Description

This study is currently being completely revised. We plan to publish the 8th edition in April 2024. Therefore we can offer you the update for free, if you order the current edition now.

The Flame Retardants Market Report is now also available in parts (e.g. individual country profiles or all manufacturer profiles). Please feel free to contact us and we will immediately send you an offer for your specific selection.

Electricity makes our lives more convenient – but unfortunately also more dangerous. The boom in e-mobility, charging stations, batteries and photovoltaic systems is increasing the need for chemicals that prevent plastics and other flammable materials from igniting or at least slow down fires. Ceresana has analyzed the global market for all types of fire retardants for the seventh time: including brominated and chlorinated flame retardants as well as ATH, organophosphorus, ATO and other additives. The new market study provides figures on demand and revenue for the entire flame retardant market, as well as demand volumes for the individual grades and their applications: Around 2.19 million metric tonnes of flame retardants are used worldwide each year.

Cables and Insulation Materials Need Fire Protection

Large quantities of fire-retardant coatings and gelcoats are needed for cars, but also for public transportation. Virtually all materials can be protected against fire and fire consequences, whether plastics, textiles, wood or paper. Ceresana expects the greatest increase in demand for flame retardants to come from the automotive industry sector: the market researchers anticipate an annual growth rate of around 3.1% in this sector until 2030. Currently consuming almost one-third of total production, the construction industry is expected to remain the largest consumer of flame retardants. Fire retardants are essential for insulating foams, but also, for example, for the sheathing of steel girders in buildings. Electrical and electronic equipment is the second largest application area for flame retardants, with a worldwide consumption of around 525,000 metric tonnes. Highly efficient synergistic combinations of different flame retardants are increasingly being developed, and fire retardants are being tailored specifically for certain applications.

Seeking Environmentally Compatible Flame Retardant Types

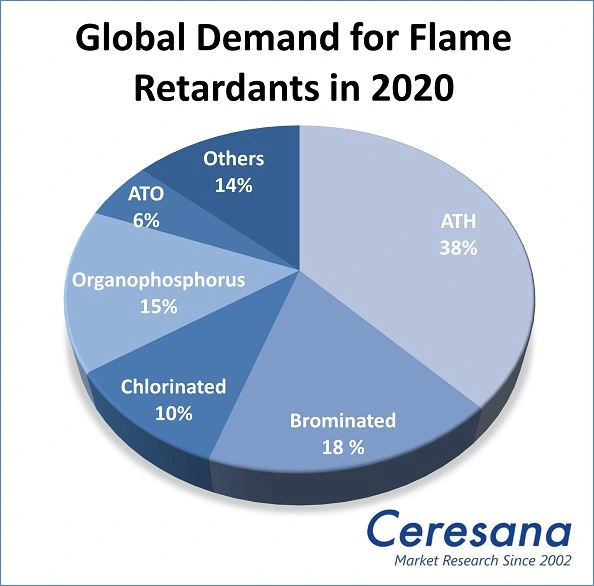

Many flame retardants are controversial because of their potential impact on health and the environment. For instance, they can accumulate in living organisms or release toxins. The recycling of plastics containing flame retardants is also a challenge. Halogen-free aluminum hydroxide, also known as aluminum trihydroxide, is considered relatively environmentally friendly: ATH is by far the world’s best-selling flame retardant, with a current market share of 38%. Brominated flame retardants, which are used particularly in electrical products and foams but are considered problematic, come in second. Government regulations and legal requirements, such as the European Union’s RoHS Directive on the restriction of hazardous substances in electrical and electronic equipment, result in significant regional differences: In Western Europe and North America, brominated compounds account for only 5.1% and 11% of the market, respectively – while in Asia they account for 28.4%. Overall, most flame retardants are consumed in Asia-Pacific: This region of the world currently accounts for around 46% of total demand for flame retardants.

The Study in Brief:

Chapter 1 provides provides a presentation and analysis of the global flame retardants market, including forecasts up to 2030: demand in tonnes and revenues in US dollars and euros are detailed for each region of the world. In addition, the global and regional flame retardant demand per product type and per application area is analyzed.

