Description

This study is currently being completely revised. We plan to publish the 5th edition in June 2024. Therefore we can offer you the update for free, if you order the current edition now.

The Printing Inks Market Report – World is now also available in parts (e.g. individual country profiles or all manufacturer profiles). Please feel free to contact us and we will immediately send you an offer for your specific selection.

The Corona pandemic is driving digitization. Since the beginning of 2020, the disruption of the print sector has accelerated significantly. Traditional customers in the printing ink industry are disappearing, but at the same time new growth opportunities are emerging for print products. Ceresana has analyzed the global printing inks market for the fourth time. The new study forecasts that total demand for printing inks (in tonnes) will increase by an average of 1.0% per year until 2030. However, there are major differences between the various regions and countries of the world.

Packaging Stimulates Growth in the Printing Inks Market

The boom in online retail is fueling demand for packaging. In the packaging sector, the segments labels (especially shrink labels), stand-up pouches, aseptic packaging, beverage packaging and specially coated packaging papers are currently growing. However, with its different materials, packaging types, properties and areas of application, the packaging market is very diverse and complex. Ceresana’s printing ink market report takes into account country-specific characteristics of the packaging market as well as different market shares of the various printing processes (see individual country profiles in chapters 2.1.1 to 2.5.5).

Rising Demand for Inkjet Printing Inks

Packaging and label printing, photo books and many other subsegments in short-run commercial printing are important growth segments for digital printing. When looking for new areas of application, ink manufacturers must take into account that digital printing has different demands for people and machines than classic printing processes: short processing times, changing paper types and short runs require precisely organized and coordinated processes. The higher the performance of digital printing systems, the more complex post press becomes. Ceresana’s current market overview examines in detail the different areas of application and printing processes, as well as the individual types of ink. The market study provides concrete figures on the demand for inkjet printing inks in the label printing segment, for example.

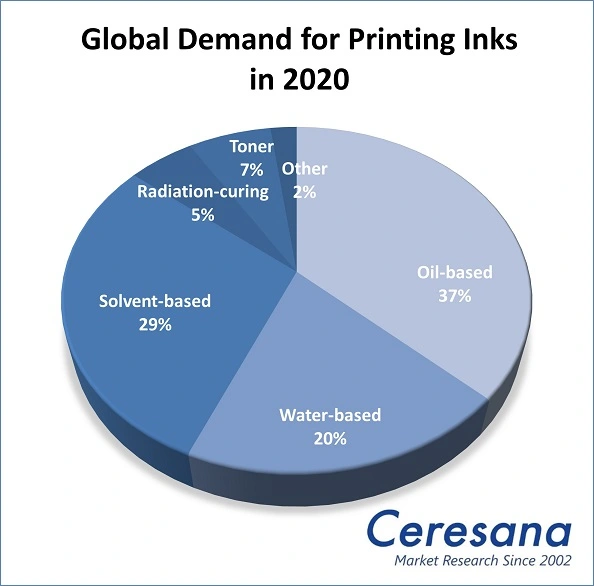

Organic Printing Inks Gain in Importance

Stricter government regulations are leading to the development of new printing inks and processing methods that are supposed to be better for the environment, but also for human health. One consequence, for example, is the increased use of UV and other radiation-curing inks. With low-migration UV inks, complete curing prevents photo initiators from being released and entering food from packaging, for example. While the demand for modern, low-pollutant and energy-saving printing processes and inks is growing significantly, the use of conventional solvent-based inks is declining.

The Study in Brief:

Chapter 1 provides key figures on the global market for printing inks – including forecasts until 2030. Data on production, imports, exports, demand and revenues are given for each region. Revenues are given in billion USD and billion EUR; all other key figures are given in 1,000 metric tonnes. The demand for printing inks is further analyzed in the following subcategories:

Demand by application areas:

- Books

- Magazines

- Newspapers

- Advertising and Catalogs

- Labels

- Packaging

- Other

Demand by printing process:

- Heatset web offset

- Coldset web offset

- Sheetfed offset

- Flexo

- Gravure

- Other analog printing

- Inkjet

- Electrophotography

Demand by printing ink – type:

- Oil-based

- Water-based

- Solvent-based

- Radiation-curing

- Toner

- Other

In chapter 2, the 17 most important national markets are discussed in more detail. Comprehensive key figures on production, imports, exports, demand and revenues are given for each country. Demand is broken down by application area, printing process and ink type. In addition, the demand per printing process in the individual application areas is given (e.g. demand for inkjet printing inks in the label printing segment).

Chapter 3 provides company profiles of the most important printing ink manufacturers, clearly organized by contact details, revenues, profits, product range, production sites and profile summary. Detailed profiles are provided by 56 manufacturers, such as 3M Company, Agfa Graphics N.V., Avery Dennison Corporation, DIC Corporation, DuPont de Nemours Inc., Fujifilm Holdings Corp., Kao Corporation, Quad/Graphics, Inc., Seiko Epson Corporation, and Siegwerk Druckfarben AG & Co. KGaA.

Scope of the Report:

Attributes | Details |

| Base Year | 2020 |

| Trend Period | 2018 – 2030 |

| Forecast Period | 2021 – 2030 |

| Pages | 380 |

| Application Areas | Books, Magazines, Newspapers, Advertising & Catalogs, Labels, Packaging, Other |

| Printing Process | Heatset Eeb Offset, Coldset Web Offset, Sheetfed Offset, Flexo, Gravure, Other Analog Printing, Inkjet, Electrophotography |

| Printing Ink – Type | Oil-Based, Water-Based, Solvent-Based, Radiation-Curing, Toner, Other |

| Company Profiles | 3M Company, Agfa Graphics N.V., Avery Dennison Corporation, DIC Corporation, DuPont de Nemours Inc., Fujifilm Holdings Corp., Kao Corporation, Quad/Graphics, Inc., Seiko Epson Corporation, and Siegwerk Druckfarben AG & Co. KGaA. (Selection) |

| Edition | 4th edition |

| Publication | December 2021 |

FAQs

How is global consumption of printing inks expected to change?

The study forecasts that that total demand for printing inks will increase by an average of 1.0% per year until 2030. However, there are major differences between the various regions and countries of the world.

Which application areas are showing increased demand?

In the packaging sector, the segments of labels (especially shrink labels), stand-up pouches, aseptic packaging, beverage packaging, and specially coated packaging papers are currently growing.

How are stricter government regulations affecting the market for printing inks?

