Description

The Labels Market Report – Europe is now also available in parts (e.g. individual country profiles or all manufacturer profiles). Please feel free to contact us and we will immediately send you an offer for your specific selection.

Are mini shampoo bottles or stickers on bananas redundant? The EU Commission wants to ban “unnecessary packaging” with a new regulation. This would also affect label manufacturers. Other EU regulations, however, are increasing the demand for labels, for example, because the nutritional value of food, the energy consumption of electrical appliances, or the hazardousness of chemicals must be indicated. Ceresana has analyzed the market for labels in 21 European countries comprehensively: Consumption of paper and plastic labels in Europe is expected to increase by around 1.5% per year until 2032.

Biobased Labels for Biobased Packaging

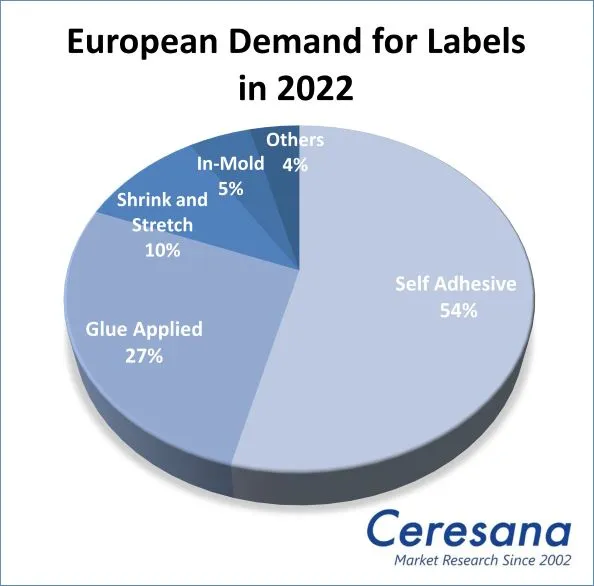

The total area of small labels and stickers adds up to millions of square meters. As environmentally friendly packaging is increasingly in demand, labels made from biodegradable or recyclable materials, such as labels made from bioplastics, can score particularly well in conjunction with biobased adhesives. Wine and beer drinkers usually do not have to worry in this regard: Labels for reusable bottles are traditionally made of paper and attached with washable starch or casein adhesives. However, market shares of glued labels are currently decreasing. The high inflation rate is troubling many consumers. Currently, the most dynamic development occurs in the “cosmetics and pharmaceuticals” sector, which consumes more and more plastic labels. In the production of shrink film labels (shrink and stretch sleeves), the controversial plastic grade PVC is increasingly being replaced by PET. Demand is increasing in particular for PET-G modified with glycol.

Labels are Becoming Smart and Talkative

QR codes, RFID tags and near field communication (NFC labels): Labels are increasingly becoming as “smart” as digitalization and the Internet of Things demand. Smart labels can communicate with smartphones or other devices: Labels report the expiration products or other important information about the contents of the packaging; they make supply chains transparent and ensure anti-counterfeiting and traceability. However, the biggest growth occurs in in-mold labels (IML), which consumers usually don’t perceive as labels at all: A printed film is inserted into a mold, for example for ice cream cups, and then liquid plastic is injected – when cured, the label and packaging form a single unit. During the IML process, the label does not have to be glued on separately; the packaging is created in one individual production step. Label and packaging can also be recycled well because they are made of the same plastic, usually polypropylene or polyethylene-HDPE. Market researchers at Ceresana expect demand for in-mold labels to grow by around 2.4% per year throughout Europe.

The current Ceresana market study “Labels – Europe”:

Chapter 1 presents label consumption in square meters and revenues (in EUR and USD) for the whole of Europe. Market forecasts are made up to the year 2032. The data on label consumption is broken down by materials (paper; polyethylene, polypropylene, PVC, PET and other plastics), by areas of application and by different label types.

Chapter 2 examines the respective total revenues and consumption of the various label types for 21 European countries, differentiated in each case for paper and plastic labels.

