plastics

3.2.2 Garbage Bags and Sacks – Plastics

3.2.3 Heavy Duty and Industry – Plastics

3.2.4 Food Packaging – Plastics

3.2.5 Other Applications – Plastics

3.2.6 Carrier Bags – Paper

3.2.7 Heavy Duty and Industry – Paper

3.2.8 Food Packaging – Paper

3.2.9 Other Applications – Paper

3.3 Eastern Europe

3.3.1 Carrier Bags – Plastics

3.3.2 Garbage Bags and Sacks – Plastics

3.3.3 Heavy Duty and Industry – Plastics

3.3.4 Food Packaging – Plastics

3.3.5 Other Applications – Plastics

3.3.6 Carrier Bags – Paper

3.3.7 Heavy Duty and Industry – Paper

3.3.8 Food Packaging – Paper

3.3.9 Other Applications – Paper

3.4 North America

3.4.1 Carrier Bags – Plastics

3.4.2 Garbage Bags and Sacks – Plastics

3.4.3 Heavy Duty and Industry – Plastics

3.4.4 Food Packaging – Plastics

3.4.5 Other Applications – Plastics

3.4.6 Carrier Bags – Paper

3.4.7 Heavy Duty and Industry – Paper

3.4.8 Food Packaging – Paper

3.4.9 Other Applications – Paper

3.5 South America

3.5.1 Carrier Bags – Plastics

3.5.2 Garbage Bags and Sacks – Plastics

3.5.3 Heavy Duty and Industry – Plastics

3.5.4 Food Packaging – Plastics

3.5.5 Other Applications – Plastics

3.5.6 Carrier Bags – Paper

3.5.7 Heavy Duty and Industry – Paper

3.5.8 Food Packaging – Paper

3.5.9 Other Applications – Paper

3.6 Asia-Pacific

3.6.1 Carrier Bags – Plastics

3.6.2 Garbage Bags and Sacks – Plastics

3.6.3 Heavy Duty and Industry – Plastics

3.6.4 Food Packaging – Plastics

3.6.5 Other Applications – Plastics

3.6.6 Carrier Bags – Paper

3.6.7 Heavy Duty and Industry – Paper

3.6.8 Food Packaging – Paper

3.6.9 Other Applications – Paper

3.7 Middle East & Africa

4 Market Data: Materials

4.1 Polyethylene (Film)

4.1.1 World

4.1.2 Western Europe

4.1.3 Eastern Europe

4.1.4 North America

4.1.5 South America

4.1.6 Asia-Pacific

4.1.7 Middle East & Africa

4.2 Other Plastics (Film)

4.2.1 World

4.2.2 Western Europe

4.2.3 Eastern Europe

4.2.4 North America

4.2.5 South America

4.2.6 Asia-Pacific

4.2.7 Middle East & Africa

4.3 Plastics (Woven)

4.3.1 World

4.3.2 Western Europe

4.3.3 Eastern Europe

4.3.4 North America

4.3.5 South America

4.3.6 Asia-Pacific

4.3.7 Middle East & Africa

4.4 Paper

4.4.1 World

4.4.2 Western Europe

4.4.3 Eastern Europe

4.4.4 North America

4.4.5 South America

4.4.6 Asia-Pacific

4.4.7 Middle East & Africa

5 Company Profiles

5.1 Western Europe

Austria (3 Producers)

Finland (5)

France (3)

Germany (9)

Ireland (3)

Italy (6)

Luxembourg (1)

Spain (1)

Sweden (3)

Switzerland (2)

The Netherlands (4)

United Kingdom (7)

5.2 Eastern Europe

Croatia (1)

Czechia (1)

Greece (1)

Poland (1)

Turkey (3)

Ukraine (1)

5.3 North America

Canada (3)

Mexico (1)

USA (21)

5.4 South America

Brazil (3)

5.5 Asia-Pacific

Australia (2)

Hong Kong (1)

India (2)

Japan (12)

Malaysia (1)

Singapore (1)

Taiwan (2)

Vietnam (1)

5.6 Africa

South Africa (2)

