Description

This study is currently being completely revised. We plan to publish the 6th edition in July 2024. Therefore we can offer you the update for free, if you order the current edition now.

The Adhesives Market Report – Europe is now also available in parts (e.g. individual country profiles or all manufacturer profiles). Please feel free to contact us and we will immediately send you an offer for your specific selection.

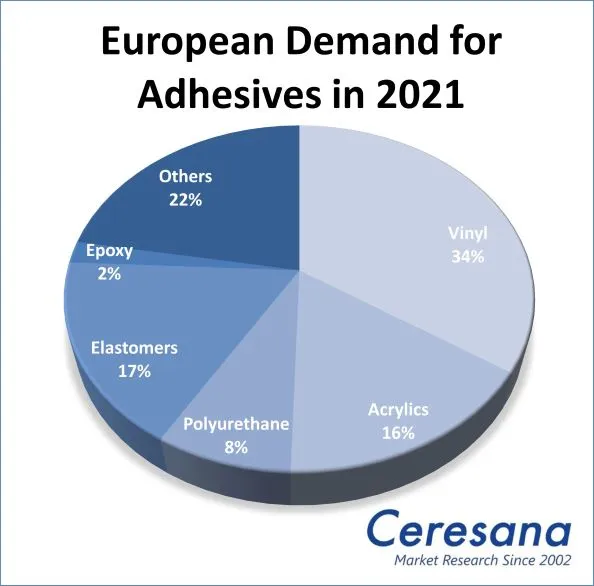

Failures can become success stories. Cyanoacrylate was completely unusable as a transparent plastic – but as a superglue, the fast-curing material is now constantly inspiring new users: climate demonstrators use it to glue themselves to roads, doctors spray wound dressings, forensic technicians secure fingerprints. Adhesive technology is highly innovative and is conquering more and more areas of application. The adhesives market report has now examined the market for adhesives in Europe for the fifth time: In 2021, the total demand of vinyl, acrylic, polyurethane, elastomer, epoxy and other adhesive types in 23 European countries, including Russia, the Caucasus and Turkey, amounted to around 3.2 million tonnes.

This study looks in detail at vinyl, acrylic, polyurethane, elastomer, epoxy and other adhesive types. For 22 individual European countries, including Russia, Caucasus countries and Turkey, information is provided on demand, production, import and export of adhesives since 2019 – and forecasts up to 2031. Volumes are given in tonnes, and revenues in both USD and EUR.

Not covered here are sealants, cement, mortar, and phenol and other formaldehyde condensates. → Ceresana offers its own market study on sealants and adhesives made of polyurethane (PUR).

Proven and Innovative Applications

The most important sales market for adhesives is the paper and packaging segment, which accounts for around 30% of total European demand. Due to stagnating private consumption, Ceresana market researchers do not expect a recovery in this area until 2024. The construction industry, the second largest market for adhesives, is also currently experiencing a significant slump. The automotive industry, which is increasingly replacing screws, rivets and welding with adhesives, is also relying on innovative joining technology: Around 18 kilograms of adhesives are used in a new car, and around 250 kilograms in a bus – from the protective layers of the battery cells to the crash-proof windows. Adhesives enable lightweight construction not only in aircraft, but also in ships, for example. Other major applications for adhesives are wood processing, leather, shoes and other consumer products.

Sticky Vinyls

The most significant adhesive type in terms of volume is currently vinyl products, which offer a particularly wide range of applications. The most important grades include adhesives based on polyvinyl acetate (PVAC). Additionally, polyvinyl acetate is used to produce polyvinyl alcohol (PVA), which is also used as an adhesive for porous materials such as paper, cardboard, wood, cork or leather. The main consumers of vinyl adhesives are the paper, packaging, wood products and construction industries. They mainly use water-based products and hot melt adhesives.

