Description

The Plastic Injection Market Report – Europe is now also available in parts (e.g. individual country profiles or all manufacturer profiles). Please feel free to contact us and we will immediately send you an offer for your specific selection.

From raw material directly to the finished part: Injection molding is one of the most important processes in the plastics industry. Although 3D printing is faster and does not require expensive molds, plastic injection is still unbeatable when it comes to cost-effective serial production of plastic products of virtually any size or shape. Ceresana has analyzed the European market for injection molded plastics: Last year, nearly 12.9 million tonnes of plastics were processed in Europe using this method.

Polypropylene for Plastic Injection

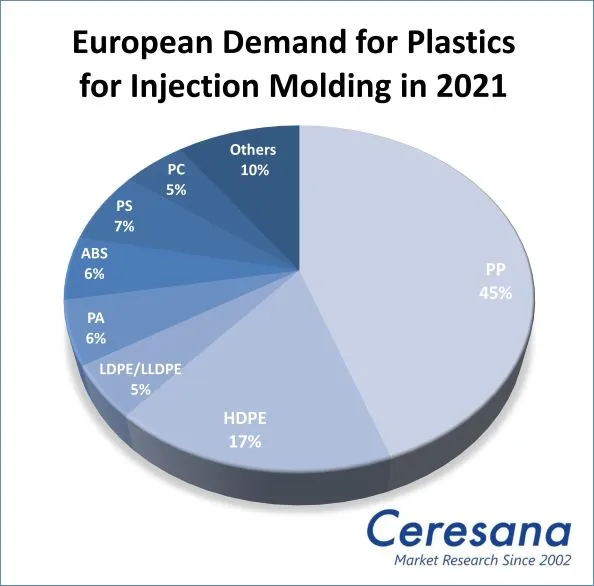

Melting a plastic granulate and injecting it into a hollow mold under high pressure is best done with thermoplastics and thermoplastic elastomers. However, more and more bioplastics are being used in this process. The most important type of plastic for injection molding is polypropylene (PP): Ceresana expects demand for products made from polypropylene to grow by an average of 1.5% per year over the next ten years. Polyethylene-HDPE follows in second place with a market share of around 17%. The current study also analyzes the market for polyethylene-LDPE and LLDPE, polyamide (PA), acrylonitrile butadiene styrene (ABS), polystyrene (PS), polycarbonate (PC) and other types of plastic. There are major differences in the various areas of application: In the packaging sector, for example, polypropylene accounts for around 71% of demand, while it only accounts for 16% in the construction sector.

Mass Produced Products for All Areas of Life

Dashboards and children’s toys, medical syringes and electric switches, toothbrushes and glass-fiber-reinforced aircraft parts: injection-molded plastic products are part of our everyday lives. The most important sales market, with a volume of around 4.5 million tonnes, is the packaging industry, which uses them primarily to protect food products: Containers, cans, trays, boxes and closures of all kinds. Inscriptions and labels can be integrated directly into ice cream cups or other plastic parts using in-mold labeling (IML). Printed films are inserted into the injection mold and then fuse seamlessly with the injected liquid plastic. Keyboards for cell phones and computers are also produced in this way. However, the second largest application area for plastic injection molding is products for the automotive industry. Ceresana expects Europe-wide demand in this sector to increase by 2.1% per year until 2031.

Overview of the Study

Chapter 1 provides a description of the European market for plastics in injection molding – including forecasts up to 2031. Demand and revenues are presented for the countries in Western and Eastern Europe.

Demand for the individual types of plastics is also discussed:

- Polypropylene (PP)

- Polyethylene (LDPE/LLDPE)

- Polyethylene (HDPE)

- Polyamide (PA)

- Acrylonitrile-butadiene-styrene (ABS)

- Polystyrene (PS)

- Polycarbonate (PC)

- other plastic types.

The following areas of application for injection-molded plastics are examined:

- packaging

- construction

- transportation

- electrical and electronics

- industrial products

- other applications.

Chapter 2 provides country-specific market data for 22 European countries, i.e. demand and revenues. Demand is analyzed in detail for various application areas and individual product types.