Graph 1: Global demand for bags and sacks from 2009 to 2025

Graph 2: Global demand for bags and sacks from 2009 to 2025 – split by regions

Graph 3: Global production of bags and sacks from 2009 to 2025

Graph 4: Global production of bags and sacks from 2009 to 2025 – split by regions

Graph 5: Demand for bags and sacks in Western Europe from 2009 to 2025

Graph 6: Production of bags and sacks in Western Europe from 2009 to 2025

Graph 7: Demand for bags and sacks in Eastern Europe from 2009 to 2025

Graph 8: Production of bags and sacks in Eastern Europe from 2009 to 2025

Graph 9: Demand for bags and sacks in North America from 2009 to 2025

Graph 10: Production of bags and sacks in North America from 2009 to 2025

Graph 11: Demand for bags and sacks in South America from 2009 to 2025

Graph 12: Production of bags and sacks in South America from 2009 to 2025

Graph 13: Demand for bags and sacks in Asia-Pacific from 2009 to 2025

Graph 14: Production of bags and sacks in Asia-Pacific from 2009 to 2025

Graph 15: Demand for bags and sacks in the Middle East & Africa from 2009 to 2025

Graph 16: Production of bags and sacks in the Middle East & Africa from 2009 to 2025

Graph 17: Demand for bags and sacks in France from 2009 to 2025

Graph 18: Production of bags and sacks in France from 2009 to 2025

Graph 19: Demand for bags and sacks in Germany from 2009 to 2025

Graph 20: Production of bags and sacks in Germany from 2009 to 2025

Graph 21: Demand for bags and sacks in Italy from 2009 to 2025

Graph 22: Production of bags and sacks in Italy from 2009 to 2025

Graph 23: Demand for bags and sacks in Spain from 2009 to 2025

Graph 24: Production of bags and sacks in Spain from 2009 to 2025

Graph 25: Demand for bags and sacks in the United Kingdom from 2009 to 2025

Graph 26: Production of bags and sacks in the United Kingdom from 2009 to 2025

Graph 27: Demand for bags and sacks in Other Western Europe from 2009 to 2025

Graph 28: Production of bags and sacks in Other Western Europe from 2009 to 2025

Graph 29: Demand for bags and sacks in Poland from 2009 to 2025

Graph 30: Production of bags and sacks in Poland from 2009 to 2025

Graph 31: Demand for bags and sacks in Russia from 2009 to 2025

Graph 32: Production of bags and sacks in Russia from 2009 to 2025

Graph 33: Demand for bags and sacks in Turkey from 2009 to 2025

Graph 34: Production of bags and sacks in Turkey from 2009 to 2025

Graph 35: Demand for bags and sacks in Other Eastern Europe from 2009 to 2025

Graph 36: Production of bags and sacks in Other Eastern Europe from 2009 to 2025

Graph 37: Demand for bags and sacks in Canada from 2009 to 2025

Graph 38: Production of bags and sacks in Canada from 2009 to 2025

Graph 39: Demand for bags and sacks in Mexico from 2009 to 2025

Graph 40: Production of bags and sacks in Mexico from 2009 to 2025

Graph 41: Demand for bags and sacks in the USA from 2009 to 2025

Graph 42: Production of bags and sacks in the USA from 2009 to 2025

Graph 43: Demand for bags and sacks in Brazil from 2009 to 2025

Graph 44: Production of bags and sacks in Brazil from 2009 to 2025

Graph 45: Demand for bags and sacks in Other South America from 2009 to 2025

Graph 46: Production of bags and sacks in Other South America from 2009 to 2025

Graph 47: Demand for bags and sacks in China from 2009 to 2025

Graph 48: Production of bags and sacks in China from 2009 to 2025

Graph 49: Demand for bags and sacks in India from 2009 to 2025

Graph 50: Production of bags and sacks in India from 2009 to 2025

Graph 51: Demand for bags and sacks in Japan from 2009 to 2025

Graph 52: Production of bags and sacks in Japan from 2009 to 2025

Graph 53: Demand for bags and sacks in South Korea from 2009 to 2025

Graph 54: Production of bags and sacks in South Korea from 2009 to 2025

Graph 55: Demand for bags and sacks in Other Asia-Pacific from 2009 to 2025

Graph 56: Production of bags and sacks in Other Asia-Pacific from 2009 to 2025

Graph 57: Global demand for bags and sacks from 2009 to 2025 – split by applications