These application areas are considered:

- Lemonades

- Water

- Fruit juices

- Other non-alcoholic beverages

- Beer

- Wine & Spirits

- Food

- Cosmetics & Pharma

- Other applications

The “Food” application area is additionally broken down into the following sub-categories (also separately for paper labels and plastic labels):

- Spreads

- Baked goods

- Ready-made meals

- Meat & Fish

- Breakfast cereals

- Chilled & frozen food

- Canned food

- Dairy products

- Fruit & Vegetables

- Sauces & Condiments

- Confectionery

- Dry food

- Other food

With regard to label types, the following categories are distinguished separately for paper and plastic labels:

- Self-adhesive labels

- Glued labels

- Shrink labels

- In-Mold labels

- Other labels

Chapter 3 provides useful company profiles of the most important producers of labels, clearly arranged according to contact details, revenues, profit, product range, production facilities, brief profile as well as product types and application areas. Detailed profiles are provided by 68 manufacturers, such as Ahlstrom Group, Amcor Ltd., CCL Label, Inc., Dow Inc., Essentra Plc., Fuji Seal International, Inc., Huhtamaki Oyi, Mondi plc, Westrock Company, and Zebra Technologies.

Scope of the Report:

Attributes | Details |

| Base Year | 2022 |

| Trend Period | 2020 – 2032 |

| Forecast Period | 2023 – 2032 |

| Pages | 420 |

| Application Areas | Lemonades, Water, Fruit juices, Other non-alcoholic beverages, Beer, Wine & Spirits, Food, Cosmetics & Pharma, Other applications |

| Types of Plastic | PE, PP, PET, PVC, Other Plastics |

| Company Profiles | Ahlstrom, Amcor, CCL, Dow, Essentra, Fuji Seal, Huhtamaki, Mondi, Westrock, and Zebra Technologies (Selection) |

| Edition | 2nd edition |

| Publication | July 2022 |

FAQs

How will European demand for labels develop until 2032?

Consumption of paper and plastic labels in Europe is expected to grow by around 1.5% per year until 2032.

Which application is currently developing the most?

Currently, the most dynamic development occurs in the “cosmetics and pharmaceuticals” sector, which consumes more and more plastic labels.

Which label type is currently experiencing the highest growth?

The highest growth is currently in in-mold labels (IML).

1 Market Data: Europe

1.1 Demand – Total

1.2 Revenues – Total

1.3 Demand Split by Application Area

1.3.1 Lemonades

1.3.2 Water

1.3.3 Fruit Juices

1.3.4 Other Non-Alcoholic Beverages

1.3.5 Beer

1.3.6 Wine and Spirits

1.3.7 Food

1.3.8 Cosmetics & Pharma

1.3.9 Other Applications

1.4 Demand within the Application Area „Food“

1.4.1 Spreads

1.4.2 Baked Goods

1.4.3 Ready-Made Meals

1.4.4 Fresh Meat and Fish

1.4.5 Breakfast Cereals

1.4.6 Chilled and Frozen Food

1.4.7 Canned Food

1.4.8 Dairy Products

1.4.9 Fresh Fruits and Vegetables

1.4.10 Sauces and Condiments

1.4.11 Sweets

1.4.12 Dry Food

1.4.13 Other Food

1.5 Demand Split by Type of Label

1.5.1 Self Adhesive Labels

1.5.2 Glue Applied Labels

1.5.3 Shrink and Stretch Labels

1.5.4 In-Mold Labels

1.5.5 Other Labels

1.6 Demand Split by Type of Plastic

1.6.1 Polyethylene

1.6.2 Polypropylene

1.6.3 PVC

1.6.4 PET

1.6.5 Other Plastics

2 Market Data: Countries

For each country: revenues, demand split by

application (separately for paper and plastic),

demand split by type of label, and demand split by

type of plastic

2.1 Austria

2.2 Belgium

2.3 Bulgaria

2.4 Czechia

2.5 Finland

2.6 France

2.7 Germany

2.8 Greece

2.9 Hungary

2.10 Italy

2.11 Lithuania

2.12 Poland

2.13 Portugal

2.14 Romania

2.15 Russia

2.16 Slovakia

2.17 Spain

2.18 Sweden

2.19 The Netherlands

2.20 Turkey

2.21 United Kingdom

2.22 Rest of Europe

3 Company Profiles

Austria (4 Manufacturers)

Belgium (2)

Czech Republic (1)

Germany (19)

Finland (3)

France (3)

Great Britain (8)

Hungary (1)

Italy (7)

Luxembourg (2)

Netherlands (4)

Poland (2)

Russia (1)

Sweden (2)

Switzerland (2)

Slovenia (1)

Spain (3)

Turkey (2)

Ukraine (1)

Graph 1: Demand in Europe from 2020 to 2032

Graph 2: Revenues generated in Europe from 2020 to 2032 in billion USD and billion EUR