They are leading to the development of new printing inks and processing methods that are supposed to be better for the environment, but also for human health. One consequence of this, for example, is the increased use of UV and other radiation-curing inks. While the demand for modern, low-pollutant and energy-saving printing processes and inks is growing significantly, the use of conventional solvent-based inks is declining.

1 Market Data: World and Regions

1.1 World

1.1.1 Demand

1.1.2 Revenues

1.1.3 Production

1.1.4 Applications

1.1.4.1 Books

1.1.4.2 Magazines

1.1.4.3 Newspaper

1.1.4.4 Advertising and Catalogs

1.1.4.5 Labels

1.1.4.6 Packaging

1.1.4.7 Other Applications

1.1.5 Printing Processes

1.1.5.1 Heatset Web Offset

1.1.5.2 Coldset Web Offset

1.1.5.3 Sheetfed Offset

1.1.5.4 Flexography

1.1.5.5 Gravure

1.1.5.6 Other Analog Printing

1.1.5.7 Inkjet

1.1.5.8 Electrophotography / Laser Printing

1.1.6 Printing Ink Types

1.1.6.1 Oil-based Printing Inks

1.1.6.2 Water-based Printing Inks

1.1.6.3 Solvent-based Printing Inks

1.1.6.4 Radiation-curing Printing Inks

1.1.6.5 Toner

1.1.6.6 Other Applications

1.2 Western Europe

1.2.1 Demand

1.2.2 Revenues

1.2.3 Production

1.2.4 Applications, Printing Processes, and Printing Ink Types

1.3 Eastern Europe

1.3.1 Demand

1.3.2 Revenues

1.3.3 Production

1.3.4 Applications, Printing Processes, and Printing Ink Types

1.4 North America

1.4.1 Demand

1.4.2 Revenues

1.4.3 Production

1.4.4 Applications, Printing Processes, and Printing Ink Types

1.5 South America

1.5.1 Demand

1.5.2 Revenues

1.5.3 Production

1.5.4 Applications, Printing Processes, and Printing Ink Types

1.6 Asia-Pacific

1.6.1 Demand

1.6.2 Revenues

1.6.3 Production

1.6.4 Applications, Printing Processes, and Printing Ink Types

1.7 Middle East

1.7.1 Demand

1.7.2 Revenues

1.7.3 Production

1.7.4 Applications, Printing Processes, and Printing Ink Types

1.8 Africa

1.8.1 Demand

1.8.2 Revenues

1.8.3 Production

1.8.4 Applications, Printing Processes, and Printing Ink Types

2 Market Data: Countries

2.1 Western Europe

2.1.1 France

2.1.1.1 Demand and Revenues

2.1.1.2 Production and Trade

2.1.2 Germany

2.1.2.1 Demand and Revenues

2.1.2.2 Production and Trade

2.1.3 Italy

2.1.3.1 Demand and Revenues

2.1.3.2 Production and Trade

2.1.4 Spain

2.1.4.1 Demand and Revenues

2.1.4.2 Production and Trade

2.1.5 The Netherlands

2.1.5.1 Demand and Revenues

2.1.5.2 Production and Trade

2.1.6 United Kingdom

2.1.6.1 Demand and Revenues

2.1.6.2 Production and Trade

2.1.7 Other Western Europe

2.1.7.1 Demand and Revenues

2.1.7.2 Production and Trade

2.2 Eastern Europe

2.2.1 Poland

2.2.1.1 Demand and Revenues

2.2.1.2 Production and Trade

2.2.2 Russia

2.2.2.1 Demand and Revenues

2.2.2.2 Production and Trade

2.2.3 Turkey

2.2.3.1 Demand and Revenues

2.2.3.2 Production and Trade

2.2.4 Other Eastern Europe

2.2.4.1 Demand and Revenues

2.2.4.2 Production and Trade

2.3 North America

2.3.1 Canada

2.3.1.1 Demand and Revenues

2.3.1.2 Production and Trade

2.3.2 Mexico

2.3.2.1 Demand and Revenues

2.3.2.2 Production and Trade

2.3.3 USA

2.3.3.1 Demand and Revenues

2.3.3.2 Production and Trade

2.4 South America

2.4.1 Brazil

2.4.1.1 Demand and Revenues

2.4.1.2 Production and Trade

2.4.2 Other South America

2.4.2.1 Demand and Revenues

2.4.2.2 Production and Trade

2.5 Asia-Pacific

2.5.1 China

2.5.1.1 Demand and Revenues

2.5.1.2 Production and Trade

2.5.2 India

2.5.2.1 Demand and Revenues

2.5.2.2 Production and Trade

2.5.3 Japan

2.5.3.1 Demand and Revenues

2.5.3.2 Production and Trade

2.5.4 South Korea

2.5.4.1 Demand and Revenues

2.5.4.2 Production and Trade

2.5.5 Other Asia-Pacific

2.5.5.1 Demand and Revenues

2.5.5.2 Production and Trade

3 Company Profiles*

3.1 Western Europe

Belgium (2 Producers)

Denmark (1)

Germany (10)

Italy (2)

Luxembourg (2)

Spain (1)

Switzerland (1)

The Netherlands (1)

3.2 Eastern Europe

Greece (1)

Slovenia (1)

3.3 North America

Mexico (1)

USA (10)

3.4 Asia-Pacific

China (3)

Hong Kong (1)

India (3)

Japan (10)

South Korea (3)

Vietnam (1)

3.5 Africa

Egypt (1)

South Africa (1)

*Note: The profiles are assigned to the country in which the company or holding is headquartered. Profiles also include JVs and subsidiaries.

Graph 1: Global demand for printing inks from 2018 to 2030

Graph 2: Global demand for printing inks from 2018 to 2030 – split by regions

Graph 3: Global revenues generated with printing inks from 2018 to 2030 in million EUR

Graph 4: Global production of printing inks from 2018 to 2030

Graph 5: Global production of printing inks from 2018 to 2030 – split by regions

Graph 6: Global demand for printing inks from 2018 to 2030 – split by applications

Graph 7: Global demand for printing inks in the segment books from 2018 to 2030 – split by regions

Graph 8: Global demand for printing inks in the segment magazines from 2018 to 2030 – split by regions

Graph 9: Global demand for printing inks in the segment newspaper from 2018 to 2030 – split by regions

Graph 10: Global demand for printing inks in the segment advertising and catalogs from 2018 to 2030 – split by regions

Graph 11: Global demand for printing inks in the segment labels from 2018 to 2030 – split by regions

Graph 12: Global demand for printing inks in the segment packaging from 2018 to 2030 – split by regions