Graph 58: Global demand for plastic carrier bags from 2009 to 2025 – split by regions

Graph 59: Global demand for plastic garbage bags and sacks from 2009 to 2025 – split by regions

Graph 60: Global demand for plastic heavy duty and industry sacks from 2009 to 2025 – split by regions

Graph 61: Global demand for plastic bags for food packaging from 2009 to 2025 – split by regions

Graph 62: Global demand for plastic bags and sacks in other applications from 2009 to 2025 – split by regions

Graph 63: Global demand for paper carrier bags from 2009 to 2025 – split by regions

Graph 64: Global demand for paper heavy duty and industry sacks from 2009 to 2025 – split by regions

Graph 65: Global demand for paper bags for food packaging from 2009 to 2025 – split by regions

Graph 66: Global demand for paper bags and sacks in other applications from 2009 to 2025 – split by regions

Graph 67: Demand for bags and sacks in Western Europe from 2009 to 2025 – split by applications

Graph 68: Demand for bags and sacks in Eastern Europe from 2009 to 2025 – split by applications

Graph 69: Demand for bags and sacks in North America from 2009 to 2025 – split by applications

Graph 70: Demand for bags and sacks in South America from 2009 to 2025 – split by applications

Graph 71: Demand for bags and sacks in Asia-Pacific from 2009 to 2025 – split by applications

Graph 72: Demand for bags and sacks in the Middle East & Africa from 2009 to 2025 – split by applications

Graph 73: Global demand for bags and sacks made of polyethylene (film) from 2009 to 2025 – split by regions

Graph 74: Global demand for bags and sacks made of other plastic films from 2009 to 2025 – split by regions

Graph 75: Global demand for bags and sacks made of woven plastics from 2009 to 2025 – split by regions

Graph 76: Global demand for bags and sacks made of paper from 2009 to 2025 – split by regions

Table 1: Global demand for bags and sacks from 2009 to 2025 – split by regions

Table 2: Global demand for bags and sacks from 2009 to 2025 – split by applications

Table 3: Global demand for bags and sacks from 2009 to 2025 – split by material

Table 4: Global production of bags and sacks from 2009 to 2025 – split by regions

Table 5: Global production of bags and sacks from 2009 to 2025 – split by material

Table 6: Demand for bags and sacks in Western Europe from 2009 to 2025 – split by major countries

Table 7: Production of bags and sacks in Western Europe from 2009 to 2025 – split by major countries

Table 8: Demand for bags and sacks in Eastern Europe from 2009 to 2025 – split by major countries

Table 9: Production of bags and sacks in Eastern Europe from 2009 to 2025 – split by major countries

Table 10: Demand for bags and sacks in North America from 2009 to 2025 – split by major countries

Table 11: Production of bags and sacks in North America from 2009 to 2025 – split by major countries

Table 12: Demand for bags and sacks in South America from 2009 to 2025 – split by major countries

Table 13: Production of bags and sacks in South America from 2009 to 2025 – split by major countries

Table 14: Demand for bags and sacks in Asia-Pacific from 2009 to 2025 – split by major countries

Table 15: Production of bags and sacks in Asia-Pacific from 2009 to 2025 – split by major countries

Table 16: Demand for bags and sacks in the Middle East & Africa from 2009 to 2025 – split by applications

Table 17: Demand for bags and sacks in the Middle East & Africa from 2009 to 2025 – split by material

Table 18: Production of bags and sacks in the Middle East & Africa from 2009 to 2025 – split by material

Table 19: Demand for bags and sacks in France from 2009 to 2025 – split by applications

Table 20: Global demand for bags and sacks in France from 2009 to 2025 – split by material

Table 21: Important manufacturers of bags and sacks in France

Table 22: Production of bags and sacks in France from 2009 to 2025 – split by material