Wanted: Environmentally Friendly Adhesives

Adhesives sometimes contain large quantities of solvents that can evaporate from bonded surfaces or from containers. Organic solvents, especially aromatic hydrocarbons such as xylene or toluene, are not only a fire hazard but also a health hazard because their vapors are addictive and can cause cancer. For this reason, more environmentally compatible alternatives are increasingly being sought. In Europe, water-based adhesives already accounted for around 52% of total consumption in 2021. If an adhesive contains only water as a solvent, however, preservatives have to be added, which in turn can be problematic for people with allergies.

The Study in Brief:

Chapter 1 of Ceresana’s new study provides a comprehensive presentation and analysis of the European adhesives market – including forecasts up to 2031: for each country, the development of sales, demand per application, trade, and production are detailed.

For the 8 largest countries in Europe, market data is broken down in detail for the different adhesive types and adhesive technologies:

- waterborne adhesives

- hot melts

- solvent-borne adhesives

- reactive adhesives

- other technologies.

Chapter 2 thoroughly analyzes the different applications of adhesives, their respective data and influencing factors:

- paper and packaging

- construction

- wood processing

- transportation

- shoes and leather

- consumer products

- other applications.

It also looks at demand for individual adhesive types:

- Vinyl

- Acrylic

- Polyurethane (PUR)

- Elastomers

- Epoxy

- Other Adhesives.

Chapter 3 provides a useful manufacturer directory with the 83 most important adhesive producers in Europe, clearly arranged by contact details, revenues, profits, product range, production sites, brief profile and specific information on adhesives. The adhesive manufacturers featured include: 3M Europe N.V., AkzoNobel N.V., Bolton Group, Compagnie de Saint-Gobain S.A., Dow Europe GmbH, H.B. Fuller Europe GmbH, Henkel AG & Co. KGaA, Lohmann GmbH & Co. KG, and tesa SE.

Scope of the Report:

Attributes | Details |

Base Year | 2021 |

Trend Period | 2019 – 2031 |

Forecast Period | 2022 – 2031 |

Pages | 260 |

Adhesive Technologies | Water-Based Adhesives, Hotmelt Adhesives, Solvent-Based Adhesives, Reactive Adhesives, Other Technologies |

Adhesive Types | Vinyl, Acrylic, Polyurethane (PUR), Elastomers, Epoxy, Other Adhesives |

Company Profiles | 3M, AkzoNobel, Bolton, Dow, Fuller, Henkel, Lohmann, Saint-Gobain, and tesa. (Selection) |

Edition | 5th edition |

Publication | December 2022 |

FAQs

What was the amount of adhesives consumed in Europe in 2021?

In 2021, the total demand adhesives amounted to around 3.2 million tonnes.

What are the most important sales markets for adhesives?

The most important sales market for adhesives is the paper and packaging segment, which accounts for around 30% of total European demand.

Which type of plastic is in highest demand?

The most significant adhesive type in terms of volume is currently vinyl products.

1 Market Data: Europe

1.1 Demand

1.2 Revenues

1.3 Production

1.4 Demand Split by Application Areas

1.4.1 Paper and Packaging

1.4.2 Construction Industry

1.4.3 Wood Processing

1.4.4 Transportation Industry

1.4.5 Shoes and Leather

1.4.6 Consumer Goods

1.4.7 Others

1.5 Demand Split by Products

1.5.1 Vinyl

1.5.2 Acrylic

1.5.3 Polyurethane (PUR)

1.5.4 Elastomers

1.5.5 Epoxy

1.5.6 Others

1.6 Demand Split by Technologies

1.6.1 Waterborne Adhesives

1.6.2 Hot Melts

1.6.3 Solvent Borne Adhesives

1.6.4 Reactive Adhesives

1.6.5 Others

2 Market Data: Countries

(For each country: Revenues, production and trade. As well as demand per products and applications and for the Top 8 per Technologies)

2.1 Austria

2.2 Belgium

2.3 Czechia

2.4 Denmark

2.5 Finland

2.6 France

2.7 Germany

2.8 Greece

2.9 Hungary

2.10 Italy

2.11 Lithuania

2.12 Poland

2.13 Portugal

2.14 Romania

2.15 Russia

2.16 Slovakia

2.17 Spain

2.18 Sweden

2.19 Switzerland

2.20 The Netherlands

2.21 Turkey

2.22 United Kingdom

2.23 Rest of Europe

3 Company Profiles*

Austria (1 Producer)