Graph 13: Global demand for printing inks in other applications from 2018 to 2030 – split by regions

Graph 14: Global demand for printing inks from 2018 to 2030 – split by printing processes

Graph 15: Global demand for heatset printing inks from 2018 to 2030 – split by regions

Graph 16: Global demand for coldset printing inks from 2018 to 2030 – split by regions

Graph 17: Global demand for sheetfed offset printing inks from 2018 to 2030 – split by regions

Graph 18: Global demand for flexographic printing inks from 2018 to 2030 – split by regions

Graph 19: Global demand for gravure printing inks from 2018 to 2030 – split by regions

Graph 20: Global demand for other analog printing inks from 2018 to 2030 – split by regions

Graph 21: Global demand for inkjet printing inks from 2018 to 2030 – split by regions

Graph 22: Global demand for toner in the segment electrophotography from 2018 to 2030 – split by regions

Graph 23: Global demand for printing inks from 2018 to 2030 – split by printing ink types

Graph 24: Global demand for oil-based printing inks from 2018 to 2030 – split by regions

Graph 25: Global demand for water-based printing inks from 2018 to 2030 – split by regions

Graph 26: Global demand for solvent-based printing inks from 2018 to 2030 – split by regions

Graph 27: Global demand for radiation-curing printing inks from 2018 to 2030 – split by regions

Graph 28: Global demand for toner from 2018 to 2030 – split by regions

Graph 29: Global demand for other printing inks from 2018 to 2030 – split by regions

Graph 30: Demand for printing inks in Western Europe from 2018 to 2030

Graph 31: Revenues generated with printing inks in Western Europe from 2018 to 2030 in million USD and million EUR

Graph 32: Production of printing inks in Western Europe from 2018 to 2030

Graph 33: Demand for printing inks in Western Europe from 2018 to 2030 – split by applications

Graph 34: Demand for printing inks in Eastern Europe from 2018 to 2030

Graph 35: Revenues generated with printing inks in Eastern Europe from 2018 to 2030 in million USD and million EUR

Graph 36: Production of printing inks in Eastern Europe from 2018 to 2030

Graph 37: Demand for printing inks in Eastern Europe from 2018 to 2030 – split by applications

Graph 38: Demand for printing inks in North America from 2018 to 2030

Graph 39: Revenues generated with printing inks in North America from 2018 to 2030 in million USD and million EUR

Graph 40: Production of printing inks in North America from 2018 to 2030

Graph 41: Demand for printing inks in North America from 2018 to 2030 – split by applications

Graph 42: Demand for printing inks in South America from 2018 to 2030

Graph 43: Revenues generated with printing inks in South America from 2018 to 2030 in million USD and million EUR

Graph 44: Production of printing inks in South America from 2018 to 2030

Graph 45: Demand for printing inks in South America from 2018 to 2030 – split by applications

Graph 46: Demand for printing inks in Asia-Pacific from 2018 to 2030

Graph 47: Revenues generated with printing inks in Asia-Pacific from 2018 to 2030 in million USD and million EUR

Graph 48: Production of printing inks in Asia-Pacific from 2018 to 2030

Graph 49: Demand for printing inks in Asia-Pacific from 2018 to 2030 – split by applications

Graph 50: Demand for printing inks in the Middle East from 2018 to 2030

Graph 51: Revenues generated with printing inks in the Middle East from 2018 to 2030 in million USD and million EUR

Graph 52: Production of printing inks in the Middle East from 2018 to 2030

Graph 53: Demand for printing inks in the Middle East from 2018 to 2030 – split by applications

Graph 54: Demand for printing inks in Africa from 2018 to 2030

Graph 55: Revenues generated with printing inks in Africa from 2018 to 2030 in million USD and million EUR

Graph 56: Production of printing inks in Africa from 2018 to 2030

Graph 57: Demand for printing inks in Africa from 2018 to 2030 – split by applications

Graph 58: Demand for printing inks in France from 2018 to 2030

Graph 59: Production of printing inks in France from 2018 to 2030

Graph 60: Demand for printing inks in Germany from 2018 to 2030

Graph 61: Production of printing inks in Germany from 2018 to 2030

Graph 62: Demand for printing inks in Italy from 2018 to 2030

Graph 63: Production of printing inks in Italy from 2018 to 2030

Graph 64: Demand for printing inks in Spain from 2018 to 2030

Graph 65: Production of printing inks in Spain from 2018 to 2030

Graph 66: Demand for printing inks in the Netherlands from 2018 to 2030

Graph 67: Production for printing inks in the Netherlands from 2018 to 2030

Graph 68: Demand for printing inks in the United Kingdom from 2018 to 2030

Graph 69: Production of printing inks in the United Kingdom from 2018 to 2030

Graph 70: Demand for printing inks in Other Western Europe from 2018 to 2030

Graph 71: Production of printing inks in Other Western Europe from 2018 to 2030

Graph 72: Demand for printing inks in Poland from 2018 to 2030

Graph 73: Production of printing inks in Poland from 2018 to 2030

Graph 74: Demand for printing inks in Russia from 2018 to 2030

Graph 75: Production of printing inks in Russia from 2018 to 2030

Graph 76: Demand for printing inks in Turkey from 2018 to 2030

Graph 77: Production of printing inks in Turkey from 2018 to 2030

Graph 78: Demand for printing inks in Other Eastern Europe from 2018 to 2030

Graph 79: Production of printing inks in Other Eastern Europe from 2018 to 2030

Graph 80: Demand for printing inks in Canada from 2018 to 2030

Graph 81: Production of printing inks in Canada from 2018 to 2030

Graph 82: Demand for printing inks in Mexico from 2018 to 2030

Graph 83: Production of printing inks in Mexico from 2018 to 2030

Graph 84: Demand for printing inks in the USA from 2018 to 2030

Graph 85: Production of printing inks in the USA from 2018 to 2030

Graph 86: Demand for printing inks in Brazil from 2018 to 2030

Graph 87: Production of printing inks in Brazil from 2018 to 2030

Graph 88: Demand for printing inks in Other South America from 2018 to 2030

Graph 89: Production of printing inks in Other South America from 2018 to 2030

Graph 90: Demand for printing inks in China from 2018 to 2030

Graph 91: Production of printing inks in China from 2018 to 2030

Graph 92: Demand for printing inks in India from 2018 to 2030

Graph 93: Production of printing inks in India from 2018 to 2030

Graph 94: Demand for printing inks in Japan from 2018 to 2030

Graph 95: Production of printing inks in Japan from 2018 to 2030

Graph 96: Demand for printing inks in South Korea from 2018 to 2030

Graph 97: Production of printing inks in South Korea from 2018 to 2030

Graph 98: Demand for printing inks in Other Asia-Pacific from 2018 to 2030

Graph 99: Production of printing inks in Other Asia-Pacific from 2018 to 2030

Table 1: Global demand for printing inks from 2018 to 2030 – split by regions

Table 2: Global revenues generated with printing inks from 2018 to 2030 in billion USD – split by regions