Graph 3: Demand in Austria from 2020 to 2032

Graph 4: Demand in Belgium from 2020 to 2032

Graph 5: Demand in Bulgaria from 2020 to 2032

Graph 6: Demand in Czechia from 2020 to 2032

Graph 7: Demand in Finland from 2020 to 2032

Graph 8: Demand in France from 2020 to 2032

Graph 9: Demand in Germany from 2020 to 2032

Graph 10: Demand in Greece from 2020 to 2032

Graph 11: Demand in Hungary from 2020 to 2032

Graph 12: Demand in Italy from 2020 to 2032

Graph 13: Demand in Lithuania from 2020 to 2032

Graph 14: Demand in Poland from 2020 to 2032

Graph 15: Demand in Portugal from 2020 to 2032

Graph 16: Demand in Romania from 2020 to 2032

Graph 17: Demand in Russia from 2020 to 2032

Graph 18: Demand in Slovakia from 2020 to 2032

Graph 19: Demand in Spain from 2020 to 2032

Graph 20: Demand in Sweden from 2020 to 2032

Graph 21: Demand in the Netherlands from 2020 to 2032

Graph 22: Demand in Turkey from 2020 to 2032

Graph 23: Demand in the United Kingdom from 2020 to 2032

Graph 24: Demand in the remaining countries of Europe from 2020 to 2032

Table 1: European demand from 2020 to 2032 – split by country

Table 2: European demand from 2020 to 2032 – split by application

Table 3: European demand in the segment lemonades from 2020 to 2032 – split by country

Table 4: European demand in the segment Water from 2020 to 2032 – split by country

Table 5: European demand in the segment Fruit juices from 2020 to 2032 – split by country

Table 6: European demand in the segment Other non-alcoholic beverages from 2020 to 2032 – split by country

Table 7: European demand in the segment Beer from 2020 to 2032 – split by country

Table 8: European demand in the segment Wine and spirits from 2020 to 2032 – split by country

Table 9: European demand in the segment Food from 2020 to 2032 – split by country

Table 10: European demand in the segment Cosmetics & pharma from 2020 to 2032 – split by country

Table 11: European demand in other applications from 2020 to 2032 – split by country

Table 12: Demand for labels in the food application area from 2020 to 2032 – split by sub-market

Table 13: European demand for labels for spreads from 2020 to 2032 – split by country

Table 14: European demand for labels for baked goods from 2020 to 2032 – split by country

Table 15: European demand for labels for ready-made meals from 2020 to 2032 – split by country

Table 16: European demand for labels for fresh meat and fish from 2020 to 2032 – split by country

Table 17: European demand for labels for breakfast cereals from 2020 to 2032 – split by country

Table 18: European demand for labels for frozen and chilled foods from 2020 to 2032 – split by country

Table 19: European demand for labels for canned foods from 2020 to 2032 – split by country

Table 20: European demand for labels for dairy products from 2020 to 2032 – split by country

Table 21: European demand for labels for fresh fruits and Vegetables from 2020 to 2032 – split by country

Table 22: European demand for labels for sauces and condiments from 2020 to 2032 – split by country

Table 23: European demand for labels for sweets from 2020 to 2032 – split by country

Table 24: European demand for labels for dry food from 2020 to 2032 – split by country

Table 25: European demand for labels for other food from 2020 to 2032 – split by country

Table 26: European demand for labels from 2020 to 2032 – split by type of label

Table 27: European demand for self adhesive labels from 2020 to 2032 – split by country

Table 28: European demand for glue applied labels from 2020 to 2032 – split by country

Table 29: European demand for shrink and stretch labels from 2020 to 2032 – split by country

Table 30: European demand for in-mold labels from 2020 to 2032 – split by country

Table 31: European demand for other labels from 2020 to 2032 – split by country

Table 32: Demand in Europe from 2020 to 2032 – split by type of plastic

Table 33: European demand for labels made of polyethylene from 2020 to 2032 – split by country

Table 34: European demand for labels made of polypropylene from 2020 to 2032 – split by country

Table 35: European demand for labels made of PVC from 2020 to 2032 – split by country

Table 36: European demand for labels made of PET from 2020 to 2032 – split by country

Table 37: European demand for labels made of other plastics from 2020 to 2032 – split by country

Table 38: Revenues generated in Austria from 2020 to 2032 in million USD and million EUR

Table 39: Demand for labels in Austria from 2020 to 2032 – split by application

Table 40: Demand for labels in the food application area in Austria from 2020 to 2032 – split by sub-segment