Table 23: Import and export of bags and sacks in France from 2009 to 2025

Table 24: Global demand for bags and sacks in Germany from 2009 to 2025 – split by applications

Table 25: Global demand for bags and sacks in Germany from 2009 to 2025 – split by material

Table 26: Production of bags and sacks in Germany from 2009 to 2025 – split by material

Table 27: Important manufacturers of bags and sacks in Germany

Table 28: Import and export bags and sacks in Germany from 2009 to 2025

Table 29: Demand for bags and sacks in Italy from 2009 to 2025 – split by applications

Table 30: Demand for bags and sacks in Italy from 2009 to 2025 – split by material

Table 31: Production of bags and sacks in Italy from 2009 to 2025 – split by material

Table 32: Important manufacturers of bags and sacks in Italy

Table 33: Import and export of bags and sacks in Italy from 2009 to 2025

Table 34: Demand for bags and sacks in Spain from 2009 to 2025 – split by applications

Table 35: Demand for bags and sacks in Spain from 2009 to 2025 – split by material

Table 36: Production of bags and sacks in Spain from 2009 to 2025 – split by material

Table 37: Import and export of bags and sacks in Spain from 2009 to 2025

Table 38: Demand for bags and sacks in the United Kingdom from 2009 to 2025 – split by applications

Table 39: Demand for bags and sacks in the United Kingdom from 2009 to 2025 – split by material

Table 40: Production of bags and sacks in the United Kingdom from 2009 to 2025 – split by material

Table 41: Important manufacturers of bags and sacks in the United Kingdom

Table 42: Import and export of bags and sacks in the United Kingdom from 2009 to 2025

Table 43: Demand for bags and sacks in Other Western Europe from 2009 to 2025 – split by applications

Table 44: Demand for bags and sacks in Other Western Europe from 2009 to 2025 – split by material

Table 45: Production of bags and sacks in Other Western Europe from 2009 to 2025 – split by material

Table 46: Important manufacturers of bags and sacks in Other Western Europe

Table 47: Import and export of bags and sacks in Other Western Europe from 2009 to 2025

Table 48: Demand for bags and sacks in Poland from 2009 to 2025 – split by applications

Table 49: Demand for bags and sacks in Poland from 2009 to 2025 – split by material

Table 50: Production of bags and sacks in Poland from 2009 to 2025 – split by material

Table 51: Import and export of bags and sacks in Poland from 2009 to 2025

Table 52: Demand for bags and sacks in Russia from 2009 to 2025 – split by applications

Table 53: Demand for bags and sacks in Russia from 2009 to 2025 – split by material

Table 54: Production of bags and sacks in Russia from 2009 to 2025 – split by material

Table 55: Import and export of bags and sacks in Russia from 2009 to 2025

Table 56: Demand for bags and sacks in Turkey from 2009 to 2025 – split by applications

Table 57: Demand for bags and sacks in Turkey from 2009 to 2025 – split by material

Table 58: Production of bags and sacks in Turkey from 2009 to 2025 – split by material

Table 59: Important manufacturers of bags and sacks in Turkey

Table 60: Import and export of bags and sacks in Turkey from 2009 to 2025

Table 61: Demand for bags and sacks in Other Eastern Europe from 2009 to 2025 – split by applications

Table 62: Demand for bags and sacks in Other Eastern Europe from 2009 to 2025 – split by material

Table 63: Important manufacturers of bags and sacks in Other Eastern Europe

Table 64: Production of bags and sacks in Other Eastern Europe from 2009 to 2025 – split by material

Table 65: Import and export of bags and sacks in Other Eastern Europe from 2009 to 2025

Table 66: Demand for bags and sacks in Canada from 2009 to 2025 – split by applications

Table 67: Demand for bags and sacks in Canada from 2009 to 2025 – split by material

Table 68: Production of bags and sacks in Canada from 2009 to 2025 – split by material

Table 69: Import and export of bags and sacks in Canada from 2009 to 2025

Table 70: Demand for bags and sacks in Mexico from 2009 to 2025 – split by applications

