Description

This study is currently being completely revised. We plan to publish the 5th edition in September 2024. Therefore we can offer you the update for free, if you order the current edition now.

The Solvents Market Report – World is now also available in parts (e.g. individual country profiles or all manufacturer profiles). Please feel free to contact us and we will immediately send you an offer for your specific selection.

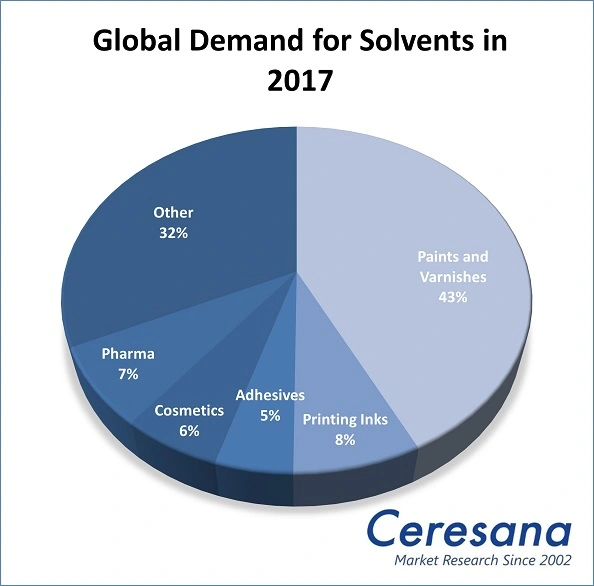

Solvents play a major role in industrial production: They can dissolve, dilute, and, in a very fine distribution, absorb other substances without changing them chemically. Solvents (sometimes also called dissolvents) are mainly used in the paints and varnishes, printing inks, and adhesives industry but also, for example, as an ingredient of pharmaceuticals, cosmetics, and detergents. Substances that cause unpleasant odors, explosive vapors, as well as health and environmental damages are controversial and increasingly targeted by the legislature. Ceresana analyzed the global market for solvents already for the fourth time.

Solvent Applications

The largest consumers of solvents are manufacturers of paints and coatings, followed at a considerable distance by producers of printing inks. Demand on the part of the pharmaceutical industry ranked third, followed by utilization in cosmetics and adhesives. Other important applications are chemical manufacturing processes, cooling circuits, dry-cleaning, and deicers. However, a trend away from solventborne products and towards more environmentally friendly alternatives based on water is prevailing in the segment paints and varnishes. This development has an inhibiting effect on demand for solvents.

Growing Demand in Asia

The industry in Asia-Pacific accounted for about 44 % of global demand in 2017. China dominated the market, followed at a considerable distance by Japan and India. The regions North America and Western Europe ranked second and third. Ceresana expects constantly high growth rates for the region Asia-Pacific. In the segments paints and varnishes, printing inks, and adhesives, this region is the major consumer. On the contrary, Western Europe and North America account for the largest demand in the segments cosmetics and pharmaceuticals.

Types of Solvents

Alcohols are the solvent type with the by far highest demand: especially ethanol, n-butanol, isopropanol, and methanol. The region Asia-Pacific is the largest consumer in the segment alcohols as well, with a demand of about 2.7 million tonnes, followed by North America. Besides alcohols, mainly ketones were utilized as solvents in 2017; but also aromatics, esters, and ethers hold significant market shares each. With an expected increase of 3.2 % per year, the group of ethers will be the fastest growing market.

The Study in Brief:

Chapter 1 is a presentation and analysis of the global solvent market – including forecasts up to 2025: For each of the seven world regions, Western Europe, Easter Europe, North America, South America, Asia-Pacific, the Middle East, and Africa, demand split by solvent types as well as revenues are examined.

Chapter 2 provides detailed data on solvent demand and revenues in 16 countries. In addition, this chapter provides in-depth information on the demand for solvents in the sectors paints and varnishes, printing inks, adhesives, cosmetics, and pharmaceuticals as well as in other application areas.

Chapter 3 offers a substantiated analysis of the application areas for solvents: data on demand development, split by the seven world regions. Additionally, demand per applications area is examined individually for the most important countries.

Chapter 4 takes a look at the several solvent groups: alcohols, ketones, esters, ethers, aromatics, non-aromatics as well as other solvents. The following solvent types have been analyzed separately: ethanol, n-butanol, isopropanol and methanol, acetone and methyl ethyl ketone as well as toluene.