Table 3: Global revenues generated with printing inks from 2018 to 2030 in billion EUR – split by regions

Table 4: Global production of printing inks from 2018 to 2030 – split by regions

Table 5: Global demand for printing inks from 2018 to 2030 – split by applications

Table 6: Global demand for printing inks in the segment books from 2018 to 2030 – split by regions

Table 7: Global demand for printing inks in the segment magazines from 2018 to 2030 – split by regions

Table 8: Global demand for printing inks in the segment newspaper from 2018 to 2030 – split by regions

Table 9: Global demand for printing inks in the segment advertising and catalogs from 2018 to 2030 – split by regions

Table 10: Global demand for printing inks in the segment labels from 2018 to 2030 – split by regions

Table 11: Global demand for printing inks in the segment packaging from 2018 to 2030 – split by regions

Table 12: Global demand for printing inks in other applications from 2018 to 2030 – split by regions

Table 13: Global demand for printing inks from 2018 to 2030 – split by printing processes

Table 14: Global demand for heatset printing inks from 2018 to 2030 – split by regions

Table 15: Global demand for coldset printing inks from 2018 to 2030 – split by regions

Table 16: Global demand for sheetfed offset printing inks from 2018 to 2030 – split by regions

Table 17: Global demand for flexographic printing inks from 2018 to 2030 – split by regions

Table 18: Global demand for gravure printing inks from 2018 to 2030 – split by regions

Table 19: Global demand for other analog printing inks from 2018 to 2030 – split by regions

Table 20: Global demand for inkjet printing inks from 2018 to 2030 – split by regions

Table 21: Global demand for toner in the segment electrophotography from 2018 to 2030 – split by regions

Table 22: Global demand for printing inks from 2018 to 2030 – split by printing ink types

Table 23: Global demand for oil-based printing inks from 2018 to 2030 – split by regions

Table 24: Global demand for water-based printing inks from 2018 to 2030 – split by regions

Table 25: Global demand for solvent-based printing inks from 2018 to 2030 – split by regions

Table 26: Global demand for radiation-curing printing inks from 2018 to 2030 – split by regions

Table 27: Global demand for toner from 2018 to 2030 – split by regions

Table 28: Global demand for other printing inks from 2018 to 2030 – split by regions

Table 29: Demand for printing inks in Western Europe from 2018 to 2030 – split by major countries

Table 30: Revenues generated with printing inks in Western Europe from 2018 to 2030 in million USD and million EUR

Table 31: Production of printing inks in Western Europe from 2018 to 2030 – split by major countries

Table 32: Demand for printing inks in Western Europe from 2018 to 2030 – split by applications

Table 33: Demand for printing inks in Western Europe from 2018 to 2030 – split by printing processes

Table 34: Demand for printing inks in Western Europe from 2018 to 2030 – split by printing ink types

Table 35: Demand for printing inks in Eastern Europe from 2018 to 2030 – split by major countries

Table 36: Revenues generated with printing inks in Eastern Europe from 2018 to 2030 in million USD and million EUR

Table 37: Production of printing inks in Eastern Europe from 2018 to 2030 – split by major countries

Table 38: Demand for printing inks in Eastern Europe from 2018 to 2030 – split by applications

Table 39: Demand for printing inks in Eastern Europe from 2018 to 2030 – split by printing processes

Table 40: Demand for printing inks in Eastern Europe from 2018 to 2030 – split by printing ink types

Table 41: Demand for printing inks in North America from 2018 to 2030 – split by major countries

Table 42: Revenues generated with printing inks in North America from 2018 to 2030 in million USD and million EUR

Table 43: Production of printing inks in North America from 2018 to 2030 – split by major countries

Table 44: Demand for printing inks in North America from 2018 to 2030 – split by applications

Table 45: Demand for printing inks in North America from 2018 to 2030 – split by printing processes

Table 46: Demand for printing inks in North America from 2018 to 2030 – split by printing ink types

Table 47: Demand for printing inks in South America from 2018 to 2030 – split by major countries

Table 48: Revenues generated with printing inks in South America from 2018 to 2030 in million USD and million EUR

Table 49: Production of printing inks in South America from 2018 to 2030 – split by major countries

Table 50: Demand for printing inks in South America from 2018 to 2030 – split by applications

Table 51: Demand for printing inks in South America from 2018 to 2030 – split by printing processes

Table 52: Demand for printing inks in South America from 2018 to 2030 – split by printing ink types

Table 53: Demand for printing inks in Asia-Pacific from 2018 to 2030 – split by major countries

Table 54: Revenues generated with printing inks in Asia-Pacific from 2018 to 2030 in million USD and million EUR

Table 55: Production of printing inks in Asia-Pacific from 2018 to 2030 – split by major countries

Table 56: Demand for printing inks in Asia-Pacific from 2018 to 2030 – split by applications

Table 57: Demand for printing inks in Asia-Pacific from 2018 to 2030 – split by printing processes

Table 58: Demand for printing inks in Asia-Pacific from 2018 to 2030 – split by printing ink types

Table 59: Revenues generated with printing inks in the Middle East from 2018 to 2030 in million USD and million EUR

Table 60: Demand for printing inks in the Middle East from 2018 to 2030 – split by applications

Table 61: Demand for printing inks in the Middle East from 2018 to 2030 – split by printing processes

Table 62: Demand for heatset printing inks in the Middle East from 2018 to 2030 – split by applications

Table 63: Demand for coldset printing inks in the Middle East from 2018 to 2030 – split by applications

Table 64: Demand for sheetfed printing inks in the Middle East from 2018 to 2030 – split by applications

Table 65: Demand for flexo printing inks in the Middle East from 2018 to 2030 – split by applications

Table 66: Demand for gravure printing inks in the Middle East from 2018 to 2030 – split by applications

Table 67: Demand for other analog printing inks in the Middle East from 2018 to 2030 – split by application

Table 68: Demand for inkjet printing inks in the Middle East from 2018 to 2030 – split by applications

Table 69: Demand for toner in the Middle East from 2018 to 2030 — split by applications