The following flame retardant types are considered in detail:

- Aluminum Trihydroxide (ATH)

- Brominated Compounds

- Chlorinated Compounds

- Organophosphorus

- Antimony Compounds (ATO)

- Other Flame Retardants

Flame retardant application areas examined in this study are:

- Construction Material

- Electrics & Electronics

- Wires & Cables

- Transportation

- Other Applications

Chapter 2 analyzes revenues generated with flame retardants and their demand for the 16 countries with the largest national markets. Demand is broken down into individual applications and product types.

Chapter 3 provides useful company profiles of the major flame retardant producers, arranged by contact details, revenues, profits, product range, production sites and brief profile. Detailed profiles are provided by 91 flame retardant producers, such as Ajinomoto Fine-Techno Co., Inc., Altana AG, CHT Germany GmbH, Clariant International Ltd., Colorobbia Holding S.p.A., CTF2000 NV, Daihachi Chemical Industry Co., Ltd., Lanxess AG, Metadynea Austria GmbH, Nabaltec AG und Schill+Seilacher GmbH.

Scope of the Report:

Attributes | Details |

| Base Year | 2020 |

| Trend Period | 2018 – 2030 |

| Forecast Period | 2021 – 2030 |

| Pages | 320 |

| Retardant Types | Aluminum Trihydroxide (ATH), Brominated Compounds, Chlorinated Compounds, Organophosphorus, Antimony Compounds (ATO), Other Flame Retardants |

| Application Areas | Construction Material, Electrics & Electronics, Wires & Cables, Transportation, Other Applications |

| Company Profiles | Ajinomoto Fine-Techno, Altana, CHT, Clariant, Colorobbia, CTF2000, Daihachi Chemical Industry, Lanxess, Metadynea Austria, Nabaltec und Schill+Seilacher (Selection) |

| Edition | 7th edition |

| Publication | May 2022 |

FAQs

What was the global consumption of flame retardants in 2020?

About 2.19 million tonnes of flame retardants were processed worldwide in 2020.

What are the most important areas of application for flame retardants?

The construction industry represents the most important application area. Electrical and electronics is the second largest application area for flame retardants with a global consumption of 525,000 tonnes.

In which application area is the highest demand growth expected?

Until 2030, researchers at Ceresana expect demand for flame retardants in the segment transportation to experience the strongest percentage growth: approx. 3.1% per year.