Table 71: Demand for bags and sacks in Mexico from 2009 to 2025 – split by material

Table 72: Production of bags and sacks in Mexico from 2009 to 2025 – split by material

Table 73: Import and export of bags and sacks in Mexico from 2009 to 2025

Table 74: Demand for bags and sacks in the USA from 2009 to 2025 – split by applications

Table 75: Demand for bags and sacks in the USA from 2009 to 2025 – split by material

Table 76: Production of bags and sacks in the USA from 2009 to 2025 – split by material

Table 77: Important manufacturers of bags and sacks in the USA

Table 78: Import and export of bags and sacks in the USA from 2009 to 2025

Table 79: Demand for bags and sacks in Brazil from 2009 to 2025 – split by applications

Table 80: Demand for bags and sacks in Brazil from 2009 to 2025 – split by material

Table 81: Important manufacturers of bags and sacks in Brazil

Table 82: Production of bags and sacks in Brazil from 2009 to 2025 – split by material

Table 83: Import and export of bags and sacks in Brazil from 2009 to 2025

Table 84: Demand for bags and sacks in Other South America from 2009 to 2025 – split by applications

Table 85: Demand for bags and sacks in Other South America from 2009 to 2025 – split by material

Table 86: Production of bags and sacks in Other South America from 2009 to 2025 – split by material

Table 87: Import and export of bags and sacks in Other South America from 2009 to 2025

Table 88: Global demand for bags and sacks in China from 2009 to 2025 – split by applications

Table 89: Demand for bags and sacks in China from 2009 to 2025 – split by material

Table 90: Production of bags and sacks in China from 2009 to 2025 – split by material

Table 91: Import and export of bags and sacks in China from 2009 to 2025

Table 92: Demand for bags and sacks in India from 2009 to 2025 – split by applications

Table 93: Demand for bags and sacks in India from 2009 to 2025 – split by material

Table 94: Production of bags and sacks in India from 2009 to 2025 – split by material

Table 95: Production of bags and sacks in India from 2009 to 2025 – split by material

Table 96: Import and export of bags and sacks in India from 2009 to 2025

Table 97: Demand for bags and sacks in Japan from 2009 to 2025 – split by applications

Table 98: Demand for bags and sacks in Japan from 2009 to 2025 – split by material

Table 99: Production of bags and sacks in Japan from 2009 to 2025 – split by material

Table 100: Important manufacturers of bags and sacks in Japan

Table 101: Import and export of bags and sacks in Japan from 2009 to 2025

Table 102: Demand for bags and sacks in South Korea from 2009 to 2025 – split by applications

Table 103: Demand for bags and sacks in South Korea from 2009 to 2025 – split by material

Table 104: Import and export of bags and sacks in South Korea from 2009 to 2025

Table 105: Production of bags and sacks in South Korea from 2009 to 2025 – split by material

Table 106: Demand for bags and sacks in Other Asia-Pacific from 2009 to 2025 – split by applications

Table 107: Demand for bags and sacks in Other Asia-Pacific from 2009 to 2025 – split by material

Table 108: Production of bags and sacks in Other Asia-Pacific from 2009 to 2025 – split by material

Table 109: Important manufacturers of bags and sacks in Other Asia-Pacific

Table 110: Import and export of bags and sacks in Other Asia-Pacific from 2009 to 2025

Table 111: Global demand for bags and sacks from 2009 to 2025 – split by applications

Table 112: Global demand for plastic carrier bags from 2009 to 2025 – split by regions

Table 113: Global demand for plastic garbage bags and sacks from 2009 to 2025 – split by regions

Table 114: Global demand for plastic heavy duty and industry sacks from 2009 to 2025 – split by regions

Table 115: Global demand for plastic bags for food packaging from 2009 to 2025 – split by regions

Table 116: Global demand for plastic bags and sacks in other applications from 2009 to 2025 – split by regions

Table 117: Global demand for paper carrier bags from 2009 to 2025 – split by regions

Table 118: Global demand for paper heavy duty and industry sacks from 2009 to 2025 – split by regions