Chapter 3 provides a useful directory of the 74 most important European companies in the field of plastic injection molding. It is clearly structured according to contact details, revenues, profit, product range, production sites and brief profile. The companies presented include Aptargroup Holding GmbH, Bemis Manufacturing Company, Bericap, Berry Global, Inc., ElringKlinger Kunststofftechnik GmbH, Essentra plc, Magna International, Inc., Röchling SE & Co. KG, and Silgan Holdings Inc.

Scope of the Report:

Attributes | Details |

| Base Year | 2021 |

| Trend Period | 2019 – 2031 |

| Forecast Period | 2022 – 2031 |

| Pages | 250 |

| Types of Plastics | Polypropylene (PP), Polyethylene (LDPE/LLDPE), Polyethylene (HDPE), Polyamide (PA), Acrylonitrile-butadiene-styrene (ABS), Polystyrene (PS), Polycarbonate (PC), Other Plastic Types |

| Application Areas | Packaging, Construction, Transportation, Electrical and Electronics, Industrial Products, Other Applications |

| Company Profiles | Aptargroup Holding GmbH, Bemis Manufacturing Company, Bericap, Berry Global, Inc., ElringKlinger Kunststofftechnik GmbH, Essentra plc, Magna International, Inc., Röchling SE & Co. KG, and Silgan Holdings Inc. (Selection) |

| Edition | 1st edition |

| Publication | November 2022 |

FAQs

How high was the demand for plastics for injection molding in 2021?

Last year, nearly 12.9 million tonnes of plastics were processed in Europe using this method.

Which is the most important plastic type for injection molding?

The most important type of plastic for injection molding is polypropylene (PP).

What is the most important sales market?

The most important sales market, with a volume of around 4.5 million tonnes, is the packaging industry.

1 Market Data: Europe

1.1 Demand

1.2 Revenues

1.3 Demand Split by Application Areas

1.3.1 Packaging

1.3.2 Construction Industry

1.3.3 Transportation

1.3.4 Electrical & Electronics

1.3.5 Industrial Products

1.3.6 Other Applications

1.4 Demand by Products

1.4.1 Polypropylene (PP)

1.4.2 Polyethylene (HDPE)

1.4.3 Polyethylene (LDPE/LLDPE)

1.4.4 Polyamide (PA)

1.4.5 Acrylonitrile Butadiene Styrene (ABS)

1.4.6 Polystyrene (PS)

1.4.7 Polycarbonate (PC)

1.4.8 Other Products

2 Market Data: Countries

(For each country: Revenues and demand per products and applications)

2.1 Austria

2.2 Belgium

2.3 Bulgaria

2.4 Czechia

2.5 Denmark

2.6 Finland

2.7 France

2.8 Germany

2.9 Greece

2.10 Hungary

2.11 Italy

2.12 Poland

2.13 Portugal

2.14 Romania

2.15 Russia

2.16 Slovakia

2.17 Spain

2.18 Sweden

2.19 Switzerland

2.20 The Netherlands

2.21 Turkey

2.22 United Kingdom

2.23 Rest of Europe

3 Company Profiles*

Austria (3 Producers)

Belgium (1)

Czechia (3)

France (6)

Germany (29)

Italy (4)

Luxembourg (1)

Portugal (3)

Spain (4)

Sweden (1)

Switzerland (5)

The Netherlands (3)

Turkey (3)

United Kingdom (8)

*Note: The profiles are assigned to the country in which the company or holding is headquartered. Profiles also include JVs and subsidiaries.