1 Market Data: World and Regions

1.1 World

1.1.1 Demand

1.1.2 Revenues

1.1.3 Applications

1.1.3.1 Construction Material

1.1.3.2 Electrical & Electronics

1.1.3.3 Cables

1.1.3.4 Transportation industry

1.1.3.5 Other Applications

1.1.4 Products

1.1.4.1 Aluminum Trihydroxide (ATH)

1.1.4.2 Brominated Compounds

1.1.4.3 Chlorinated Compounds

1.1.4.4 Organophosphorus

1.1.4.5 Antimony Compounds (ATO)

1.1.4.6 Other Products

1.2 Western Europe

1.2.1 Demand

1.2.2 Revenues

1.2.3 Applications and Products

1.3 Eastern Europe

1.3.1 Demand

1.3.2 Revenues

1.3.3 Applications and Products

1.4 North America

1.4.1 Demand

1.4.2 Revenues

1.4.3 Applications and Products

1.5 South America

1.5.1 Demand

1.5.2 Revenues

1.5.3 Applications and Products

1.6 Asia-Pacific

1.6.1 Demand

1.6.2 Revenues

1.6.3 Applications and Products

1.7 Middle East

1.7.1 Demand

1.7.2 Revenues

1.7.3 Applications and Products

1.8 Africa

1.8.1 Demand

1.8.2 Revenues

1.8.3 Applications and Products

2 Market Data: Countries

2.1 Western Europe

2.1.1 France

2.1.2 Germany

2.1.3 Italy

2.1.4 Spain

2.1.5 United Kingdom

2.1.6 Other Western Europe

2.2 Eastern Europe

2.2.1 Poland

2.2.2 Russia

2.2.3 Turkey

2.2.4 Other Eastern Europe

2.3 North America

2.3.1 Canada

2.3.2 Mexico

2.3.3 USA

2.4 South America

2.4.1 Brazil

2.4.2 Other South America

2.5 Asia-Pacific

2.5.1 China

2.5.2 India

2.5.3 Japan

2.5.4 South Korea

2.5.5 Other Asia-Pacific

3 Company Profiles*

3.1 Western Europe

Austria (3 Producers)

Belgium (5)

France (1)

Germany (11)

Italy (3)

Spain (1)

Sweden (2)

Switzerland (1)

The Netherlands (5)

United Kingdom (5)

3.2 Eastern Europe

Poland (1)

Russia (2)

Slovakia (1)

Turkey (1)

3.3 North America

USA (8)

3.4 Asia-Pacific

Australia (1)

China (8)

India (3)

Japan (25)

Taiwan (1)

3.5 Middle East

Israel (2)

Saudi Arabia (1)

*Note: The profiles are assigned to the country in which the company or holding is headquartered. Profiles also include JVs and subsidiaries.

Graph 1: Worldwide demand for flame retardants from 2018 to 2030

Graph 2: Global demand for flame retardants from 2018 to 2030– split by regions

Graph 3: Global revenues generated with flame retardants from 2018 to 2030 in billion USD and billion EUR

Graph 4: Global revenues generated with flame retardants from 2018 to 2030 in billion USD – split by regions

Graph 5: Global revenues generated with flame retardants from 2018 to 2030 in billion EUR – split by regions

Graph 6: Global demand for flame retardants from 2018 to 2030 – split by applications

Graph 7: Global demand for flame retardants in the segment construction materials from 2018 to 2030 – split by regions

Graph 8: Global demand for flame retardants in the segment electrical & electronics from 2018 to 2030 – split by regions

Graph 9: Global demand for flame retardants in the segment wires & cables from 2018 to 2030 – split by regions

Graph 10: Global demand for flame retardants in the transportation industry from 2018 to 2030 – split by regions

Graph 11: Global demand for flame retardants in other applications from 2018 to 2030 – split by regions

Graph 12: Global demand for flame retardants from 2018 to 2030 – split by products

Graph 13: Global demand for ATH from 2018 to 2030 – split by regions

Graph 14: Global demand for brominated compounds from 2018 to 2030 – split by regions

Graph 15: Global demand for chlorinated compounds from 2018 to 2030 – split by regions

Graph 16: Global demand for organophosphorus flame retardants from 2018 to 2030 – split by regions

Graph 17: Global demand for ATO from 2018 to 2030 – split by regions

Graph 18: Global demand for other products from 2018 to 2030 – split by regions

Graph 19: Demand for flame retardants in Western Europe from 2018 to 2030

Graph 20: Revenues generated with flame retardants in Western Europe from 2018 to 2030 in billion USD and billion EUR

Graph 21: Demand for flame retardants in Western Europe from 2018 to 2030 – split by applications

Graph 22: Demand for flame retardants in Eastern Europe from 2018 to 2030

Graph 23: Revenues generated with flame retardants in Eastern Europe from 2018 to 2030 in billion USD and billion EUR

Graph 24: Demand for flame retardants in Eastern Europe from 2018 to 2030 – split by applications

Graph 25: Demand for flame retardants in North America from 2018 to 2030

Graph 26: Revenues generated with flame retardants in North America from 2018 to 2030 in billion USD and billion EUR

Graph 27: Demand for flame retardants in North America from 2018 to 2030 – split by applications

Graph 28: Demand for flame retardants in South America from 2018 to 2030

Graph 29: Revenues generated with flame retardants in South America from 2018 to 2030 in billion USD and billion EUR