Chapter 5 provides profiles of the largest solvent manufacturers, clearly arranged according to contact details, turnover, profit, product range, production sites, profile summary, and product base. Extensive profiles of 102 producers are given, including BP plc, Cargill Incorporated, China National Petroleum Corporation (CNPC), ExxonMobil Chemical Company, Oil and Natural Gas Corporation (ONGC), Petróleo Brasileiro S.A. (Petrobras), PJSC Lukoil, Royal Dutch Shell PLC, Sinopec Corp., and Total SA.

Scope of the Report:

Attributes | Details |

| Base Year | 2017 |

| Trend Period | 2009 – 2025 |

| Forecast Period | 2018 – 2025 |

| Pages | 440 |

| Application Areas | Paints and Varnishes, Printing Inks, Adhesives, Cosmetics, Pharmaceuticals, Other Application Areas |

| Solvent Types | Alcohols, Ketones, Esters, Ethers, Aromatics, Non-Aromatics, Other Solvents |

| Company Profiles | BP plc, Cargill Incorporated, China National Petroleum Corporation (CNPC), ExxonMobil Chemical Company, Oil and Natural Gas Corporation (ONGC), Petróleo Brasileiro S.A. (Petrobras), PJSC Lukoil, Royal Dutch Shell PLC, Sinopec Corp., and Total SA (Selection) |

| Edition | 4th edition |

| Publication | April 2018 |

FAQs

Which region is the largest solvent consumer?

Asia-Pacific accounted for about 44% of global demand in 2017. Followed by the regions North America and Western Europe.

Which solvent type dominates the market?

Alcohols are by far the most utilized solvent type.

Which solvent type submarket is forecast to develop most dynamically?

With an expected increase of 3.2 % per year, the group of ethers will be the fastest growing market.

1 Market Data

1.1.2 Revenues

1.2.2 Revenues

1.3.2 Revenues

1.4.2 Revenues

1.5.2 Revenues

1.6.2 Revenues

1.7.2 Revenues

1.8.2 Revenues

2 Country Profiles

2.1.2 Germany

2.1.3 Italy

2.1.4 Spain

2.1.5 United Kingdom

2.1.6 Other Western Europe

2.2.2 Russia

2.2.3 Turkey

2.2.4 Other Eastern Europe

2.3.2 Mexico

2.3.3 USA

2.4.2 Other South America

2.5.2 India

2.5.3 Japan

2.5.4 South Korea

2.5.5 Other Asia-Pacific

3 Applications

3.1.2 Printing Inks

3.1.3 Adhesives

3.1.4 Cosmetics

3.1.5 Pharmaceuticals

3.1.6 Other Applications

3.2.2 Printing Inks

3.2.3 Adhesives

3.2.4 Cosmetics

3.2.5 Pharmaceuticals

3.2.6 Other Applications

3.3.2 Printing Inks

3.3.3 Adhesives

3.3.4 Cosmetics

3.3.5 Pharmaceuticals

3.3.6 Other Applications

3.4.2 Printing Inks

3.4.3 Adhesives

3.4.4 Cosmetics

3.4.5 Pharmaceuticals

3.4.6 Other Applications

3.5.2 Printing Inks

3.5.3 Adhesives

3.5.4 Cosmetics

3.5.5 Pharmaceuticals

3.5.6 Other Applications

3.6.2 Printing Inks

3.6.3 Adhesives

3.6.4 Cosmetics

3.6.5 Pharmaceuticals

3.6.6 Other Applications

4 Products

4.1.2 n-Butanol

4.1.3 Isopropanol

4.1.4 Methanol

4.1.5 Other Alcohols

4.2.2 Methyl Ethyl Ketone (MEK)

4.2.3 Other Ketones

4.5.2 Other Aromatics

5 Company Profiles

Belgium (2)

Finland (1)

France (3)

Germany (4)

Italy (1)

Norway (1)

Portugal (1)

Spain (1)

Switzerland (1)

The Netherlands (4)

United Kingdom (2)

Hungary (1)

Poland (1)

Russia (4)

Mexico (1)

USA (21)

Columbia (1)

Venezuela (1)

China (5)

Hong Kong (1)

India (5)

Indonesia (1)

Japan (13)

Malaysia (1)

Philippines (1)

South Korea (8)

Taiwan (2)

Thailand (2)

Qatar (1)

Saudi Arabia (1)

5.7 Africa

South Africa (1)

Graph 1: Global demand for solvents from 2009 to 2025

Graph 2: Global demand for solvents from 2009 to 2025 – split by regions

Graph 3: Global revenues generated with solvents from 2009 to 2025 in billion USD and billion EUR