Table 71: Revenues generated with printing inks in Africa from 2018 to 2030 in million USD and million EUR

Table 72: Demand for printing inks in Africa from 2018 to 2030 – split by applications

Table 73: Demand for printing inks in Africa from 2018 to 2030 – split by printing processes

Table 74: Demand for heatset printing inks in Africa from 2018 to 2030 – split by applications

Table 75: Demand for coldset printing inks in Africa from 2018 to 2030 – split by applications

Table 76: Demand for sheetfed printing inks in Africa from 2018 to 2030 – split by applications

Table 77: Demand for flexo printing inks in Africa from 2018 to 2030 – split by applications

Table 78: Demand for gravure printing inks in Africa from 2018 to 2030 – split by applications

Table 79: Demand for other analog printing inks in Africa from 2018 to 2030 – split by application

Table 80: Demand for inkjet printing inks in Africa from 2018 to 2030 – split by applications

Table 81: Demand for EPS in Africa from 2018 to 2030 – split by applications

Table 83: Revenues generated with printing inks in France from 2018 to 2030 in million USD and million EUR

Table 84: Demand for printing inks in France from 2018 to 2030 – split by application

Table 85: Demand for printing inks in France from 2018 to 2030 – split by printing processes

Table 86: Demand for heatset printing inks in France from 2018 to 2030 – split by applications

Table 87: Demand for coldset printing inks in France from 2018 to 2030 – split by applications

Table 88: Demand for sheetfed printing inks in France from 2018 to 2030 – split by applications

Table 89: Demand for flexographic printing inks in France from 2018 to 2030 – split by applications

Table 90: Demand for gravure printing inks in France from 2018 to 2030 – split by applications

Table 91: Demand for other analog printing inks in France from 2018 to 2030 – split by applications

Table 92: Demand for inkjet printing inks in France from 2018 to 2030 – split by applications

Table 93: Demand for toner in France from 2018 to 2030 – split by applications

Table 94: Demand for printing inks in France from 2018 to 2030 – split by printing ink types

Table 95: Production, import, and export of and demand for printing inks in France from 2018 to 2030

Table 96: Revenues generated with printing inks in Germany from 2018 to 2030 in million USD and million EUR

Table 97: Demand for printing inks in Germany from 2018 to 2030 – split by applications

Table 98: Demand for printing inks in Germany from 2018 to 2030 – split by printing processes

Table 99: Demand for heatset printing inks in Germany from 2018 to 2030 – split by applications

Table 100: Demand for coldset printing inks in Germany from 2018 to 2030 – split by applications

Table 101: Demand for sheetfed printing inks in Germany from 2018 to 2030 – split by applications

Table 102: Demand for flexographic printing inks in Germany from 2018 to 2030 – split by applications

Table 103: Demand for gravure printing inks in Germany from 2018 to 2030 – split by application

Table 104: Demand for other analog printing inks in Germany from 2018 to 2030 – split by application

Table 105: Demand for inkjet printing inks in Germany from 2018 to 2030 – split by applications

Table 106: Demand for toner in Germany from 2018 to 2030 – split by applications

Table 107: Demand for printing inks in Germany from 2018 to 2030 – split by printing ink types

Table 108: Production, import, and export of and demand for printing inks in Germany from 2018 to 2030

Table 109: Revenues generated with printing inks in Italy from 2018 to 2030 in million USD and million EUR

Table 110: Demand for printing inks in Italy from 2018 to 2030 – split by applications

Table 111: Demand for printing inks in Italy from 2018 to 2030 – split by printing processes

Table 112: Demand for heatset printing inks in Italy from 2018 to 2030 – split by applications

Table 113: Demand for coldset printing inks in Italy from 2018 to 2030 – split by applications

Table 114: Demand for sheetfed printing inks in Italy from 2018 to 2030 – split by applications

Table 115: Demand for flexographic printing inks in Italy from 2018 to 2030 – split by applications

Table 116: Demand for gravure printing inks in Italy from 2018 to 2030 – split by applications

Table 117: Demand for other analog printing inks in Italy from 2018 to 2030 – split by applications

Table 118: Demand for inkjet printing inks in Italy from 2018 to 2030 – split by applications

Table 119: Demand for toner in Italy from 2018 to 2030 – split by applications

Table 120: Demand for printing inks in Italy from 2018 to 2030 – split by printing ink types

Table 121: Production, import, and export of and demand for printing inks in Italy from 2018 to 2030

Table 122: Revenues generated with printing inks in Spain from 2018 to 2030 in million USD and million EUR

Table 123: Demand for printing inks in Spain from 2018 to 2030 – split by application

Table 124: Demand for printing inks in Spain from 2018 to 2030 – split by printing processes

Table 125: Demand for heatset printing inks in Spain from 2018 to 2030 – split by applications

Table 126: Demand for coldset printing inks in Spain from 2018 to 2030 – split by applications

Table 127: Demand for sheetfed printing inks in Spain from 2018 to 2030 – split by applications

Table 128: Demand for flexographic printing inks in Spain from 2018 to 2030 – split by applications

Table 129: Demand for gravure printing inks in Spain from 2018 to 2030 – split by applications

Table 130: Demand for other analog printing inks in Spain from 2018 to 2030 – split by applications

Table 131: Demand for inkjet printing inks in Spain from 2018 to 2030 – split by applications

Table 132: Demand for toner in Spain from 2018 to 2030 – split by applications

Table 133:Demand for printing inks in Spain from 2018 to 2030 – split by printing ink types

Table 134: Production, import, and export of and demand for printing inks in Spain from 2018 to 2030

Table 135: Revenues generated with printing inks in the Netherlands from 2018 to 2030 in million USD and million EUR

Table 136: Demand for printing inks in the Netherlands from 2018 to 2030 – split by applications

Table 137: Demand for printing inks in the Netherlands from 2018 to 2030 – split by printing processes

Table 138: Demand for heatset printing inks in the Netherlands from 2018 to 2030 – split by applications

Table 139: Demand for coldset printing inks in the Netherlands from 2018 to 2030 – split by applications

Table 140: Demand for sheetfed printing inks in the Netherlands from 2018 to 2030 – split by applications

Table 141: Demand for flexographic printing inks in the Netherlands from 2018 to 2030 – split by applications

Table 142: Demand for gravure printing inks in the Netherlands from 2018 to 2030 – split by applications

Table 143: Demand for other analog printing inks in the Netherlands from 2018 to 2030 – split by applications

Table 144: Demand for inkjet printing inks in the Netherlands from 2018 to 2030 – split by applications