Graph 30: Demand for flame retardants in South America from 2018 to 2030 – split by applications

Graph 31: Demand for flame retardants in Asia-Pacific from 2018 to 2030

Graph 32: Revenues generated with flame retardants in Asia-Pacific from 2018 to 2030 in billion USD and billion EUR

Graph 33: Demand for flame retardants in Asia-Pacific from 2018 to 2030 – split by applications

Graph 34: Demand for flame retardants in the Middle East from 2018 to 2030

Graph 35: Revenues generated with flame retardants in the Middle East from 2018 to 2030 in billion USD and billion EUR

Graph 36: Demand for flame retardants in the Middle East from 2018 to 2030 – split by applications

Graph 37: Demand for flame retardants in Africa from 2018 to 2030

Graph 38: Revenues generated with flame retardants in Africa from 2018 to 2030 in billion USD and billion EUR

Graph 39: Demand for flame retardants in Africa from 2018 to 2030 – split by applications

Graph 40: Demand for flame retardants in France from 2018 to 2030

Graph 41: Demand for flame retardants in Germany from 2018 to 2030

Graph 42: Demand for flame retardants in Italy from 2018 to 2030

Graph 43: Demand for flame retardants in Spain from 2018 to 2030

Graph 44: Demand for flame retardants in the United Kingdom from 2018 to 2030

Graph 45: Demand for flame retardants in Other Western Europe from 2018 to 2030

Graph 46: Demand for flame retardants in Poland from 2018 to 2030

Graph 47: Demand for flame retardants in Russia from 2018 to 2030

Graph 48: Demand for flame retardants in Turkey from 2018 to 2030

Graph 49: Demand for flame retardants in Other Eastern Europe from 2018 to 2030

Graph 50: Demand for flame retardants in Canada from 2018 to 2030

Graph 51: Demand for flame retardants in Mexico from 2018 to 2030

Graph 52: Demand for flame retardants in the USA from 2018 to 2030

Graph 53: Demand for flame retardants in Brazil from 2018 to 2030

Graph 54: Demand for flame retardants in Other South America from 2018 to 2030

Graph 55: Demand for flame retardants in China from 2018 to 2030

Graph 56: Demand for flame retardants in India from 2018 to 2030

Graph 57: Demand for flame retardants in Japan from 2018 to 2030

Graph 58: Demand for flame retardants in South Korea from 2018 to 2030

Graph 59: Demand for flame retardants in Other Asia-Pacific from 2018 to 2030

Table 1: Global demand for flame retardants from 2018 to 2030– split by regions

Table 2: Global revenues generated with flame retardants from 2018 to 2030 in billion USD – split by regions

Table 3: Global revenues generated with flame retardants from 2018 to 2030 in billion EUR – split by regions

Table 4: Global demand for flame retardants from 2018 to 2030 – split by applications

Table 5: Global demand for flame retardants in the segment construction materials from 2018 to 2030 – split by regions

Table 6: Global demand for flame retardants in the segment electrical & electronics from 2018 to 2030 – split by regions

Table 7: Global demand for flame retardants in the segment wires & cables from 2018 to 2030 – split by regions

Table 8: Global demand for flame retardants in the transportation industry from 2018 to 2030 – split by regions

Table 9: Global demand for flame retardants in other applications from 2018 to 2030 – split by regions

Table 10: Global demand for flame retardants from 2018 to 2030 – split by products

Table 11: Global demand for ATH from 2018 to 2030 – split by regions

Table 12: Global demand for brominated compounds from 2018 to 2030 – split by regions

Table 13: Global demand for chlorinated compounds from 2018 to 2030 – split by regions

Table 14: Global demand for organophosphorus flame retardants from 2018 to 2030 – split by regions

Table 15: Global demand for ATO from 2018 to 2030 – split by regions

Table 16: Global demand for other products from 2018 to 2030 – split by regions

Table 17: Demand for flame retardants in Western Europe from 2018 to 2030 – split by major countries