Graph 1: Demand in Europe from 2019 to 2031

Graph 2: Revenues generated in Europe from 2019 to 2031 in billion USD and billion EUR

Graph 3: Demand in Austria from 2019 until 2031

Graph 4: Demand in Belgium from 2019 to 2031

Graph 5: Demand in Bulgaria from 2019 to 2031

Graph 6: Demand in Czechia from 2019 to 2031

Graph 7: Demand in Denmark from 2019 to 2031

Graph 8: Demand in Finland from 2019 to 2031

Graph 9: Demand in France from 2019 to 2031

Graph 10: Demand in Germany from 2019 to 2031

Graph 11: Demand in Greece from 2019 to 2031

Graph 12: Demand in Hungary from 2019 to 2031

Graph 13: Demand in Italy from 2019 to 2031

Graph 14: Demand in Poland from 2019 to 2031

Graph 15: Demand in Portugal from 2019 to 2031

Graph 16: Demand in Romania from 2019 to 2031

Graph 17: Demand in Russia from 2019 to 2031

Graph 18: Demand in Slovakia from 2019 to 2031

Graph 19: Demand in Spain from 2019 to 2031

Graph 20: Demand in Sweden from 2019 to 2031

Graph 21: Demand in Switzerland from 2019 to 2031

Graph 22: Demand in the Netherlands from 2019 to 2031

Graph 23: Demand in Turkey from 2019 to 2031

Graph 24: Demand in the United Kingdom from 2019 to 2031

Graph 25: Demand in the remaining European countries from 2019 to 2031

Table 1: European demand from 2019 to 2031 – split by countries

Table 2: European demand from 2019 to 2031 – split by applications

Table 3: European demand in the segment packaging from 2019 to 2031 – split by countries

Table 4: European demand in the segment packaging from 2019 to 2031 – split by products

Table 5: European demand in the segment construction from 2019 to 2031 – split by countries

Table 6: European demand in the segment construction from 2019 to 2031 – split by products

Table 7: European demand in the segment transportation from 2019 to 2031 – split by countries

Table 8: European demand in the segment transportation from 2019 to 2031 – split by products

Table 9: European demand in the segment E&E from 2019 to 2031 – split by countries

Table 10: European demand in the segment E&E from 2019 to 2031 – split by products

Table 11: European demand in the segment industry from 2019 to 2031 – split by countries

Table 12: European demand in the segment industry from 2019 to 2031 – split by products

Table 13: European demand in other applications from 2019 to 2031 – split by countries

Table 14: European demand in other applications from 2019 to 2031 – split by products

Table 15: Demand in Europe from 2019 to 2031 – split by products

Table 16: European demand for polypropylene from 2019 to 2031 – split by countries

Table 17: European demand for polyethylene (HDPE) from 2019 to 2031 – split by countries

Table 18: European demand for polyethylene (LDPE/LLDPE) from 2019 to 2031 – split by countries

Table 19: European demand for polyamide from 2019 to 2031 – split by countries

Table 20: European demand for acrylonitrile butadiene styrene from 2019 to 2031 – split by countries

Table 21: European demand for polystyrene from 2019 to 2031 – split by countries

Table 22: European demand for polycarbonate from 2019 to 2031 – split by countries

Table 23: European demand for other products from 2019 to 2031 – split by countries

Table 24: Revenues generated in Austria from 2019 to 2031 in billion USD and billion EUR

Table 25: Demand in Austria from 2019 to 2031 – split by applications

Table 26: Demand in Austria from 2019 to 2031 – split by products

Table 27: Revenues generated in Belgium from 2019 to 2031 in billion USD and billion EUR

Table 28: Demand in Belgium from 2019 to 2031 – split by applications

Table 29: Demand in Belgium from 2019 to 2031 – split by products

Table 30: Revenues generated in Bulgaria from 2019 to 2031 in billion USD and billion EUR

Table 31: Demand in Bulgaria from 2019 to 2031 – split by applications

Table 32: Demand in Bulgaria from 2019 to 2031 – split by products

Table 33: Revenues generated in Czechia from 2019 to 2031 in billion USD and billion EUR

Table 34: Demand in Czechia from 2019 to 2031 – split by applications

Table 35: Demand in Czechia from 2019 to 2031 – split by products

Table 36: Revenues generated in Denmark from 2019 to 2031 in billion USD and billion EUR

Table 37: Demand in Denmark from 2019 to 2031 – split by applications

Table 38: Demand in Denmark from 2019 to 2031 – split by products

Table 39: Revenues generated in Finland from 2019 to 2031 in billion USD and billion EUR