Table 145: Demand for toner in the Netherlands from 2018 to 2030 – split by applications

Table 146: Demand for printing inks in the Netherlands from 2018 to 2030 – split by printing ink types

Table 147: Production, import, and export of and demand for printing inks in the Netherlands from 2018 to 2030

Table 148: Revenues generated with printing inks in the United Kingdom from 2018 to 2030 in million USD and million EUR

Table 149: Demand for printing inks in the United Kingdom from 2018 to 2030 – split by application

Table 150: Demand for printing inks in the United Kingdom from 2018 to 2030 – split by printing processes

Table 151: Demand for heatset printing inks in the United Kingdom from 2018 to 2030 – split by applications

Table 152: Demand for coldset printing inks in the United Kingdom from 2018 to 2030 – split by applications

Table 153: Demand for sheetfed printing inks in the United Kingdom from 2018 to 2030 – split by applications

Table 154: Demand for flexographic printing inks in the United Kingdom from 2018 to 2030 – split by applications

Table 155: Demand for gravure printing inks in the United Kingdom from 2018 to 2030 – split by applications

Table 156: Demand for other analog printing inks in the United Kingdom from 2018 to 2030 – split by applications

Table 157: Demand for inkjet printing inks in the United Kingdom from 2018 to 2030 – split by applications

Table 158: Demand for toner in the United Kingdom from 2018 to 2030 – split by applications

Table 159: Demand for printing inks in the United Kingdom from 2018 to 2030 – split by printing ink types

Table 160: Production, import, and export of and demand for printing inks in the United Kingdom from 2018 to 2030

Table 161: Revenues generated with printing inks in the remaining countries of Western Europe from 2018 to 2030 in million USD and million EUR

Table 162: Demand for printing inks in Other Western Europe from 2018 to 2030 – split by applications

Table 163: Demand for printing inks in Other Western Europe from 2018 to 2030 – split by printing processes

Table 164: Demand for heatset printing inks in Other Western Europe from 2018 to 2030 – split by applications

Table 165: Demand for coldset printing inks in Other Western Europe from 2018 to 2030 – split by applications

Table 166: Demand for sheetfed printing inks in Other Western Europe from 2018 to 2030 – split by applications

Table 167: Demand for flexographic printing inks in Other Western Europe from 2018 to 2030 – split by applications

Table 168: Demand for gravure printing inks in Other Western Europe from 2018 to 2030 – split by applications

Table 169: Demand for other analog printing inks in Other Western Europe from 2018 to 2030 – split by applications

Table 170: Demand for inkjet printing inks in Other Western Europe from 2018 to 2030 – split by applications

Table 171: Demand for toner in Other Western Europe from 2018 to 2030 – split by applications

Table 172: Demand for printing inks in Other Western Europe from 2018 to 2030 – split by printing ink types

Table 173: Production, import, and export of and demand for printing inks in Other Western Europe from 2018 to 2030

Table 174: Revenues generated with printing inks in Poland from 2018 to 2030 in million USD and million EUR

Table 175: Demand for printing inks in Poland from 2018 to 2030 – split by application

Table 176: Demand for printing inks in Poland from 2018 to 2030 – split by printing processes

Table 177: Demand for heatset printing inks in Poland from 2018 to 2030 – split by applications

Table 178: Demand for coldset printing inks in Poland from 2018 to 2030 – split by applications

Table 179: Demand for sheetfed printing inks in Poland from 2018 to 2030 – split by applications

Table 180: Demand for flexographic printing inks in Poland from 2018 to 2030 – split by applications

Table 181: Demand for gravure printing inks in Poland from 2018 to 2030 – split by applications

Table 182: Demand for other analog printing inks in Poland from 2018 to 2030 – split by applications

Table 183: Demand for inkjet printing inks in Poland from 2018 to 2030 – split by applications

Table 184: Demand for toner in Poland from 2018 to 2030 – split by applications

Table 185:Demand for printing inks in Poland from 2018 to 2030 – split by printing ink types

Table 186: Production, import, and export of and demand for printing inks in Poland from 2018 to 2030

Table 187: Revenues generated with printing inks in Russia from 2018 to 2030 in million USD and million EUR

Table 188: Demand for printing inks in Russia from 2018 to 2030 – split by application

Table 189: Demand for printing inks in Russia from 2018 to 2030 – split by printing processes

Table 190: Demand for heatset printing inks in Russia from 2018 to 2030 – split by applications

Table 191: Demand for coldset printing inks in Russia from 2018 to 2030 – split by applications

Table 192: Demand for sheetfed printing inks in Russia from 2018 to 2030 – split by applications

Table 193: Demand for flexographic printing inks in Russia from 2018 to 2030 – split by applications

Table 194: Demand for gravure printing inks in Russia from 2018 to 2030 – split by applications

Table 195: Demand for other analog printing inks in Russia from 2018 to 2030 – split by applications

Table 196: Demand for inkjet printing inks in Russia from 2018 to 2030 – split by applications

Table 197: Demand for toner in Russia from 2018 to 2030 – split by applications

Table 198: Demand for printing inks in Russia from 2018 to 2030 – split by printing ink types

Table 199: Production, import, and export of and demand for printing inks in Russia from 2018 to 2030

Table 200: Revenues generated with printing inks in Turkey from 2018 to 2030 in million USD and million EUR

Table 201: Demand for printing inks in Turkey from 2018 to 2030 – split by application

Table 202: Demand for printing inks in Turkey from 2018 to 2030 – split by printing processes

Table 203: Demand for heaset printing inks in Turkey from 2018 to 2030 – split by application

Table 204: Demand for coldset printing inks in Turkey from 2018 to 2030 – split by applications

Table 205: Demand for sheetfed printing inks in Turkey from 2018 to 2030 – split by applications

Table 206: Demand for flexographic printing inks in Turkey from 2018 to 2030 – split by application

Table 207: Demand for gravure printing inks in Turkey from 2018 to 2030 – split by application

Table 208: Demand for other analog printing inks in Turkey from 2018 to 2030 – split by applications

Table 209: Demand for inkjet printing inks in Turkey from 2018 to 2030 – split by applications

Table 210: Demand for toner in Turkey from 2018 to 2030 – split by applications

Table 211: Demand for printing inks in Turkey from 2018 to 2030 – split by printing ink types

Table 212: Production, import, and export of and demand for printing inks in Turkey from 2018 to 2030

Table 213: Revenues generated with printing inks in Other Eastern Europe from 2018 to 2030 in billion USD and billion EUR

Table 214: Demand for printing inks in Other Eastern Europe from 2018 to 2030 – split by applications