Table 18: Revenues generated with flame retardants in Western Europe from 2018 to 2030 in million USD and million EUR

Table 19: Demand for flame retardants in Western Europe from 2018 to 2030 – split by applications

Table 20: Demand for flame retardants in Western Europe from 2018 to 2030 – split by products

Table 21: Demand for flame retardants in Eastern Europe from 2018 to 2030 – split by major countries

Table 22: Revenues generated with flame retardants in Eastern Europe from 2018 to 2030 in million USD and million EUR

Table 23: Demand for flame retardants in Eastern Europe from 2018 to 2030 – split by applications

Table 24: Demand for flame retardants in Eastern Europe from 2018 to 2030 – split by products

Table 25: Demand for flame retardants in North America from 2018 to 2030 – split by major countries

Table 26: Revenues generated with flame retardants in North America from 2018 to 2030 in million USD and million EUR

Table 27: Demand for flame retardants in North America from 2018 to 2030 – split by applications

Table 28: Demand for flame retardants in North America from 2018 to 2030 – split by products

Table 29: Demand for flame retardants in South America from 2018 to 2030 – split by major countries

Table 30: Revenues generated with flame retardants in South America from 2018 to 2030 in million USD and million EUR

Table 31: Demand for flame retardants in South America from 2018 to 2030 – split by applications

Table 32: Demand for flame retardants in South America from 2018 to 2030 – split by products

Table 33: Demand for flame retardants in Asia-Pacific from 2018 to 2030 – split by major countries

Table 34: Revenues generated with flame retardants in Asia-Pacific from 2018 to 2030 in million USD and million EUR

Table 35: Demand for flame retardants in Asia-Pacific from 2018 to 2030 – split by applications

Table 36: Demand for flame retardants in Asia-Pacific from 2018 to 2030 – split by products

Table 37: Revenues generated with flame retardants in the Middle East from 2018 to 2030 in million USD and million EUR

Table 38: Demand for flame retardants in the Middle East from 2018 to 2030 – split by applications

Table 39: Demand for flame retardants in the Middle East from 2018 to 2030 – split by products

Table 40: Revenues generated with flame retardants in Africa from 2018 to 2030 in million USD and million EUR

Table 41: Demand for flame retardants in Africa from 2018 to 2030 – split by applications

Table 42: Demand for flame retardants in Africa from 2018 to 2030 – split by products

Table 43: Revenues generated with flame retardants in France from 2018 to 2030 in million USD and million EUR

Table 44: Demand for flame retardants in France from 2018 to 2030 – split by applications

Table 45: Demand for flame retardants in France from 2018 to 2030 – split by types

Table 46: Revenues generated with flame retardants in Germany from 2018 to 2030 in million USD and million EUR

Table 47: Demand for flame retardants in Germany from 2018 to 2030 – split by applications

Table 48: Demand for flame retardants in Germany from 2018 to 2030 – split by types

Table 49: Revenues generated with flame retardants in Italy from 2018 to 2030 in million USD and million EUR

Table 50: Demand for flame retardants in Italy from 2018 to 2030 – split by applications

Table 51: Demand for flame retardants in Italy from 2018 to 2030 – split by types

Table 52: Revenues generated with flame retardants in Spain from 2018 to 2030 in million USD and million EUR

Table 53: Demand for flame retardants in Spain from 2018 to 2030 – split by applications

Table 54: Demand for flame retardants in Spain from 2018 to 2030 – split by types

Table 55: Revenues generated with flame retardants in the United Kingdom from 2018 to 2030 in million USD and million EUR

Table 56: Demand for flame retardants in the United Kingdom from 2018 to 2030 – split by applications

Table 57: Demand for flame retardants in the United Kingdom from 2018 to 2030 – split by types

Table 58: Revenues generated with flame retardants in Other Western Europe from 2018 to 2030 in million USD and million EUR

Table 59: Demand for flame retardants in Other Western Europe from 2018 to 2030 – split by applications