Belgium (4)

Estonia (1)

Finland (1)

France (6)

Germany (27)

Ireland (1)

Italy (5)

Luxemburg (1)

Norway (1)

Poland (4)

Portugal (1)

Slovakia (1)

Slovenia (2)

Spain (2)

Sweden (1)

Switzerland (11)

The Netherlands (5)

Turkey (3)

United Kingdom (5)

*Note: The profiles are assigned to the country in which the company or holding is headquartered. Profiles also include JVs and subsidiaries.

Graph 1: Demand in Europe from 2019 to 2031

Graph 2: Revenues generated in Europe from 2019 to 2031 in billion USD and billion EUR

Graph 3: Production in Europe from 2019 to 2031

Graph 4: Demand in Austria from 2019 until 2031

Graph 5: Production in Austria from 2019 to 2031

Graph 6: Demand in Belgium from 2019 to 2031

Graph 7: Production in Belgium from 2019 to 2031

Graph 8: Demand in Czechia from 2019 to 2031

Graph 9: Production in Czechia from 2019 to 2031

Graph 10: Demand in Denmark from 2019 to 2031

Graph 11: Production in Denmark from 2019 to 2031

Graph 12: Demand in Finland from 2019 to 2031

Graph 13: Production in Finland from 2019 to 2031

Graph 14: Demand in France from 2019 to 2031

Graph 15: Production in France from 2019 to 2031

Graph 16: Demand in Germany from 2019 to 2031

Graph 17: Production in Germany from 2019 to 2031

Graph 18: Demand in Greece from 2019 to 2031

Graph 19: Production in Greece from 2019 to 2031

Graph 20: Demand in Hungary from 2019 to 2031

Graph 21: Production in Hungary from 2019 to 2031

Graph 22: Demand in Italy from 2019 to 2031

Graph 23: Production in Italy from 2019 to 2031

Graph 24: Demand in Lithuania from 2019 to 2031

Graph 25: Production in Lithuania from 2019 to 2031

Graph 26: Demand in Poland from 2019 to 2031

Graph 27: Production in Poland from 2019 to 2031

Graph 28: Demand in Portugal from 2019 to 2031

Graph 29: Production in Portugal from 2019 to 2031

Graph 30: Demand in Romania from 2019 to 2031

Graph 31: Production in Romania from 2019 to 2031

Graph 32: Demand in Russia from 2019 to 2031

Graph 33: Production in Russia from 2019 to 2031

Graph 34: Demand in Slovakia from 2019 to 2031

Graph 35: Production in Slovakia from 2019 to 2031

Graph 36: Demand in Spain from 2019 to 2031

Graph 37: Production in Spain from 2019 to 2031

Graph 38: Demand in Sweden from 2019 to 2031

Graph 39: Production in Sweden from 2019 to 2031

Graph 40: Demand in Switzerland from 2019 to 2031

Graph 41: Production in Switzerland from 2019 to 2031

Graph 42: Demand in the Netherlands from 2019 to 2031

Graph 43: Production in the Netherlands from 2019 to 2031

Graph 44: Demand in Turkey from 2019 to 2031

Graph 45: Production in Turkey from 2019 to 2031

Graph 46: Demand in the United Kingdom from 2019 to 2031

Graph 47: Production in the United Kingdom from 2019 to 2031

Graph 48: Demand in the remaining European countries from 2019 to 2031

Graph 49: Production in the remaining European countries from 2019 to 2031

Table 1: European demand from 2019 to 2031 – split by countries

Table 2: Production in Europe from 2019 to 2031 – split by countries

Table 3: European demand from 2019 to 2031 – split by applications

Table 4: European demand in the segment paper/packaging from 2019 to 2031 – split by countries

Table 5: European demand in the segment construction from 2019 to 2031 – split by countries