Table 119: Global demand for paper bags for food packaging from 2009 to 2025 – split by regions

Table 120: Global demand for paper bags and sacks in other applications from 2009 to 2025 – split by regions

Table 121: Demand for bags and sacks in Western Europe from 2009 to 2025 – split by applications

Table 122: Demand for plastic carrier bags in Western Europe from 2009 to 2025 – split by major countries

Table 123: Demand for plastic garbage sacks in Western Europe from 2009 to 2025 – split by major countries

Table 124: Demand for plastic heavy duty and industry sacks in Western Europe from 2009 to 2025 – split by major countries

Table 125: Demand for plastic bags for food packaging in Western Europe from 2009 to 2025 – split by major countries

Table 126: Demand for plastic bags and sacks in other applications in Western Europe from 2009 to 2025 – split by major countries

Table 127: Demand for paper carrier bags in Western Europe from 2009 to 2025 – split by major countries

Table 128: Demand for paper heavy duty and industry sacks in Western Europe from 2009 to 2025 – split by major countries

Table 129: Demand for paper bags for food packaging in Western Europe from 2009 to 2025 – split by major countries

Table 130: Demand for paper bags and sacks in other applications in Western Europe from 2009 to 2025 – split by major countries

Table 131: Demand for bags and sacks in Eastern Europe from 2009 to 2025 – split by applications

Table 132: Demand for plastic carrier bags in Eastern Europe from 2009 to 2025 – split by major countries

Table 133: Demand for plastic garbage sacks in Eastern Europe from 2009 to 2025 – split by major countries

Table 134: Demand for plastic heavy duty and industry sacks in Eastern Europe from 2009 to 2025 – split by major countries

Table 135: Demand for plastic bags for food packaging in Eastern Europe from 2009 to 2025 – split by major countries

Table 136: Demand for plastic bags and sacks in other applications in Eastern Europe from 2009 to 2025 – split by major countries

Table 137: Demand for paper carrier bags in Eastern Europe from 2009 to 2025 – split by major countries

Table 138: Demand for paper heavy duty and industry sacks in Eastern Europe from 2009 to 2025 – split by major countries

Table 139: Demand for paper bags for food packaging in Eastern Europe from 2009 to 2025 – split by major countries

Table 140: Demand for paper bags and sacks in other applications in Eastern Europe from 2009 to 2025 – split by major countries

Table 141: Demand for bags and sacks in North America from 2009 to 2025 – split by applications

Table 142: Demand for plastic carrier bags in North America from 2009 to 2025 – split by major countries

Table 143: Demand for plastic garbage sacks in North America from 2009 to 2025 – split by major countries

Table 144: Demand for plastic heavy duty and industry sacks in North America from 2009 to 2025 – split by major countries

Table 145: Demand for plastic bags for food packaging in North America from 2009 to 2025 – split by major countries

Table 146: Demand for plastic bags and sacks in other applications in North America from 2009 to 2025 – split by major countries

Table 147: Demand for paper carrier bags in North America from 2009 to 2025 – split by major countries

Table 148: Demand for paper heavy duty and industry sacks in North America from 2009 to 2025 – split by major countries

Table 149: Demand for paper bags for food packaging in North America from 2009 to 2025 – split by major countries

Table 150: Demand for paper bags and sacks in other applications in North America from 2009 to 2025 – split by major countries

Table 151: Demand for bags and sacks in South America from 2009 to 2025 – split by applications

Table 152: Demand for plastic carrier bags in South America from 2009 to 2025 – split by major countries

Table 153: Demand for plastic garbage sacks in South America from 2009 to 2025 – split by major countries

Table 154: Demand for plastic heavy duty and industry sacks in South America from 2009 to 2025 – split by major countries

Table 155: Demand for plastic bags for food packaging in South America from 2009 to 2025 – split by major countries

Table 156: Demand for plastic bags and sacks in other applications in South America from 2009 to 2025 – split by major countries

Table 157: Demand for paper carrier bags in South America from 2009 to 2025 – split by major countries

Table 158: Demand for paper heavy duty and industry sacks in South America from 2009 to 2025 – split by major countries