Graph 4: Euro-reference rate between 2009 and 2017: USD per EUR

Graph 5: Global revenues generated with solvents from 2009 to 2025 in billion USD – split by regions

Graph 6: Global revenues generated with solvents from 2009 to 2025 in billion EUR – split by regions

Graph 7: Demand for solvents in Western Europe from 2009 to 2025

Graph 8: Demand for solvents in Western Europe from 2009 to 2025 – split by solvent types

Graph 9: Revenues generated with solvents in Western Europe from 2009 to 2025 in billion USD and billion EUR

Graph 10: Demand for solvents in Eastern Europe from 2009 to 2025

Graph 11: Demand for solvents in Eastern Europe from 2009 to 2025 – split by solvent types

Graph 12: Revenues generated with solvents in Eastern Europe from 2009 to 2025 in billion USD and billion EUR

Graph 13: Demand for solvents in North America from 2009 to 2025

Graph 14: Demand for solvents in North America from 2009 to 2025 – split by solvent types

Graph 15: Revenues generated with solvents in North America from 2009 to 2025 in billion USD and billion EUR

Graph 16: Demand for solvents in South America from 2009 to 2025

Graph 17: Demand for solvents in South America from 2009 to 2025 – split by solvent types

Graph 18: Revenues generated with solvents in South America from 2009 to 2025 in billion USD and billion EUR

Graph 19: Demand for solvents in Asia-Pacific from 2009 to 2025

Graph 20: Demand for solvents in Asia-Pacific from 2009 to 2025 – split by solvent types

Graph 21: Revenues generated with solvents in Asia-Pacific from 2009 to 2025 in billion USD and billion EUR

Graph 22: Demand for solvents in the Middle East from 2009 to 2025

Graph 23: Demand for solvents in the Middle East from 2009 to 2025 – split by solvent types

Graph 24: Revenues generated with solvents in the Middle East from 2009 to 2025 in billion USD and billion EUR

Graph 25: Demand for solvents in Africa from 2009 to 2025

Graph 26: Demand for solvents in Africa from 2009 to 2025 – split by solvent types

Graph 27: Revenues generated with solvents in Africa from 2009 to 2025 in billion USD and billion EUR

Graph 28: Demand for solvents in France from 2009 to 2025

Graph 29: Revenues generated with solvents in France from 2009 to 2025 in billion USD and billion EUR

Graph 30: Demand for solvents in Germany from 2009 to 2025

Graph 31: Revenues generated with solvents in Germany from 2009 to 2025 in billion USD and billion EUR

Graph 32: Demand for solvents in Italy from 2009 to 2025

Graph 33: Revenues generated with solvents in Italy from 2009 to 2025 in billion USD and billion EUR

Graph 34: Demand for solvents in Spain from 2009 to 2025

Graph 35: Revenues generated with solvents in Spain from 2009 to 2025 in billion USD and billion EUR

Graph 36: Demand for solvents in the United Kingdom from 2009 to 2025

Graph 37: Revenues generated with solvents in the United Kingdom from 2009 to 2025 in billion USD and billion EUR

Graph 38: Demand for solvents in Other Western Europe from 2009 to 2025

Graph 39: Revenues generated with solvents in Other Western Europe from 2009 to 2025 in billion USD and billion EUR

Graph 40: Demand for solvents in Poland from 2009 to 2025

Graph 41: Revenues generated with solvents in Poland from 2009 to 2025 in billion USD and billion EUR

Graph 42: Demand for solvents in Russia from 2009 to 2025

Graph 43: Revenues generated with solvents in Russia from 2009 to 2025 in billion USD and billion EUR

Graph 44: Demand for solvents in Turkey from 2009 to 2025

Graph 45: Revenues generated with solvents in Turkey from 2009 to 2025 in billion USD and billion EUR

Graph 46: Demand for solvents in Other Eastern Europe from 2009 to 2025

Graph 47: Revenues generated with solvents in Other Eastern Europe from 2009 to 2025 in billion USD and billion EUR

Graph 48: Demand for solvents in Canada from 2009 to 2025

Graph 49: Revenues generated with solvents in Canada from 2009 to 2025 in billion USD and billion EUR

Graph 50: Demand for solvents in Mexico from 2009 to 2025

Graph 51: Revenues generated with solvents in Mexico from 2009 to 2025 in billion USD and billion EUR