Table 41: Demand for labels made of paper in Austria from 2020 to 2032 – split by application

Table 42: Demand for labels made of paper in the food application area in Austria from 2020 to 2032 – split by sub-market

Table 43: Demand for labels made of plastic in Austria from 2020 to 2032 – split by application

Table 44: Demand for labels made of plastic in the food application area in Austria from 2020 to 2032 – split by sub-market

Table 45: Demand for labels in Austria from 2020 to 2032 – split by type of label

Table 46: Demand for labels made of paper in Austria from 2020 to 2032 – split by type of label

Table 47: Demand for labels made of plastic in Austria from 2020 to 2032 – split by type of label

Table 48: Demand for labels in Austria from 2020 to 2032 – split by type of plastic

Table 49: Revenues generated in Belgium from 2020 to 2032 in million USD and million EUR

Table 50: Demand for labels in Belgium from 2020 to 2032 – split by application

Table 51: Demand for labels in the food application area in Belgium from 2020 to 2032 – split by sub-market

Table 52: Demand for labels made of paper in Belgium from 2020 to 2032 – split by application

Table 53: Demand for labels made of paper in the food application area in Belgium from 2020 to 2032 – split by sub-market

Table 54: Demand for labels made of plastic in Belgium from 2020 to 2032 – split by application

Table 55: Demand for labels made of plastic in the food application area in Belgium from 2020 to 2032 – split by sub-market

Table 56: Demand for labels in Belgium from 2020 to 2032 – split by type of label

Table 57: Demand for labels made of paper in Belgium from 2020 to 2032 – split by type of label

Table 58: Demand for labels made of plastic in Belgium from 2020 to 2032 – split by type of label

Table 59: Demand for labels in Belgium from 2020 to 2032 – split by type of plastic

Table 60: Revenues in Bulgaria from 2020 to 2032 in million USD and million EUR

Table 61: Demand for labels in Bulgaria from 2020 to 2032 – split by application

Table 62: Demand for labels in the food application area in Bulgaria from 2020 to 2032 – split by sub-market

Table 63: Demand for labels made of paper in Bulgaria from 2020 to 2032 – split by application

Table 64: Demand for labels made of paper in the food application area in Bulgaria from 2020 to 2032 – split by sub-market

Table 65: Demand for labels made of plastic in Bulgaria from 2020 to 2032 – split by application

Table 66: Demand for labels made of plastic in the food application area in Bulgaria from 2020 to 2032 – split by sub-market

Table 67: Demand for labels in Bulgaria from 2020 to 2032 – split by type of label

Table 68: Demand for labels made of paper in Bulgaria from 2020 to 2032 – split by type of label

Table 69: Demand for labels made of plastic in Bulgaria from 2020 to 2032 – split by type of label

Table 70: Demand for labels in Bulgaria from 2020 to 2032 – split by type of plastic

Table 71: Revenues generated in Czechia from 2020 to 2032 in million USD and million EUR

Table 72: Demand for labels in Czechia from 2020 to 2032 – split by application

Table 73: Demand for labels in the food application area in Czechia from 2020 to 2032 – split by sub-market

Table 74: Demand for labels made of paper in Czechia from 2020 to 2032 – split by application

Table 75: Demand for labels made of paper in the food application area in Czechia from 2020 to 2032 – split by sub-market

Table 76: Demand for labels made of plastic in Czechia from 2020 to 2032 – split by application

Table 77: Demand for labels made of plastic in the food application area in Czechia from 2020 to 2032 – split by sub-market

Table 78: Demand for labels in Czechia from 2020 to 2032 – split by type of label

Table 79: Demand for labels made of paper in Czechia from 2020 to 2032 – split by type of label

Table 80: Demand for labels made of plastic in Czechia from 2020 to 2032 – split by type of label

Table 81: Demand for labels in Czechia from 2020 to 2032 – split by type of plastic

Table 82: Revenues generated in Finland from 2020 to 2032 in million USD and million EUR

Table 83: Demand for labels in Finland from 2020 to 2032 – split by application

Table 84: Demand for labels in the food application area in Finland from 2020 to 2032 – split by sub-market

Table 85: Demand for labels made of paper in Finland from 2020 to 2032 – split by application

Table 86: Demand for labels made of paper in the food application area in Finland from 2020 to 2032 – split by sub-market

Table 87: Demand for labels made of plastic in Finland from 2020 to 2032 – split by application

Table 88: Demand for labels made of plastic in the food application area in Finland from 2020 to 2032 – split by sub-market