Table 6: European demand in the segment wood processing from 2019 to 2031 – split by countries

Table 7: European demand in the segment transportation from 2019 to 2031 – split by countries

Table 8: European demand in the segment shoes and leather from 2019 to 2031 – split by countries

Table 9: European demand in the segment consumer goods from 2019 to 2031 – split by countries

Table 10: European demand in other applications from 2019 to 2031 – split by countries

Table 11: Demand in Europe from 2019 to 2031 – split by products

Table 12: European demand for vinyl adhesives from 2019 to 2031 – split by countries

Table 13: European demand for acrylic adhesives from 2019 to 2031 – split by countries

Table 14: European demand for polyurethane adhesives from 2019 to 2031 – split by countries

Table 15: European demand for elastomer adhesives from 2019 to 2031 – split by countries

Table 16: European demand for epoxy adhesives from 2019 to 2031 – split by countries

Table 17: European demand for other adhesives from 2019 to 2031 – split by countries

Table 18: European demand from 2019 to 2031 – split by technologies

Table 19: European demand for waterborne adhesives from 2019 to 2031 – split by countries

Table 20: European demand for hot melts from 2019 to 2031 – split by countries

Table 21: European demand for solvent borne adhesives from 2019 to 2031 – split by countries

Table 22: European demand for reactive adhesives from 2019 to 2031 – split by countries

Table 23: European demand for other adhesives from 2019 to 2031 – split by countries

Table 24: Revenues generated in Austria from 2019 to 2031 in million USD and million EUR

Table 25: Demand in Austria from 2019 to 2031 – split by applications

Table 26: Production, import, export and demand in Austria from 2019 to 2031

Table 27: Revenues generated in Belgium from 2019 to 2031 in million USD and million EUR

Table 28: Demand in Belgium from 2019 to 2031 – split by applications

Table 29: Production, import, export and demand in Belgium from 2019 to 2031

Table 30: Revenues generated in Czechia from 2019 to 2031, in million USD and million EUR

Table 31: Demand in Czechia from 2019 to 2031 – split by applications

Table 32: Production, import, export and demand in Czechia from 2019 to 2031

Table 33: Revenues generated in Denmark from 2019 to 2031 in million USD and million EUR

Table 34: Demand in Denmark from 2019 to 2031 – split by applications

Table 35: Production, import, export and demand in Denmark from 2019 to 2031

Table 36: Revenues generated in Finland from 2019 to 2031 in million USD and million EUR

Table 37: Demand in Finland from 2019 to 2031 – split by applications

Table 38: Production, import, export and demand in Finland from 2019 to 2031

Table 39: Revenues generated in France from 2019 to 2031, in million USD and million EUR

Table 40: Demand in France from 2019 to 2031 – split by applications

Table 41: Demand in France from 2019 to 2031 – split by products

Table 42: Demand in France from 2019 to 2031 – split by technologies

Table 43: Production, import, export and demand in France from 2019 to 2031

Table 44: Revenues generated in Germany from 2019 to 2031, in million USD and million EUR

Table 45: Demand in Germany from 2019 to 2031 – split by applications

Table 46: Demand in Germany from 2019 to 2031 – split by products

Table 47: Demand in Germany from 2019 to 2031 – split by technologies

Table 48: Production, import, export and demand in Germany from 2019 to 2031

Table 49: Revenues generated in Greece from 2019 to 2031 in million USD and million EUR

Table 50: Demand in Greece from 2019 to 2031 – split by applications

Table 51: Production, import, export and demand in Greece from 2019 to 2031

Table 52: Revenues generated in Hungary from 2019 to 2031 in million USD and million EUR

Table 53: Demand in Hungary from 2019 to 2031 – split by applications

Table 54: Production, import, export and demand in Hungary from 2019 to 2031

Table 55: Revenues generated in Italy from 2019 to 2031, in million USD and million EUR