Table 215: Demand for printing inks in Other Eastern Europe from 2018 to 2030 – split by printing processes

Table 216: Demand for heatset printing inks in Other Eastern Europe from 2018 to 2030 – split by applications

Table 217: Demand for coldset printing inks in Other Eastern Europe from 2018 to 2030 – split by applications

Table 218: Demand for sheetfed printing inks in Other Eastern Europe from 2018 to 2030 – split by applications

Table 219: Demand for flexographic printing inks in Other Eastern Europe from 2018 to 2030 – split by applications

Table 220: Demand for gravure printing inks in Other Eastern Europe from 2018 to 2030 – split by applications

Table 221: Demand for other analog printing inks in Other Eastern Europe from 2018 to 2030 – split by applications

Table 222: Demand for inkjet printing inks in Other Eastern Europe from 2018 to 2030 – split by applications

Table 223: Demand for toner in Other Eastern Europe from 2018 to 2030 – split by applications

Table 224: Demand for printing inks in Other Eastern Europe from 2018 to 2030 – split by printing ink types

Table 225: Production, import, and export of and demand for printing inks in Other Eastern Europe from 2018 to 2030

Table 226: Revenues generated with printing inks in Canada from 2018 to 2030 in million USD and million EUR

Table 227: Demand for printing inks in Canada from 2018 to 2030 – split by applications

Table 228: Demand for printing inks in Canada from 2018 to 2030 – split by printing processes

Table 229: Demand for heatset printing inks in Canada from 2018 to 2030 – split by applications

Table 230: Demand for coldset printing inks in Canada from 2018 to 2030 – split by applications

Table 231: Demand for sheetfed printing inks in Canada from 2018 to 2030 – split by applications

Table 232: Demand for flexographic printing inks in Canada from 2018 to 2030 – split by applications

Table 233: Demand for gravure printing inks in Canada from 2018 to 2030 – split by applications

Table 234: Demand for other analog printing inks in Canada from 2018 to 2030 – split by applications

Table 235: Demand for inkjet printing inks in Canada from 2018 to 2030 – split by applications

Table 236: Demand for toner in Canada from 2018 to 2030 – split by applications

Table 237: Demand for printing inks in Canada from 2018 to 2030 – split by printing ink types

Table 238: Production, import, and export of and demand for printing inks in Canada from 2018 to 2030

Table 239: Revenues generated with printing inks in Mexico from 2018 to 2030 in million USD and million EUR

Table 240: Demand for printing inks in Mexico from 2018 to 2030 – split by applications

Table 241: Demand for printing inks in Mexico from 2018 to 2030 – split by printing processes

Table 242: Demand for heatset printing inks in Mexico from 2018 to 2030 – split by applications

Table 243: Demand for coldset printing inks in Mexico from 2018 to 2030 – split by applications

Table 244: Demand for sheetfed printing inks in Mexico from 2018 to 2030 – split by applications

Table 245: Demand for flexographic printing inks in Mexico from 2018 to 2030 – split by applications

Table 246: Demand for gravure printing inks in Mexico from 2018 to 2030 – split by applications

Table 247: Demand for other analog printing inks in Mexico from 2018 to 2030 – split by applications

Table 248: Demand for inkjet printing inks in Mexico from 2018 to 2030 – split by applications

Table 249: Demand for toner in Mexico from 2018 to 2030 – split by applications

Table 250: Demand for printing inks in Mexico from 2018 to 2030 – split by printing ink types

Table 251: Production, import, and export of and demand for printing inks in Mexico from 2018 to 2030

Table 252: Revenues generated with printing inks in the USA from 2018 to 2030 in million USD and million EUR

Table 253: Demand for printing inks in the USA from 2018 to 2030 – split by applications

Table 254: Demand for printing inks in the USA from 2018 to 2030 – split by printing processes

Table 255: Demand for heatset printing inks in the USA from 2018 to 2030 – split by applications

Table 256: Demand for coldset printing inks in the USA from 2018 to 2030 – split by applications

Table 257: Demand for sheetfed printing inks in the USA from 2018 to 2030 – split by applications

Table 258: Demand for flexographic printing inks in the USA from 2018 to 2030 – split by applications

Table 259: Demand for gravure printing inks in the USA from 2018 to 2030 – split by applications

Table 260: Demand for other analog printing inks in the USA from 2018 to 2030 – split by applications

Table 261: Demand for inkjet printing inks in the USA from 2018 to 2030 – split by applications

Table 262: Demand for toner in the USA from 2018 to 2030 – split by applications

Table 263: Demand for printing inks in the USA from 2018 to 2030 – split by printing ink types

Table 264: Production, import, and export of and demand for printing inks in the USA from 2018 to 2030

Table 265: Revenues generated with printing inks in Brazil from 2018 to 2030 in million USD and million EUR

Table 266: Demand for printing inks in Brazil from 2018 to 2030 – split by applications

Table 267: Demand for printing inks in Brazil from 2018 to 2030 – split by printing processes

Table 268: Demand for heatset printing inks in Brazil from 2018 to 2030 – split by applications

Table 269: Demand for coldset printing inks in Brazil from 2018 to 2030 – split by applications

Table 270: Demand for sheetfed printing inks in Brazil from 2018 to 2030 – split by applications

Table 271: Demand for flexographic printing inks in Brazil from 2018 to 2030 – split by applications

Table 272: Demand for gravure printing inks in Brazil from 2018 to 2030 – split by applications

Table 273: Demand for other analog printing inks in Brazil from 2018 to 2030 – split by applications

Table 274: Demand for inkjet printing inks in Brazil from 2018 to 2030 – split by applications

Table 275: Demand for toner in Brazil from 2018 to 2030 – split by applications

Table 276: Demand for printing inks in Brazil from 2018 to 2030 – split by printing ink types

Table 277: Production, import, and export of and demand for printing inks in Brazil from 2018 to 2030

Table 278: Revenues generated with printing inks in the remaining countries of South America from 2018 to 2030 in million USD and million EUR

Table 279: Demand for printing inks in Other South America from 2018 to 2030 – split by applications

Table 280: Demand for printing inks in Other South America from 2018 to 2030 – split by printing processes

Table 281: Demand for heatset printing inks in Other South America from 2018 to 2030 – split by applications

Table 282: Demand for coldset printing inks in Other South America from 2018 to 2030 – split by applications

Table 283: Demand for printing inks in Other South America from 2018 to 2030 – split by applications

Table 284: Demand for flexographic printing inks in Other South America from 2018 to 2030 – split by applications