Table 89: Demand for labels in Finland from 2020 to 2032 – split by type of label

Table 90: Demand for labels made of paper in Finland from 2020 to 2032 – split by type of label

Table 91: Demand for labels made of plastic in Finland from 2020 to 2032 – split by type of label

Table 92: Demand for labels in Finland from 2020 to 2032 – split by type of plastic

Table 93: Revenues generated in France from 2020 to 2032 in million USD and million EUR

Table 94: Demand for labels in France from 2020 to 2032 – split by application

Table 95: Demand for labels in the food application area in France from 2020 to 2032 – split by sub-market

Table 96: Demand for labels made of paper in France from 2020 to 2032 – split by application

Table 97: Demand for labels made of paper in the food application area in France from 2020 to 2032 – split by sub-market

Table 98: Demand for labels made of plastic in France from 2020 to 2032 – split by application

Table 99: Demand for labels made of plastic in the food application area in France from 2020 to 2032 – split by sub-market

Table 100: Demand for labels in France from 2020 to 2032 – split by type of label

Table 101: Demand for labels made of paper in France from 2020 to 2032 – split by type of label

Table 102: Demand for labels made of plastic in France from 2020 to 2032 – split by type of label

Table 103: Demand for labels in France from 2020 to 2032 – split by type of plastic

Table 104: Revenues in Germany from 2020 to 2032 in million USD and million EUR

Table 105: Demand for labels in Germany from 2020 to 2032 – split by application

Table 106: Demand for labels in the food application area in Germany from 2020 to 2032 – split by sub-market

Table 107: Demand for labels made of paper in Germany from 2020 to 2032 – split by application

Table 108: Demand for labels made of paper in the food application area in Germany from 2020 to 2032 – split by sub-market

Table 109: Demand for labels made of plastic in Germany from 2020 to 2032 – split by application

Table 110: Demand for labels made of plastic in the food application area in Germany from 2020 to 2032 – split by sub-market

Table 111: Demand for labels in Germany from 2020 to 2032 – split by type of label

Table 112: Demand for labels made of paper in Germany from 2020 to 2032 – split by type of label

Table 113: Demand for labels made of plastic in Germany from 2020 to 2032 – split by type of label

Table 114: Demand for labels in Germany from 2020 to 2032 – split by type of plastic

Table 115: Revenues generated in Greece from 2020 to 2032 in million USD and million EUR

Table 116: Demand for labels in Greece from 2020 to 2032 – split by application

Table 117: Demand for labels in the food application area in Greece from 2020 to 2032 – split by sub-market

Table 118: Demand for labels made of paper in Greece from 2020 to 2032 – split by application

Table 119: Demand for labels made of paper in the food application area in Greece from 2020 to 2032 – split by sub-market

Table 120: Demand for labels made of plastic in Greece from 2020 to 2032 – split by application

Table 121: Demand for labels made of plastic in the food application area in Greece from 2020 to 2032 – split by sub-market

Table 122: Demand for labels in Greece from 2020 to 2032 – split by type of label

Table 123: Demand for labels made of paper in Greece from 2020 to 2032 – split by type of label

Table 124: Demand for labels made of plastic in Greece from 2020 to 2032 – split by type of label

Table 125: Demand for labels in Greece from 2020 to 2032 – split by type of plastic

Table 126: Revenues generated in Hungary from 2020 to 2032 in million USD and million EUR

Table 127: Demand for labels in Hungary from 2020 to 2032 – split by application

Table 128: Demand for labels in the food application area in Hungary from 2020 to 2032 – split by sub-market

Table 129: Demand for labels made of paper in Hungary from 2020 to 2032 – split by application

Table 130: Demand for labels made of paper in the food application area in Hungary from 2020 to 2032 – split by sub-market

Table 131: Demand for labels made of plastic in Hungary from 2020 to 2032 – split by application

Table 132: Demand for labels made of plastic in the food application area in Hungary from 2020 to 2032 – split by sub-market

Table 133: Demand for labels in Hungary from 2020 to 2032 – split by type of label

Table 134: Demand for labels made of paper in Hungary from 2020 to 2032 – split by type of label

Table 135: Demand for labels made of plastic in Hungary from 2020 to 2032 – split by type of label

Table 136: Demand for labels in Hungary from 2020 to 2032 – split by type of plastic

Table 137: Revenues generated in Italy from 2020 to 2032 in million USD and million EUR