Table 60: Demand for flame retardants in Other Western Europe from 2018 to 2030 – split by types

Table 61: Revenues generated with flame retardants in Poland from 2018 to 2030 in million USD and million EUR

Table 62: Demand for flame retardants in Poland from 2018 to 2030 – split by applications

Table 63: Demand for flame retardants in Poland from 2018 to 2030 – split by types

Table 64: Revenues generated with flame retardants in Russia from 2018 to 2030 in million USD and million EUR

Table 65: Demand for flame retardants in Russia from 2018 to 2030 – split by applications

Table 66: Demand for flame retardants in Russia from 2018 to 2030 – split by types

Table 67: Revenues generated with flame retardants in Turkey from 2018 to 2030 in million USD and million EUR

Table 68: Demand for flame retardants in Turkey from 2018 to 2030 – split by applications

Table 69: Demand for flame retardants in Turkey from 2018 to 2030 – split by types

Table 70: Revenues generated with flame retardants in Other Eastern Europe from 2018 to 2030 in billion USD and billion EUR

Table 71: Demand for flame retardants in Other Eastern Europe from 2018 to 2030 – split by applications

Table 72: Demand for flame retardants in Other Eastern Europe from 2018 to 2030 – split by types

Table 73: Revenues generated with flame retardants in Canada from 2018 to 2030 in million USD and million EUR

Table 74: Demand for flame retardants in Canada from 2018 to 2030 – split by applications

Table 75: Demand for flame retardants in Canada from 2018 to 2030 – split by types

Table 76: Revenues generated with flame retardants in Mexico from 2018 to 2030 in million USD and million EUR

Table 77: Demand for flame retardants in Mexico from 2018 to 2030 – split by applications

Table 78: Demand for flame retardants in Mexico from 2018 to 2030 – split by types

Table 79: Revenues generated with flame retardants in the USA from 2018 to 2030 in million USD and million EUR

Table 80: Demand for flame retardants in the USA from 2018 to 2030 – split by applications

Table 81: Demand for flame retardants in the USA from 2018 to 2030 – split by types

Table 82: Revenues generated with flame retardants in Brazil from 2018 to 2030 in million USD and million EUR

Table 83: Demand for flame retardants in Brazil from 2018 to 2030 – split by applications

Table 84: Demand for flame retardants in Brazil from 2018 to 2030 – split by types

Table 85: Revenues generated with flame retardants in Other South America from 2018 to 2030 in million USD and million EUR

Table 86: Demand for flame retardants in Other South America from 2018 to 2030 – split by applications

Table 87: Demand for flame retardants in Other South America from 2018 to 2030 – split by types

Table 88: Revenues generated with flame retardants in China from 2018 to 2030 in million USD and million EUR

Table 89: Demand for flame retardants in China from 2018 to 2030 – split by applications

Table 90: Demand for flame retardants in China from 2018 to 2030 – split by types

Table 91: Revenues generated with flame retardants in India from 2018 to 2030 in million USD and million EUR

Table 92: Demand for flame retardants in India from 2018 to 2030 – split by applications

Table 93: Demand for flame retardants in India from 2018 to 2030 – split by types

Table 94: Revenues generated with flame retardants in Japan from 2018 to 2030 in million USD and million EUR

Table 95: Demand for flame retardants in Japan from 2018 to 2030 – split by applications

Table 96: Demand for flame retardants in Japan from 2018 to 2030 – split by types

Table 97: Revenues generated with flame retardants in South Korea from 2018 to 2030 in million USD and million EUR

Table 98: Demand for flame retardants in South Korea from 2018 to 2030 – split by applications

Table 99: Demand for flame retardants in South Korea from 2018 to 2030 – split by types

Table 100: Revenues generated with flame retardants in Other Asia-Pacific from 2018 to 2030 in million USD and million EUR

Table 101: Demand for flame retardants in Other Asia-Pacific from 2018 to 2030 – split by applications

Table 102: Demand for flame retardants in Other Asia-Pacific from 2018 to 2030 – split by types