Table 285: Demand for gravure printing inks in Other South America from 2018 to 2030 – split by applications

Table 286: Demand for other analog printing inks in Other South America from 2018 to 2030 – split by applications

Table 287: Demand for inkjet printing inks in Other South America from 2018 to 2030 – split by applications

Table 288: Demand for toner in Other South America from 2018 to 2030 – split by applications

Table 289: Demand for printing inks in Other South America from 2018 to 2030 – split by printing ink types

Table 290: Production, import, and export of and demand for printing inks in Other South America from 2018 to 2030

Table 291: Revenues generated with printing inks in China from 2018 to 2030 in million USD and million EUR

Table 292: Demand for printing inks in China from 2018 to 2030 – split by application

Table 293: Demand for printing inks in China from 2018 to 2030 – split by printing processes

Table 294: Demand for heatset printing inks in China from 2018 to 2030 – split by applications

Table 295: Demand for coldset printing inks in China from 2018 to 2030 – split by applications

Table 296: Demand for sheetfed printing inks in China from 2018 to 2030 – split by applications

Table 297: Demand for flexographic printing inks in China from 2018 to 2030 – split by applications

Table 298: Demand for gravure printing inks in China from 2018 to 2030 – split by applications

Table 299: Demand for other analog printing inks in China from 2018 to 2030 – split by applications

Table 300: Demand for inkjet printing inks in China from 2018 to 2030 – split by applications

Table 301: Demand for toner in China from 2018 to 2030 – split by applications

Table 302: Demand for printing inks in China from 2018 to 2030 – split by printing ink types

Table 303: Production, import, and export of and demand for printing inks in China from 2018 to 2030

Table 304: Revenues generated with printing inks in India from 2018 to 2030 in million USD and million EUR

Table 305: Demand for printing inks in India from 2018 to 2030 – split by applications

Table 306: Demand for printing inks in India from 2018 to 2030 – split by printing processes

Table 307: Demand for heatset printing inks in India from 2018 to 2030 – split by applications

Table 308: Demand for coldset printing inks in India from 2018 to 2030 – split by applications

Table 309: Demand for sheetfed printing inks in India from 2018 to 2030 – split by applications

Table 310: Demand for flexographic printing inks in India from 2018 to 2030 – split by applications

Table 311: Demand for gravure printing inks in India from 2018 to 2030 – split by applications

Table 312: Demand for other analog printing inks in India from 2018 to 2030 – split by applications

Table 313: Demand for inkjet printing inks in India from 2018 to 2030 – split by applications

Table 314: Demand for toner in India from 2018 to 2030 – split by applications

Table 315: Demand for printing inks in India from 2018 to 2030 – split by printing ink types

Table 316: Production, import, and export of and demand for printing inks in India from 2018 to 2030

Table 317: Revenues generated with printing inks in Japan from 2018 to 2030 in million USD and million EUR

Table 318: Demand for printing inks in Japan from 2018 to 2030 – split by applications

Table 319: Demand for printing inks in Japan from 2018 to 2030 – split by printing processes

Table 320: Demand for heatset printing inks in Japan from 2018 to 2030 – split by applications

Table 321: Demand for coldset printing inks in Japan from 2018 to 2030 – split by applications

Table 322: Demand for sheetfed printing inks in Japan from 2018 to 2030 – split by applications

Table 323: Demand for flexographic printing inks in Japan from 2018 to 2030 – split by applications

Table 324: Demand for gravure printing inks in Japan from 2018 to 2030 – split by applications

Table 325: Demand for other analog printing inks in Japan from 2018 to 2030 – split by applications

Table 326: Demand for inkjet printing inks in Japan from 2018 to 2030 – split by applications

Table 327: Demand for toner in Japan from 2018 to 2030 – split by applications

Table 328: Demand for printing inks in Japan from 2018 to 2030 – split by printing ink types

Table 329: Production, import, and export of and demand for printing inks in Japan from 2018 to 2030

Table 330: Revenues generated with printing inks in South Korea from 2018 to 2030 in million USD and million EUR

Table 331: Demand for printing inks in South Korea from 2018 to 2030 – split by applications

Table 332: Demand for printing inks in South Korea from 2018 to 2030 – split by printing processes

Table 333: Demand for heatset printing inks in South Korea from 2018 to 2030 – split by applications

Table 334: Demand for coldset printing inks in South Korea from 2018 to 2030 – split by applications

Table 335: Demand for sheetfed printing inks in South Korea from 2018 to 2030 – split by applications

Table 336: Demand for flexographic printing inks in South Korea from 2018 to 2030 – split by applications

Table 337: Demand for gravure printing inks in South Korea from 2018 to 2030 – split by applications

Table 338: Demand for other analog printing inks in South Korea from 2018 to 2030 – split by applications

Table 339: Demand for inkjet printing inks in South Korea from 2018 to 2030 – split by applications

Table 340: Demand for toner in South Korea from 2018 to 2030 – split by applications

Table 341: Demand for printing inks in South Korea from 2018 to 2030 – split by printing ink types

Table 342: Production, import, and export of and demand for printing inks in South Korea from 2018 to 2030

Table 343: Revenues generated with printing inks in the remaining countries of Asia-Pacific from 2018 to 2030 in million USD and million EUR

Table 344: Demand for printing inks in Other Asia-Pacific from 2018 to 2030 – split by application

Table 345: Demand for printing inks in Other Asia-Pacific from 2018 to 2030 – split by printing processes

Table 346: Demand for heatset printing inks in Other Asia-Pacific from 2018 to 2030 – split by applications

Table 347: Demand for coldset printing inks in Other Asia-Pacific from 2018 to 2030 – split by applications

Table 348: Demand for sheetfed printing inks in Other Asia-Pacific from 2018 to 2030 – split by applications

Table 349: Demand for flexographic printing inks in Other Asia-Pacific from 2018 to 2030 – split by applications

Table 350: Demand for gravure printing inks in Other Asia-Pacific from 2018 to 2030 – split by applications

Table 351: Demand for other analog printing inks in Other Asia-Pacific from 2018 to 2030 – split by applications

Table 352: Demand for inkjet printing inks in Other Asia-Pacific from 2018 to 2030 – split by applications

Table 353: Demand for toner in Other Asia-Pacific from 2018 to 2030 – split by applications

Table 354: Demand for printing inks in Other Asia-Pacific from 2018 to 2030 – split by printing ink types

Table 355: Production, import, and export of and demand for printing inks in Other Asia-Pacific from 2018 to 2030