Table 138: Demand for labels in Italy from 2020 to 2032 – split by application

Table 139: Demand for labels in the food application area in Italy from 2020 to 2032 – split by sub-market

Table 140: Demand for labels made of paper in Italy from 2020 to 2032 – split by application

Table 141: Demand for labels made of paper in the food application area in Italy from 2020 to 2032 – split by sub-market

Table 142: Demand for labels made of plastic in Italy from 2020 to 2032 – split by application

Table 143: Demand for labels made of plastic in the food application area in Italy from 2020 to 2032 – split by sub-market

Table 144: Demand for labels in Italy from 2020 to 2032 – split by type of label

Table 145: Demand for labels made of paper in Italy from 2020 to 2032 – split by type of label

Table 146: Demand for labels made of plastic in Italy from 2020 to 2032 – split by type of label

Table 147: Demand for labels made of paper in Italy from 2020 to 2032 – split by type of plastic

Table 148: Revenues generated in Lithuania from 2020 to 2032, in million USD and million EUR

Table 149: Demand for labels in Lithuania from 2020 to 2032 – split by application

Table 150: Demand for labels in the food application area in Lithuania from 2020 to 2032 – split by sub-market

Table 151: Demand for labels made of paper in Lithuania from 2020 to 2032 – split by application

Table 152: Demand for labels made of paper in the food application area in Lithuania from 2020 to 2032 – split by sub-market

Table 153: Demand for labels made of plastic in Lithuania from 2020 to 2032 – split by application

Table 154: Demand for labels made of plastic in the food application area in Lithuania from 2020 to 2032 – split by sub-market

Table 155: Demand for labels in Lithuania from 2020 to 2032 – split by type of label

Table 156: Demand for labels made of paper in Lithuania from 2020 to 2032 – split by type of label

Table 157: Demand for labels made of plastic in Lithuania from 2020 to 2032 – split by type of label

Table 158: Demand for labels in Lithuania from 2020 to 2032 – split by type of plastic

Table 159: Revenues generated in Poland from 2020 to 2032 in million USD and million EUR

Table 160: Demand for labels in Poland from 2020 to 2032 – split by application

Table 161: Demand for labels in the food application area in Poland from 2020 to 2032 – split by sub-market

Table 162: Demand for labels made of paper in Poland from 2020 to 2032 – split by application

Table 163: Demand for labels made of paper in the food application area in Poland from 2020 to 2032 – split by sub-market

Table 164: Demand for labels made of plastic in Poland from 2020 to 2032 – split by application

Table 165: Demand for labels made of plastic in the food application area in Poland from 2020 to 2032 – split by sub-market

Table 166: Demand for labels in Poland from 2020 to 2032 – split by type of label

Table 167: Demand for labels made of paper in Poland from 2020 to 2032 – split by type of label

Table 168: Demand for labels made of plastic in Poland from 2020 to 2032 – split by type of label

Table 169: Demand for labels in Poland from 2020 to 2032 – split by type of plastic

Table 170: Revenues generated in Portugal from 2020 to 2032 in million USD and million EUR

Table 171: Demand for labels in Portugal from 2020 to 2032 – split by application

Table 172: Demand for labels in the food application area in Portugal from 2020 to 2032 – split by sub-market

Table 173: Demand for PVC containers in Portugal from 2008 to 2024 – split by applications

Table 174: Demand for labels made of paper in the food application area in Portugal from 2020 to 2032 – split by sub-market

Table 175: Demand for labels made of plastics in Portugal from 2020 to 2032 – split by application

Table 176: Demand for labels made of plastic in the food application area in Portugal from 2020 to 2032 – split by sub-market

Table 177: Demand for labels in Portugal from 2020 to 2032 – split by type of label

Table 178: Demand for labels made of paper in Portugal from 2020 to 2032 – split by type of label

Table 179: Demand for labels made of plastic in Portugal from 2020 to 2032 – split by type of label

Table 180: Demand for labels in Portugal from 2020 to 2032 – split by type of plastic

Table 181: Revenues generated in Romania from 2020 to 2032 in million USD and million EUR

Table 182: Demand for labels in Romania from 2020 to 2032 – split by application

Table 183: Demand for labels in the food application area in Romania from 2020 to 2032 – split by sub-market

Table 184: Demand for labels made of paper in Romania from 2020 to 2032 – split by application

Table 185: Demand for labels made of paper in the food application area in Romania from 2020 to 2032 – split by sub-market

Table 186: Demand for labels made of plastic in Romania from 2020 to 2032 – split by application