Graph 52: Demand for solvents in the USA from 2009 to 2025

Graph 53: Revenues generated with solvents in the USA from 2009 to 2025 in billion USD and billion EUR

Graph 54: Demand for solvents in Brazil from 2009 to 2025

Graph 55: Revenues generated with solvents in Brazil from 2009 to 2025 in billion USD and billion EUR

Graph 56: Demand for solvents in Other South America from 2009 to 2025

Graph 57: Revenues generated with solvents in Other South America from 2009 to 2025 in billion USD and billion EUR

Graph 58: Demand for solvents in China from 2009 to 2025

Graph 59: Revenues generated with solvents in China from 2009 to 2025 in billion USD and billion EUR

Graph 60: Demand for solvents in India from 2009 to 2025

Graph 61: Revenues generated with solvents in India from 2009 to 2025 in billion USD and billion EUR

Graph 62: Demand for solvents in Japan from 2009 to 2025

Graph 63: Revenues generated with solvents in Japan from 2009 to 2025 in billion USD and billion EUR

Graph 64: Demand for solvents in South Korea from 2009 to 2025

Graph 65: Revenues generated with solvents in South Korea from 2009 to 2025 in billion USD and billion EUR

Graph 66: Demand for solvents in Other Asia-Pacific from 2009 to 2025

Graph 67: Revenues generated with solvents in Other Asia-Pacific from 2009 to 2025 in billion USD and billion EUR

Graph 68: Global demand for solvents from 2009 to 2025 – split by applications

Graph 69: Global demand for solvents in the segment paints and varnishes from 2009 to 2025 – split by regions

Graph 70: Global demand for solvents in the segment printing inks from 2009 to 2025 – split by regions

Graph 71: Global demand for solvents in the segment adhesives from 2009 to 2025 – split by regions

Graph 72: Global demand for solvents in the segment cosmetics from 2009 to 2025 – split by regions

Graph 73: Global demand for solvents in the segment pharmaceuticals from 2009 to 2025 – split by regions

Graph 74: Global demand for solvents in other applications from 2009 to 2025 – split by regions

Graph 75: Demand for solvents in Western Europe from 2009 to 2025 – split by applications

Graph 76: Demand for solvents in Eastern Europe from 2009 to 2025 – split by applications

Graph 77: Demand for solvents in North America from 2009 to 2025 – split by applications

Graph 78: Demand for solvents in South America from 2009 to 2025 – split by applications

Graph 79: Demand for solvents in Asia-Pacific from 2009 to 2025 – split by applications

Graph 80: Demand for solvents in the Middle East from 2009 to 2025 – split by applications

Graph 81: Demand for solvents in Africa from 2009 to 2025 – split by applications

Graph 82: Global demand for solvents – split by types of solvents

Graph 83: Global demand for alcohols from 2009 to 2025 – split by regions

Graph 84: Global demand for ketones from 2009 to 2025 – split by regions

Graph 85: Global demand for esters from 2009 to 2025 – split by regions

Graph 86: Global demand for ethers from 2009 to 2025 – split by regions

Graph 87: Global demand for aromatics from 2009 to 2025 – split by regions

Graph 88: Global demand for non-aromatics from 2009 to 2025 – split by regions

Graph 89: Global demand for other solvents from 2009 to 2025 – split by regions

Table 1: Global demand for solvents from 2009 to 2025 – split by regions

Table 2: Global revenues generated with solvents from 2009 to 2025 in billion USD – split by regions

Table 3: Global revenues generated with solvents from 2009 to 2025 in billion EUR – split by regions

Table 4: Demand for solvents in Western Europe from 2009 to 2025 – split by major countries

Table 5: Demand for solvents in Western Europe from 2009 to 2025 – split by solvent types

Table 6: Demand for solvents in Eastern Europe from 2009 to 2025 – split by major countries

Table 7: Demand for solvents in Eastern Europe from 2009 to 2025 – split by solvent types

Table 8: Demand for solvents in North America from 2009 to 2025 – split by major countries

Table 9: Demand for solvents in North America from 2009 to 2025 – split by solvent types

Table 10: Demand for solvents in South America from 2009 to 2025 – split by major countries

Table 11: Demand for solvents in South America from 2009 to 2025 – split by solvent types

Table 12: Demand for solvents in Asia-Pacific from 2009 to 2025 – split by major countries

Table 13: Demand for solvents in Asia-Pacific from 2009 to 2025 – split by solvent types

Table 14: Demand for solvents in the Middle East from 2009 to 2025 – split by solvent types