Table 56: Demand in Italy from 2019 to 2031 – split by applications

Table 57: Demand in Italy from 2019 to 2031 – split by products

Table 58: Demand in Italy from 2019 to 2031 – split by technologies

Table 59: Production, import, export and demand in Italy from 2019 to 2031

Table 60: Revenues generated in Lithuania from 2019 to 2031, in million USD and million EUR

Table 61: Demand in Lithuania from 2019 to 2031 – split by applications

Table 62: Production, import, export and demand in Lithuania from 2019 to 2031

Table 63: Revenues generated in Poland from 2019 to 2031, in million USD and million EUR

Table 64: Demand in Poland from 2019 to 2031 – split by applications

Table 65: Demand in Poland from 2019 to 2031 – split by products

Table 66:Demand in Poland from 2019 to 2031 – split by technologies

Table 67: Production, import, export and demand in Poland from 2019 to 2031

Table 68: Revenues generated in Portugal from 2019 to 2031 in million USD and million EUR

Table 69: Demand in Portugal from 2019 to 2031 – split by applications

Table 70: Production, import, export and demand in Portugal from 2019 to 2031

Table 71: Revenues generated in Romania from 2019 to 2031 in million USD and million EUR

Table 72: Demand in Romania from 2019 to 2031 – split by applications

Table 73: Production, import, export and demand in Romania from 2019 to 2031

Table 74: Revenues generated in Russia from 2019 to 2031, in million USD and million EUR

Table 75: Demand in Russia from 2019 to 2031 – split by applications

Table 76: Demand in Russia from 2019 to 2031 – split by products

Table 77: Demand in Russia from 2019 to 2031 – split by technologies

Table 78: Production, import, export and demand in Russia from 2019 to 2031

Table 79: Revenues generated in Slovakia from 2019 to 2031 in million USD and million EUR

Table 80: Demand in Slovakia from 2019 to 2031 – split by applications

Table 81: Production, import, export and demand in Slovakia from 2019 to 2031

Table 82: Revenues generated in Spain from 2019 to 2031, in million USD and million EUR

Table 83: Demand in Spain from 2019 to 2031 – split by applications

Table 84: Demand in Spain from 2019 to 2031 – split by products

Table 85:Demand in Spain from 2019 to 2031 – split by technologies

Table 86: Production, import, export and demand in Spain from 2019 to 2031

Table 87: Revenues generated in Sweden from 2019 to 2031 in million USD and million EUR

Table 88: Demand in Sweden from 2019 to 2031 – split by applications

Table 89: Production, import, export and demand in Sweden from 2019 to 2031

Table 90: Revenues generated in Switzerland from 2019 to 2031 in million USD and million EUR

Table 91: Demand in Switzerland from 2019 to 2031 – split by applications

Table 92: Production, import, export and demand in Switzerland from 2019 to 2031

Table 93: Revenues generated in the Netherlands from 2019 to 2031 in million USD and million EUR

Table 94: Demand in the Netherlands from 2019 to 2031 – split by applications

Table 95: Production, import, export and demand in the Netherlands from 2019 to 2031

Table 96: Revenues generated in Turkey from 2019 to 2031, in million USD and million EUR

Table 97: Demand in Turkey from 2019 to 2031 – split by applications

Table 98: Demand in Turkey from 2019 to 2031 – split by products

Table 99: Demand in Turkey from 2019 to 2031 – split by technologies

Table 100: Production, import, export and demand in Turkey from 2019 to 2031

Table 101: Revenues generated in the United Kingdom from 2019 to 2031, in million USD and million EUR

Table 102: Demand in the United Kingdom from 2019 to 2031 – split by applications

Table 103: Demand in the United Kingdom from 2019 to 2031 – split by products

Table 104: Demand in the United Kingdom from 2019 to 2031 – split by technologies

Table 105: Production, import, export and demand in the United Kingdom from 2019 to 2031

Table 106: Revenues generated in the remaining countries of Europe from 2019 to 2031 in million USD and million EUR

Table 107: Demand in the remaining European countries from 2019 to 2031 – split by applications

Table 108: Production, import, export and demand in the remaining countries of Europe from 2019 to 2031