Table 187: Demand for labels made of plastic in the food application area in Romania from 2020 to 2032 – split by sub-market

Table 188: Demand for labels in Romania from 2020 to 2032 – split by type of label

Table 189: Demand for labels made of paper in Romania from 2020 to 2032 – split by type of label

Table 190: Demand for labels made of plastic in Romania from 2020 to 2032 – split by type of label

Table 191: Demand for labels in Romania from 2020 to 2032 – split by type of plastic

Table 192: Revenues generated in Russia from 2020 to 2032 in million USD and million EUR

Table 193: Demand for labels in Russia from 2020 to 2032 – split by application

Table 194: Demand for labels in the food application area in Russia from 2020 to 2032 – split by sub-market

Table 195: Demand for labels made of paper in Russia from 2020 to 2032 – split by application

Table 196: Demand for labels made of paper in the food application area in Russia from 2020 to 2032 – split by sub-market

Table 197: Demand for labels made of plastic in Russia from 2020 to 2032 – split by application

Table 198: Demand for labels made of plastic in the food application area in Russia from 2020 to 2032 – split by sub-market

Table 199: Demand for labels in Russia from 2020 to 2032 – split by type of label

Table 200: Demand for labels made of paper in Russia from 2020 to 2032 – split by type of label

Table 201: Demand for labels made of plastic in Russia from 2020 to 2032 – split by type of label

Table 202: Demand for labels in Russia from 2020 to 2032 – split by type of plastic

Table 203: Revenues generated in Slovakia from 2020 to 2032 in million USD and million EUR

Table 204: Demand for labels in Slovakia from 2020 to 2032 – split by application

Table 205: Demand for labels in the food application area in Slovakia from 2020 to 2032 – split by sub-market

Table 206: Demand for labels made of paper in Slovakia from 2020 to 2032 – split by application

Table 207: Demand for labels made of paper in the food application area in Slovakia from 2020 to 2032 – split by sub-market

Table 208: Demand for labels made of plastic in Slovakia from 2020 to 2032 – split by application

Table 209: Demand for labels made of plastic in the food application area in Slovakia from 2020 to 2032 – split by sub-market

Table 210: Demand for labels in Slovakia from 2020 to 2032 – split by type of label

Table 211: Demand for labels made of paper in Slovakia from 2020 to 2032 – split by type of label

Table 212: Demand for labels made of plastic in Slovakia from 2020 to 2032 – split by type of label

Table 213: Demand for labels in Slovakia from 2020 to 2032 – split by type of plastic

Table 214: Revenues in Spain from 2020 to 2032 in million USD and million EUR

Table 215: Demand for labels in Spain from 2020 to 2032 – split by application

Table 216: Demand for labels in the food application area in Spain from 2020 to 2032 – split by sub-market

Table 217: Demand for labels made of paper in Spain from 2020 to 2032 – split by application

Table 218: Demand for labels made of paper in the food application area in Spain from 2020 to 2032 – split by sub-market

Table 219: Demand for labels made of plastic in Spain from 2020 to 2032 – split by application

Table 220: Demand for labels made of plastic in the food application area in Spain from 2020 to 2032 – split by sub-market

Table 221: Demand for labels in Spain from 2020 to 2032 – split by type of label

Table 222: Demand for labels made of paper in Spain from 2020 to 2032 – split by type of label

Table 223: Demand for labels made of plastic in Spain from 2020 to 2032 – split by type of label

Table 224: Demand for labels in Spain from 2020 to 2032 – split by type of plastic

Table 225: Revenues generated in Sweden from 2020 to 2032 in million USD and million EUR

Table 226: Demand for labels in Sweden from 2020 to 2032 – split by application

Table 227: Demand for labels in the food application area in Sweden from 2020 to 2032 – split by sub-market

Table 228: Demand for labels made of paper in Sweden from 2020 to 2032 – split by application

Table 229: Demand for labels made of paper in the food application area in Sweden from 2020 to 2032 – split by sub-market

Table 230: Demand for labels made of plastic in Sweden from 2020 to 2032 – split by application

Table 231: Demand for labels made of plastic in the food application area in Sweden from 2020 to 2032 – split by sub-market

Table 232: Demand for labels in Sweden from 2020 to 2032 – split by type of label

Table 233: Demand for labels made of paper in Sweden from 2020 to 2032 – split by type of label

Table 234: Demand for labels made of plastic in Sweden from 2020 to 2032 – split by type of label