Table 15: Important manufacturers of solvents in the Middle East

Table 16: Demand for solvents in Africa from 2009 to 2025 – split by solvent types

Table 17: Demand for solvents in France from 2009 to 2025 – split by applications

Table 18: Important manufacturers of solvents in France

Table 19: Demand for solvents in Germany from 2009 to 2025 – split by applications

Table 20: Important manufacturers of solvents in Germany

Table 21: Demand for solvents in Italy from 2009 to 2025 – split by applications

Table 22: Demand for solvents in Spain from 2009 to 2025 – split by applications

Table 23: Demand for solvents in the United Kingdom from 2009 to 2025 – split by applications

Table 24: Demand for solvents in Other Western Europe from 2009 to 2025 – split by applications

Table 25: Important manufacturers of solvents in Other Western Europe

Table 26: Demand for solvents in Poland from 2009 to 2025 – split by applications

Table 27: Demand for solvents in Russia from 2009 to 2025 – split by applications

Table 28: Important manufacturers of solvents in Russia

Table 29: Demand for solvents in Turkey from 2009 to 2025 – split by applications

Table 30: Demand for solvents in Other Eastern Europe from 2009 to 2025 – split by applications

Table 31: Demand for solvents in Canada from 2009 to 2025 – split by applications

Table 32: Important manufacturers of solvents in Canada

Table 33: Demand for solvents in Mexico from 2009 to 2025 – split by applications

Table 34: Demand for solvents in the USA from 2009 to 2025 – split by applications

Table 35: Important manufacturers of solvents in the USA

Table 36: Demand for solvents in Brazil from 2009 to 2025 – split by applications

Table 37: Demand for solvents in Other South America from 2009 to 2025 – split by applications

Table 38: Demand for solvents in China from 2009 to 2025 – split by applications

Table 39: Important manufacturers of solvents in China

Table 40: Demand for solvents in India from 2009 to 2025 – split by applications

Table 41: Important manufacturers of solvents in India

Table 42: Demand for solvents in Japan from 2009 to 2025 – split by applications

Table 43: Important manufacturers of solvents in Japan

Table 44: Demand for solvents in South Korea from 2009 to 2025 – split by applications

Table 45: Important manufacturers of solvents in South Korea

Table 46: Demand for solvents in Other Asia-Pacific from 2009 to 2025 – split by applications

Table 47: Important manufacturers of solvents in Other Asia-Pacific

Table 48: Global demand for solvents from 2009 to 2025 – split by applications

Table 49: Global demand for solvents in the segment paints and varnishes from 2009 to 2025 – split by regions

Table 50: Global demand for solvents in the segment printing inks from 2009 to 2025 – split by regions

Table 51: Global demand for solvents in the segment adhesives from 2009 to 2025 – split by regions

Table 52: Global demand for solvents in the segment cosmetics from 2009 to 2025 – split by regions

Table 53: Global demand for solvents in the segment pharmaceuticals from 2009 to 2025 – split by regions

Table 54: Global demand for solvents in other applications from 2009 to 2025 – split by regions

Table 55: Demand for solvents in Western Europe from 2009 to 2025 – split by applications

Table 56: Demand for solvents in the segment paints and varnishes in Western Europe from 2009 to 2025 – split by major countries

Table 57: Demand for solvents in the segment printing inks in Western Europe from 2009 to 2025 – split by major countries

Table 58: Demand for solvents in the segment adhesives in Western Europe from 2009 to 2025 – split by major countries

Table 59: Demand for solvents in the segment cosmetics in Western Europe from 2009 to 2025 – split by major countries

Table 60: Demand for solvents in the segment pharmaceuticals in Western Europe from 2009 to 2025 – split by major countries

Table 61: Demand for solvents in other applications in Western Europe from 2009 to 2025 – split by major countries

Table 62: Demand for solvents in Eastern Europe from 2009 to 2025 – split by applications

Table 63: Demand for solvents in the segment paints and varnishes in Eastern Europe from 2009 to 2025 – split by major countries

Table 64: Demand for solvents in the segment printing inks in Eastern Europe from 2009 to 2025 – split by major countries

Table 65: Demand for solvents in the segment adhesives in Eastern Europe from 2009 to 2025 – split by major countries

Table 66: Demand for solvents in the segment cosmetics in Eastern Europe from 2009 to 2025 – split by major countries

Table 67: Demand for solvents in the segment pharmaceuticals in Eastern Europe from 2009 to 2025 – split by major countries