Table 40: Demand in Finland from 2019 to 2031 – split by applications

Table 41: Demand in Finland from 2019 to 2031 – split by products

Table 42: Revenues generated in France from 2019 to 2031 in billion USD and billion EUR

Table 43: Demand in France from 2019 to 2031 – split by applications

Table 44: Demand in France from 2019 to 2031 – split by products

Table 45: Revenues generated in Germany from 2019 to 2031 in billion USD and billion EUR

Table 46: Demand in Germany from 2019 to 2031 – split by applications

Table 47: Demand in Germany from 2019 to 2031 – split by products

Table 48: Revenues generated in Greece from 2019 to 2031 in billion USD and billion EUR

Table 49: Demand in Greece from 2019 to 2031 – split by applications

Table 50: Demand in Greece from 2019 to 2031 – split by products

Table 51: Revenues generated in Hungary from 2019 to 2031 in billion USD and billion EUR

Table 52: Demand in Hungary from 2019 to 2031 – split by applications

Table 53: Demand in Hungary from 2019 to 2031 – split by products

Table 54: Revenues generated in Italy from 2019 to 2031 in billion USD and billion EUR

Table 55: Demand in Italy from 2019 to 2031 – split by applications

Table 56: Demand in Italy from 2019 to 2031 – split by products

Table 57: Revenues generated in Poland from 2019 to 2031 in billion USD and billion EUR

Table 58: Demand in Poland from 2019 to 2031 – split by applications

Table 59: Demand in Poland from 2019 to 2031 – split by products

Table 60: Revenues generated in Portugal from 2019 to 2031 in billion USD and billion EUR

Table 61: Demand in Portugal from 2019 to 2031 – split by applications

Table 62: Demand in Portugal from 2019 to 2031 – split by products

Table 63: Revenues generated in Romania from 2019 to 2031 in billion USD and billion EUR

Table 64: Demand in Romania from 2019 to 2031 – split by applications

Table 65: Demand in Romania from 2019 to 2031 – split by products

Table 66: Revenues generated in Russia from 2019 to 2031 in billion USD and billion EUR

Table 67: Demand in Russia from 2019 to 2031 – split by applications

Table 68: Demand in Russia from 2019 to 2031 – split by products

Table 69: Revenues generated in Slovakia from 2019 to 2031, in billion USD and billion EUR

Table 70: Demand in Slovakia from 2019 to 2031 – split by applications

Table 71: Demand in Slovakia from 2019 to 2031 – split by products

Table 72: Revenues generated in Spain from 2019 to 2031 in billion USD and billion EUR

Table 73: Demand in Spain from 2019 to 2031 – split by applications

Table 74: Demand in Spain from 2019 to 2031 – split by products

Table 75: Revenues generated in Sweden from 2019 to 2031 in billion USD and billion EUR

Table 76: Demand in Sweden from 2019 to 2031 – split by applications

Table 77: Demand in Sweden from 2019 to 2031 – split by products

Table 78: Revenues generated in Switzerland from 2019 to 2031 in billion USD and billion EUR

Table 79: Demand in Switzerland from 2019 to 2031 – split by applications

Table 80: Demand in Switzerland from 2019 to 2031 – split by products

Table 81: Revenues generated in the Netherlands from 2019 to 2031, in billion USD and billion EUR

Table 82: Demand in the Netherlands from 2019 to 2031 – split by applications

Table 83: Demand in the Netherlands from 2019 to 2031 – split by products

Table 84: Revenues generated in Turkey from 2019 to 2031, in billion USD and billion EUR

Table 85: Demand in Turkey from 2019 to 2031 – split by applications

Table 86: Demand in Turkey from 2019 to 2031 – split by products

Table 87: Revenues generated in the United Kingdom from 2019 to 2031 in billion USD and billion EUR

Table 88: Demand in the United Kingdom from 2019 to 2031 – split by applications

Table 89: Demand in the United Kingdom from 2019 to 2031 – split by products

Table 90: Revenues in the remaining European countries from 2019 to 2031 in billion USD and billion EUR

Table 91: Demand in the remaining European countries from 2019 to 2031 – split by applications

Table 92: Demand in the remaining European countries from 2019 to 2031 – split by products