Table 159: Demand for paper bags for food packaging in South America from 2009 to 2025 – split by major countries

Table 160: Demand for paper bags and sacks in other applications in South America from 2009 to 2025 – split by major countries

Table 161: Demand for bags and sacks in Asia-Pacific from 2009 to 2025 – split by applications

Table 162: Demand for plastic carrier bags in Asia-Pacific from 2009 to 2025 – split by major countries

Table 163: Demand for plastic garbage sacks in Asia-Pacific from 2009 to 2025 – split by major countries

Table 164: Demand for plastic heavy duty and industry sacks in Asia-Pacific from 2009 to 2025 – split by major countries

Table 165: Demand for plastic bags for food packaging in Asia-Pacific from 2009 to 2025 – split by major countries

Table 166: Demand for plastic bags and sacks in other applications in Asia-Pacific from 2009 to 2025 – split by major countries

Table 167: Demand for paper carrier bags in Asia-Pacific from 2009 to 2025 – split by major countries

Table 168: Demand for paper heavy duty and industry sacks in Asia-Pacific from 2009 to 2025 – split by major countries

Table 169: Demand for paper bags for food packaging in Asia-Pacific from 2009 to 2025 – split by major countries

Table 170: Demand for paper bags and sacks in other applications in Asia-Pacific from 2009 to 2025 – split by major countries

Table 171: Demand for bags and sacks in the Middle East & Africa from 2009 to 2025 – split by applications

Table 172: Global demand for bags and sacks made of polyethylene (film) from 2009 to 2025 – split by regions

Table 173: Demand for bags and sacks made of polyethylene (film) in Western Europe from 2009 to 2025 – split by major countries

Table 174: Demand for bags and sacks made of polyethylene (film) in Eastern Europe from 2009 to 2025 – split by major countries

Table 175: Demand for bags and sacks made of polyethylene (film) in North America from 2009 to 2025 – split by major countries

Table 176: Demand for bags and sacks made of polyethylene (film) in South America from 2009 to 2025 – split by major countries

Table 177: Demand for bags and sacks made of polyethylene (film) in Asia-Pacific from 2009 to 2025 – split by major countries

Table 178: Global demand for bags and sacks made of other plastic films from 2009 to 2025 – split by regions

Table 179: Demand for bags and sacks made of other plastic films in Western Europe from 2009 to 2025 – split by major countries

Table 180: Demand for bags and sacks made of other plastic films in Eastern Europe from 2009 to 2025 – split by major countries

Table 181: Demand for bags and sacks made of other plastic films in North America from 2009 to 2025 – split by major countries

Table 182: Demand for bags and sacks made of other plastic films in South America from 2009 to 2025 – split by major countries

Table 183: Demand for bags and sacks made of other plastic films in Asia-Pacific from 2009 to 2025 – split by major countries

Table 184: Global demand for bags and sacks made of woven plastics from 2009 to 2025 – split by regions

Table 185: Demand for bags and sacks made of woven plastics in Western Europe from 2009 to 2025 – split by major countries

Table 186: Demand for bags and sacks made of woven plastics in Eastern Europe from 2009 to 2025 – split by major countries

Table 187: Demand for bags and sacks made of woven plastics in North America from 2009 to 2025 – split by major countries

Table 188: Demand for bags and sacks made of woven plastics in South America from 2009 to 2025 – split by major countries

Table 189: Demand for bags and sacks made of woven plastics in Asia-Pacific from 2009 to 2025 – split by major countries

Table 190: Global demand for bags and sacks made of paper from 2009 to 2025 – split by regions

Table 191: Demand for bags and sacks made of paper in Western Europe from 2009 to 2025 – split by major countries

Table 192: Demand for bags and sacks made of paper in Eastern Europe from 2009 to 2025 – split by major countries

Table 193: Demand for bags and sacks made of paper in North America from 2009 to 2025 – split by major countries

Table 194: Demand for bags and sacks made of paper in South America from 2009 to 2025 – split by major countries

Table 195: Demand for bags and sacks made of paper in Asia-Pacific from 2009 to 2025 – split by major countries