Table 68: Demand for solvents in other applications in Eastern Europe from 2009 to 2025 – split by major countries

Table 69: Demand for solvents in North America from 2009 to 2025 – split by applications

Table 70: Demand for solvents in the segment paints and varnishes in North America from 2009 to 2025 – split by major countries

Table 71: Demand for solvents in the segment printing inks in North America from 2009 to 2025 – split by major countries

Table 72: Demand for solvents in the segment adhesives in North America from 2009 to 2025 – split by major countries

Table 73: Demand for solvents in the segment cosmetics in North America from 2009 to 2025 – split by major countries

Table 74: Demand for solvents in the segment pharmaceuticals in North America from 2009 to 2025 – split by major countries

Table 75: Demand for solvents in other applications in North America from 2009 to 2025 – split by major countries

Table 76: Demand for solvents in South America from 2009 to 2025 – split by applications

Table 77: Demand for solvents in the segment paints and varnishes in South America from 2009 to 2025 – split by major countries

Table 78: Demand for solvents in the segment printing inks in South America from 2009 to 2025 – split by major countries

Table 79: Demand for solvents in the segment adhesives in South America from 2009 to 2025 – split by major countries

Table 80: Demand for solvents in the segment cosmetics in South America from 2009 to 2025 – split by major countries

Table 81: Demand for solvents in the segment pharmaceuticals in South America from 2009 to 2025 – split by major countries

Table 82: Demand for solvents in other applications in South America from 2009 to 2025 – split by major countries

Table 83: Demand for solvents in Asia-Pacific from 2009 to 2025 – split by applications

Table 84: Demand for solvents in the segment paints and varnishes in Asia-Pacific from 2009 to 2025 – split by major countries

Table 85: Demand for solvents in the segment printing inks in Asia-Pacific from 2009 to 2025 – split by major countries

Table 86: Demand for solvents in the segment adhesives in Asia-Pacific from 2009 to 2025 – split by major countries

Table 87: Demand for solvents in the segment cosmetics in Asia-Pacific from 2009 to 2025 – split by major countries

Table 88: Demand for solvents in the segment pharmaceuticals in Asia-Pacific from 2009 to 2025 – split by major countries

Table 89: Demand for solvents in other applications in Asia-Pacific from 2009 to 2025 – split by major countries

Table 90: Demand for solvents in the Middle East from 2009 to 2025 – split by applications

Table 91: Demand for solvents in Africa from 2009 to 2025 – split by applications

Table 92: Global demand for solvents – split by types of solvents

Table 93: Global revenues generated with solvents in million USD – split by types of solvents

Table 94: Global demand for alcohols from 2009 to 2025 – split by regions

Table 95: Global revenues generated with alcohols in million USD from 2009 to 2025 – split by regions

Table 96: Global demand for ethanol from 2009 to 2025 – split by regions

Table 97: Global demand for n-butanol from 2009 to 2025 – split by regions

Table 98: Global demand for isopropanol from 2009 to 2025 – split by regions

Table 99: Global demand for methanol from 2009 to 2025 – split by regions

Table 100: Global demand for other alcohols from 2009 to 2025 – split by regions

Table 101: Global demand for ketones from 2009 to 2025 – split by regions

Table 102: Global revenues generated with ketones in million USD from 2009 to 2025 – split by regions

Table 103: Global demand for acetone from 2009 to 2025 – split by regions

Table 104: Global demand for MEK from 2009 to 2025 – split by regions

Table 105: Global demand for other ketones from 2009 to 2025 – split by regions

Table 106: Global demand for esters from 2009 to 2025 – split by regions

Table 107: Global revenues generated with esters in million USD from 2009 to 2025 – split by regions

Table 108: Global demand for ethers from 2009 to 2025 – split by regions

Table 109: Global revenues generated with ethers in million USD from 2009 to 2025 – split by regions

Table 110: Global demand for aromatics from 2009 to 2025 – split by regions

Table 111: Global revenues generated with aromatics in million USD from 2009 to 2025 – split by regions

Table 112: Global demand for toluene from 2009 to 2025 – split by regions

Table 113: Global demand for other aromatics from 2009 to 2025 – split by regions

Table 114: Global demand for non-aromatics from 2009 to 2025 – split by regions

Table 115: Global revenues generated with non-aromatics in million USD from 2009 to 2025 – split by regions

Table 116: Global demand for other solvents from 2009 to 2025 – split by regions

Table 117: Global revenues generated with other solvents in million USD from 2009 to 2025 – split by regions