Table 235: Demand for labels in Sweden from 2020 to 2032 – split by type of plastic

Table 236: Revenues generated in the Netherlands from 2020 to 2032 in million USD and million EUR

Table 237: Demand for labels in the Netherlands from 2020 to 2032 – split by application

Table 238: Demand for labels in the food application area in the Netherlands from 2020 to 2032 – split by sub-market

Table 239: Demand for labels made of paper in the Netherlands from 2020 to 2032 – split by application

Table 240: Demand for labels made of paper in the food application area in the Netherlands from 2020 to 2032 – split by sub-market

Table 241: Demand for labels made of plastic in the Netherlands from 2020 to 2032 – split by application

Table 242: Demand for labels made of plastic in the food application area in the Netherlands from 2020 to 2032 – split by sub-market

Table 243: Demand for labels in the Netherlands from 2020 to 2032 – split by type of label

Table 244: Demand for labels made of paper in the Netherlands from 2020 to 2032 – split by type of label

Table 245: Demand for labels made of plastic in the Netherlands from 2020 to 2032 – split by type of label

Table 246: Demand for labels in the Netherlands from 2020 to 2032 – split by type of plastic

Table 247: Revenues generated in Turkey from 2020 to 2032 in million USD and million EUR

Table 248: Demand for labels in Turkey from 2020 to 2032 – split by application

Table 249: Demand for labels in the food application area in Turkey from 2020 to 2032 – split by sub-market

Table 250: Demand for labels made of paper in Turkey from 2020 to 2032 – split by application

Table 251: Demand for labels made of paper in the food application area in Turkey from 2020 to 2032 – split by sub-market

Table 252: Demand for labels made of plastic in Turkey from 2020 to 2032 – split by application

Table 253: Demand for labels made of plastic in the food application area in Turkey from 2020 to 2032 – split by sub-market

Table 254: Demand for labels in Turkey from 2020 to 2032 – split by type of label

Table 255: Demand for labels made of paper in Turkey from 2020 to 2032 – split by type of label

Table 256: Demand for labels made of plastic in Turkey from 2020 to 2032 – split by type of label

Table 257: Demand for labels in Turkey from 2020 to 2032 – split by type of plastic

Table 258: Revenues in the United Kingdom from 2020 to 2032 in million USD and million EUR

Table 259: Demand for labels in the United Kingdom from 2020 to 2032 – split by application

Table 260: Demand for labels in the food application area in the United Kingdom from 2020 to 2032 – split by sub-market

Table 261: Demand for labels made of paper in the United Kingdom from 2020 to 2032 – split by application

Table 262: Demand for labels made of paper in the food application area in the United Kingdom from 2020 to 2032 – split by sub-market

Table 263: Demand for labels made of plastic in the United Kingdom from 2020 to 2032 – split by application

Table 264: Demand for labels made of plastic in the food application area in the United Kingdom from 2020 to 2032 – split by sub-market

Table 265: Demand for labels in the United Kingdom from 2020 to 2032 – split by type of label

Table 266: Demand for labels made of paper in the United Kingdom from 2020 to 2032 – split by type of label

Table 267: Demand for labels made of plastic in the United Kingdom from 2020 to 2032 – split by type of label

Table 268: Demand for labels in the United Kingdom from 2020 to 2032 – split by type of plastic

Table 269: Revenues generated in the remaining countries of Europe from 2020 to 2032 in million USD and million EUR

Table 270: Demand for labels in the remaining countries of Europe from 2020 to 2032 – split by application

Table 271: Demand for labels in the food application area in the remaining countries of Europe from 2020 to 2032 – split by sub-market

Table 272: Demand for labels made of paper in the remaining countries of Europe from 2020 to 2032 – split by application

Table 273: Demand for labels made of paper in the food application area in the remaining countries of Europe from 2020 to 2032 – split by sub-market

Table 274: Demand for labels made of plastic in the remaining countries of Europe from 2020 to 2032 – split by application

Table 275: Demand for labels made of plastic in the food application area in the remaining countries of Europe from 2020 to 2032 – split by sub-market

Table 276: Demand for labels in the remaining countries of Europe from 2020 to 2032 – split by type of label

Table 277: Demand for labels made of paper in the remaining countries of Europe from 2020 to 2032 – split by type of label

Table 278: Demand for labels made of plastic in the remaining countries of Europe from 2020 to 2032 – split by type of label

Table 279: Demand for labels in the remaining countries of Europe from 2020 to 2032 – split by type of plastic